NEWNow you can hearken to Fox Information articles!

2025 is right here, and after weight loss plan and train, money and paying off debt are at all times on the prime of the record for People’ New Yr’s resolutions. How are you going to make a recreation plan that’s actionable and tactical on January 1? Listed below are 5 nice concepts to get the brand new yr off to a bang!

1. Go to the grocery retailer … much less

Do you know the common particular person visits the grocery retailer greater than 10 instances a month? In accordance with Oxygen Financial, that provides as much as a big chunk of your time. And with every journey taking a median of 43 minutes (supply: Time Institute), the hours actually add up. And bear in mind this, the grocery shops have the identical purpose because the casinos in Las Vegas, which is to separate you out of your pockets.

In reality, proper close to me in Atlanta, Ga., a Publix not too long ago opened with a full bar the place you may drink beer and wine. Now, why would it’s essential to do this? The reason being that grocery shops know it is paramount to get you to spend extra time within the retailer and, consequently, you’ll spend extra money.

RARE GOLD COIN WORTH THOUSANDS DROPPED INTO SALVATION ARMY BUCKET BY ANONYMOUS HOLIDAY DONOR

Right here’s how one can lower down on these journeys:

Individuals speak about changing into millionaires, however the path to riches begins with a couple of small steps. (Kurt Knutsson, CyberGuy)

- Make a listing earlier than you buy groceries and keep on with it. This can prevent from wandering aimlessly or shopping for belongings you don’t want.

- Keep away from going hungry, particularly throughout peak buying hours (4–5 p.m.), when your cravings may result in impulse buys.

- Don’t fall for end-cap advertising and marketing traps. Simply because it says BOGO (purchase one, get one free) doesn’t imply it’s in your finest curiosity to purchase one in any respect.

2. Make investments like a millionaire — beginning with $100

Investing isn’t only for the ultra-wealthy anymore. With as little as $100, you can diversify your portfolio with property as soon as reserved just for the wealthy:

- Artwork: Platforms like Masterworks can help you purchase shares in positive artwork items, providing you with an opportunity to personal a part of works by world-famous artists.

- Collectibles: Think about proudly owning a chunk of a traditional automobile, like a 1965 Ford Mustang Fastback, via Rally. This progressive platform makes high-value collectibles accessible to everybody.

- Actual Property: Construct fairness whereas serving to renters do the identical with ROOTS, an organization that allows you to spend money on properties with community-focused targets.

These choices provide inventive methods to develop your wealth with out requiring a large upfront funding.

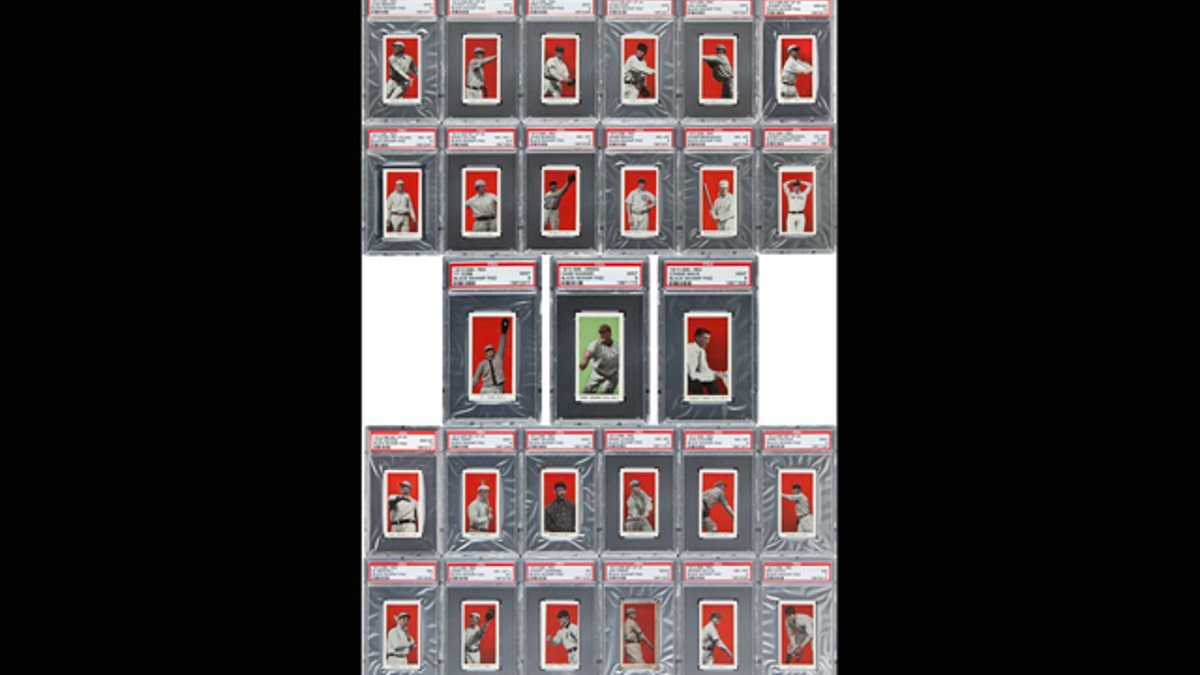

One of many good strikes for 2025 is to spend money on collectibles in a small method. FILE: This undated photograph offered by Heritage Auctions of Dallas, exhibits a few of the greater than 700 well-preserved 1910 baseball playing cards discovered within the attic of a home in Defiance, Ohio. (AP)

3. Repay your money owed

Debt is a large monetary burden for a lot of People, with bank card debt alone nearing $1.2 trillion and the common stability sitting at $6,327. Tackling your debt now will set you up for long-term monetary freedom.

Listed below are two professional suggestions going into 2025:

- Give attention to the highest-interest, smallest stability bank cards first to reduce the entire quantity you’ll pay over time, and put one thing within the win column early within the yr.

- Don’t use reward playing cards, promote them. When you have unused reward playing cards, promote them on platforms like CardCash. This can flip unused balances into chilly exhausting money you may put towards your money owed.

4. Audit your recurring subscriptions

Recurring subscriptions can quietly drain your funds. Many individuals overlook about companies they not use, and prices for some subscriptions like YouTube TV have doubled over the previous seven years (now priced at $82.99 monthly).

Right here’s the right way to regain management:

- Evaluate your year-end bank card statements to determine subscriptions, apps and memberships you not use, need or want.

- For subscriptions, you need to maintain, discover choices that you would be able to share the associated fee with buddies or household. For instance, YouTube TV permits six members on one subscription.

CLICK HERE FOR MORE FOX NEWS OPINION

Investing isn’t only for the ultra-wealthy anymore. With as little as $100, you may diversify your portfolio with property as soon as reserved just for the wealthy.

5. Your level applications are shedding tempo to inflation

Do you’ve got a stash of airline miles, resort rewards, or bank card factors? These factors characterize actual cash — however their worth decreases over time as a consequence of inflation and rising redemption prices.

Think about this: Previously 5 years, your factors have doubtless misplaced 20% of their worth. Ready too lengthy to make use of them may imply lacking out on rewards you’ve earned.

Right here’s the right way to take advantage of your factors:

- Use them for flights, resort stays or assertion credit every time potential.

CLICK HERE TO GET THE FOX NEWS APP

Individuals who need to save ought to have a look at the their subscriptions to see if they’ll lower any not in use. FILE: In an aerial view, the Netflix emblem is displayed above its company places of work on January 24, 2024, in Los Angeles, California. (Mario Tama/Getty Photos)

- Often examine the phrases and expiration dates in your rewards applications.

- Deal with your factors like money — spend them properly earlier than they lose extra worth

It’s not a decision, it’s a recreation plan

Whether or not it’s chopping down on pointless buying journeys or discovering progressive methods to speculate, these easy adjustments could make a big effect in your funds. Begin small by reviewing your grocery habits or subscriptions, then work your method as much as investing and tackling debt. Each step you are taking will convey you nearer to changing into a millionaire.

Source link