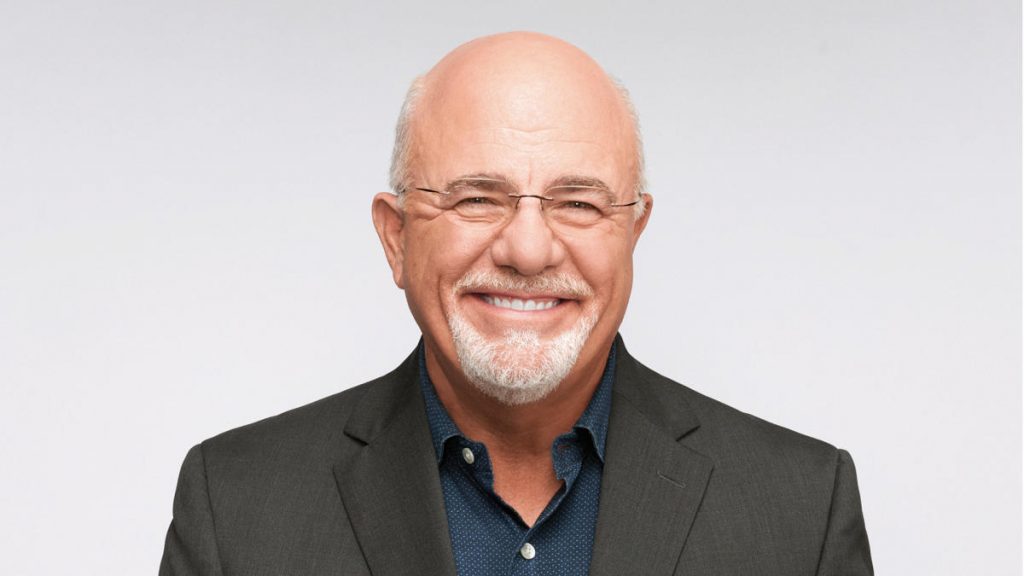

Whether or not your month-to-month payments go away little leftover money otherwise you’re specializing in different targets, you may end up among the many many People who have to atone for their retirement savings. Should you’re nonetheless far-off from retirement age, you might really feel no stress to contribute a lot but. However these six retirement statistics that the monetary guru Dave Ramsey shared on his blog might make you think twice.

Watch Out: Avoid This Retirement Savings Mistake That’s Costing Americans Up To $300K

Learn Subsequent: 5 Subtly Genius Strikes All Rich Individuals Make With Their Cash

Ramsey defined that 54% of American employees didn’t even know their retirement financial savings wants. This makes planning how a lot to contribute usually and monitoring your progress very difficult.

Many elements play a job in your financial savings wants, together with your retirement age, meant way of life, price of residing, inflation, revenue sources and healthcare prices. You should utilize a web-based calculator, reminiscent of this one from the AARP, or converse to a retirement advisor to seek out out.

Study Extra: 5 Cities You Need To Consider If You’re Retiring in 2025

Should you anticipate to dwell off your month-to-month Social Safety funds, you could be stunned that the common month-to-month fee was simply $1,907 in January 2024. The Social Safety Administration additionally talked about the funds are made to solely cowl 40% of what you had earned whereas working.

Since this doubtless gained’t cowl your prices, having enough retirement financial savings is essential on your monetary safety. Plus, don’t overlook potential modifications to Social Safety that would negatively have an effect on your profit quantity.

A 2023 report from Ramsey Solutions confirmed that 34% hadn’t saved any cash in any respect. This not solely contains cash for retirement but in addition an emergency fund and financial savings for different targets. Along with inflicting monetary struggles throughout retirement, having no financial savings to deal with at the moment’s emergencies is harmful and will result in debt.

Often placing month-to-month revenue towards these functions pays off and gives monetary safety. You may set some preliminary targets of placing apart a minimum of three months of bills towards emergencies and 15% of your earnings towards retirement.

Ramsey talked about that 39% of People didn’t spend money on shares, which are inclined to have one of the best common returns amongst investments. Some traders may not really feel snug with the upper volatility that comes with these investments and select safer, much less worthwhile choices as an alternative.

Source link