Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is dealing with a vital take a look at as its worth continues to swing with out clear path, navigating a tense and unsure macroeconomic setting. Whereas volatility persists, many analysts imagine the worst section of the correction could also be over. After dropping over 30% from its all-time excessive, Bitcoin has managed to carry above key help ranges, reinforcing short-term optimism.

Associated Studying

Nevertheless, world tensions—pushed by escalating commerce disputes and aggressive tariff insurance policies from the US—are shaking monetary markets. The specter of a world recession looms giant, making traders cautious throughout each conventional and digital asset courses.

Regardless of the noise, on-chain information from Glassnode provides a layer of optimism. In line with their newest evaluation, 63% of Bitcoin’s circulating provide has not moved in at the very least one yr. This historic degree of dormant provide highlights the rising conviction amongst long-term holders, who’re weathering the present volatility with out panic.

Such habits reinforces the assumption that Bitcoin’s basis stays strong, whilst short-term merchants exit the market. The robust palms are holding agency, and their resilience might lay the groundwork for the next major move—as soon as macroeconomic circumstances start to stabilize.

Bitcoin Holds Sturdy Amid World Volatility: Rising Lengthy-Time period Conviction

Huge worth swings proceed to shake each crypto and equities markets as volatility intensifies in response to rising world tensions and unresolved macroeconomic threats. Bitcoin, nonetheless, has held robust above the $81K degree, suggesting {that a} potential restoration could also be taking form.

The 90-day pause on U.S. tariffs—excluding China—provided momentary aid, however uncertainty nonetheless dominates investor sentiment. Ongoing commerce conflicts between the USA and China threaten world financial stability, with many analysts warning of a possible recession if no decision is reached. These fears are weighing closely on danger property throughout the board.

Regardless of the difficult backdrop, Bitcoin’s efficiency suggests underlying resilience. Bulls are step by step regaining momentum after the latest sharp correction, and plenty of market watchers imagine the worst section of the drawdown could also be over.

Including to the optimism, prime analyst Quinten Francois shared Glassnode data revealing that 63% of the Bitcoin provide has not moved in at the very least a yr. This metric, typically related to robust long-term conviction, exhibits that almost all of Bitcoin holders are selecting to carry via volatility slightly than promote into weak point. It displays a maturing investor base with confidence in Bitcoin’s long-term worth, even amid world uncertainty.

If present help ranges proceed to carry and macro circumstances stabilize, Bitcoin could also be on the verge of a sustained restoration.

Associated Studying

BTC Value Stalls Beneath Key Resistance After Bullish Surge

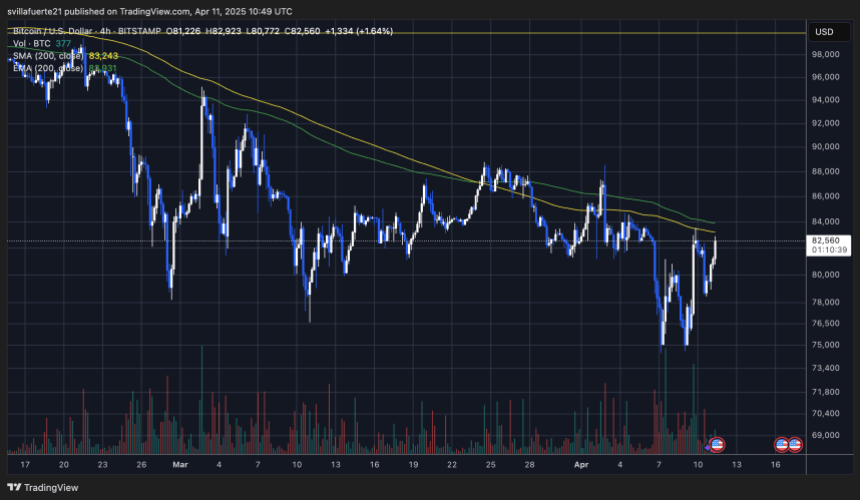

Bitcoin is presently buying and selling at $82,600 following a powerful surge that helped the asset recuperate from latest lows. The transfer has introduced some short-term optimism to the market, particularly as BTC managed to reclaim the $81K degree—a key help zone that now wants to carry for bullish momentum to proceed.

Nevertheless, vital resistance lies forward. The worth stopped close to the 4-hour 200 Transferring Common, presently sitting round $83,500. This technical degree has constantly acted as a short-term barrier since Bitcoin misplaced the $100K mark, and bulls want a decisive breakout above it to verify the start of a real reversal.

If Bitcoin can break and maintain above $83,500, the following quick goal is the $85K zone. Reclaiming that vary might open the trail for a push towards the $88K–$90K resistance band and probably resume the longer-term uptrend.

Associated Studying

On the flip facet, failing to carry above $81K would sign weak point and certain invite renewed promoting stress. A breakdown beneath $80K would reinforce bearish sentiment, presumably triggering a recent wave of panic promoting and sending BTC again towards the $75K help zone. Bulls should act shortly to defend present ranges and push increased.

Featured picture from Dall-E, chart from TradingView

Source link