Algorand leads tokenized shares in 2025, outpacing Ethereum. The $425M Exodus inventory on NYSE highlights the ALGO edge in RWA tokenization. By 2030, the trade might rise to command a market cap of over $1 trillion.

Tokenization is the longer term, and with BlackRock, one of many world’s largest asset managers, on the forefront of this drive, the longer term seems shiny for platforms that change into trade leaders. In the intervening time, Algorand is dominating the world of tokenized shares, contemplating the entire worth locked (TVL) of securities buying and selling on this proof-of-stake and safe blockchain.

Stand Apart Ethereum: Algorand Dominates Tokenized Shares

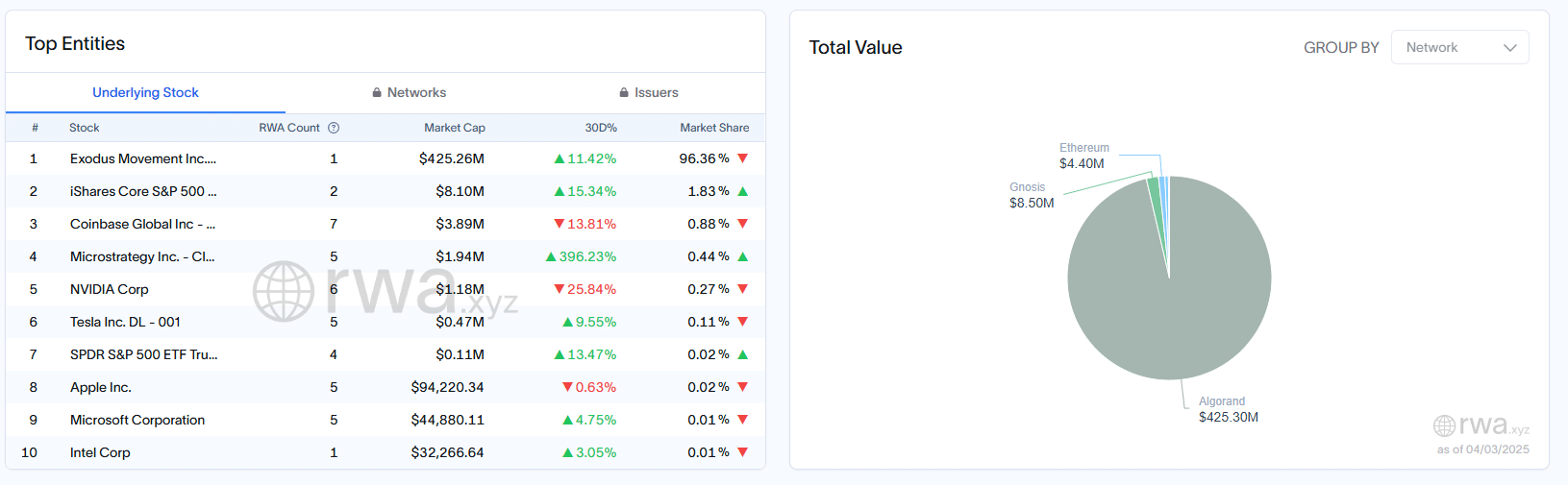

Information from RWA.xyz reveals that Algorand has extra tokenized inventory worth than Ethereum and its layer-2 scaling options, equivalent to Arbitrum, Base, and Polygon, mixed.

(Source)

On this realm, Exodus (EXOD), a tokenized inventory on Algorand, is capturing the eye of merchants–a few of whom are additionally shopping for among the hottest presales to invest in.

At press time, over $425 million price of EXOD tokens are circulated and secured on the Algorand mainnet. Nevertheless, EXOD is the one tokenized inventory in Algorand.

Ethereum wins primarily based on the variety of tokenized equities and indexes deployed. For instance, there are tokenized NVIDIA, Technique, and Coinbase shares on Ethereum and its layer-2s like Polygon and Base–which can be the host of among the best meme coins to buy in 2025.

The tokenized Coinbase inventory, COIN, has a market cap of $3.8 million, circulates on Ethereum, and is backed by Gnosis.

EXOD Tokenized Inventory: All the things You Have to Know About Main RWA

Exodus is the staff behind a Bitcoin pockets, and EXOD is their inventory, which is on the market for buying and selling on the NYSE, one of many largest exchanges on the earth.

EXOD is a Class A share, and holders can commerce the tokenized inventory freely on the NYSE.

Buying and selling of EXOD started on December 18, 2024, marking a historic second for the Bitcoin pockets and crypto normally. Most significantly, the transfer underscored the rising integration of latest know-how with conventional finance (TradFi).

With EXOD buying and selling on-chain, not solely is the inventory extra clear, however its liquidity is greater, boosted by elevated legitimacy and adoption after itemizing on the NYSE.

Nevertheless, even with this itemizing, the journey wasn’t easy.

In Might 2024, the USA SEC rejected their utility earlier than ultimately approving the itemizing seven months later, in December 2024, when Donald Trump took over as president of the USA.

Crypto legal guidelines in the USA will probably enhance within the subsequent few years.

Accordingly, Algorand is getting ready for this future and releasing new developer instruments.

On March 26, they launched AlgoKit 3.0, an improve that accelerates the event expertise for companies and builders specializing in real-world asset (RWA) tokenization.

AlgoKit 3.0 is dwell.

Now supporting native TypeScript alongside native Python, opening the doorways for 18M+ builders to construct on the Algorand blockchain; no must study area of interest languages.

Web3 simply bought far more accessible.

Construct immediately: https://t.co/tOd2MKQliM pic.twitter.com/mbf3NYXpJ1

— Algorand Basis (@AlgoFoundation) March 26, 2025

The Algorand Basis mentioned the discharge consists of new TypeScript good contract help that expands past Python. After this replace, builders can now write good contracts in TypeScript.

On the identical time, they launched superior debugging instruments to streamline good contract verification, thereby decreasing errors whereas bettering safety.

One of many greatest updates on this launch was the enhancement of scalability and efficiency. Algorand now helps a throughput of over 10,000 TPS, following the discharge of the Dynamic Lambda replace in January that slashed block instances to below three seconds.

With these instruments and multiple tokenization platforms on Algorand, like Lofty, Koibanx, and Trusty Digital, extra customers will probably select to tokenize on Algorand, benefiting from its superior scalability, safety, and dominance.

This outlook solely is smart.

John Woods, the CTO of Algorand, mentioned that tokenizing property on scalable chains like Algorand will unlock new monetary prospects.

DISCOVER: Best New Cryptocurrencies to Invest in 2025 – Top New Crypto Coins

Algorand Outpaces Ethereum In Tokenized Shares, Exodus On NYSE Dominates

-

Algorand tokenized inventory, EXOD, buying and selling on NYSE dominates and surpasses these in Ethereum -

AlgoKit 3.0 equipment launched to spice up RWA tokenization -

Will Tokenization unlock new monetary alternatives?

Source link