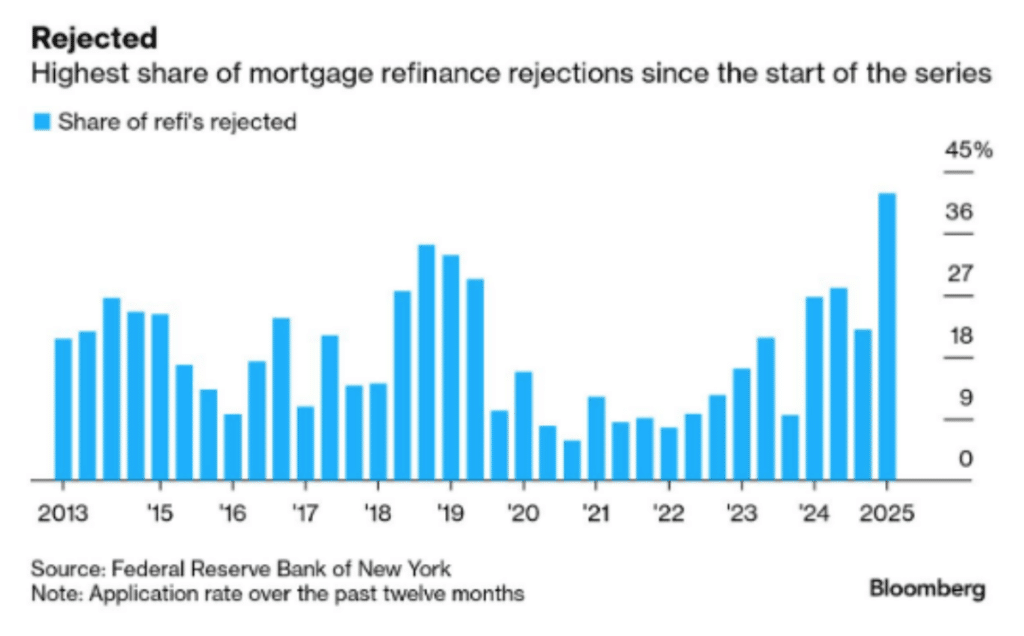

Are we going right into a recession? 42% of mortgage refinance functions are being rejected, probably the most in historical past.

Moreover, non-public sector debt is ~$30.5T, and $18T of that’s family debt (mortgage, automobile, bank card, HELOC). That’s almost as high as the national debt, carrying a lot increased rates of interest, and the non-public sector can’t print money or levy taxes.

Oh, and the scholar mortgage repayments are about to renew at a lot increased ranges after COVID mortgage debt deferment funds put on off. Is the U.S. screwed?

Are We in a Recession or Headed In direction of One?

Along with the debt, the housing market is out of the palms of U.S. consumers and within the palms of China.

International collectors, led by China, are dumping U.S. mortgage bonds, injecting new anxiousness into surging mortgage charges. Almost $1.32 trillion in U.S. mortgage-backed securities had been in international palms on the yr’s begin, however the tide is receding quick. China alone slashed its stake by virtually 20% by December 2024, whereas Japan and Canada have hit the brakes on contemporary buys.

The housing market is insane.

Why would I purchase a house that has elevated +212% within the final 7 years?

I really feel prefer it is smart to attend for costs and charges to drop.

Am I mistaken? pic.twitter.com/3H9Iod4Xiv

— Ethan (@EZebroni) April 6, 2025

The Federal Reserve’s retreat from the mortgage-backed securities market is throwing one other wrench into the housing sector. As soon as a stabilizing drive in crises just like the pandemic, the Fed is now letting these property bleed off its books, including weight to an already strained market.

Mortgage analyst Eric Hagen referred to as it what it’s: “one other layer of strain.”

Homebuyers Really feel the Squeeze

The rising charges are hitting homebuyers particularly arduous throughout what must be a busy spring housing market. Excessive dwelling costs, coupled with client fears over job safety and weak financial savings accounts, have already dampened purchaser optimism.

A survey from Redfin discovered that 1 in 5 potential consumers is promoting shares to fund down funds, displaying simply how tight private funds have develop into. Moreover, mortgage rejection charges have hit report highs for mortgage refinances and auto loans.

What’s Forward for the Housing Market?

Rising mortgage charges, elevated client debt, international sell-offs in MBS, and shrinking shopping for energy are tightening the noose on the housing market. If international buyers hold dumping U.S. bonds, charges may simply edge increased, squeezing consumers and dragging market exercise into the bottom.

The Fed’s long-game technique would possibly stabilize issues later however rapid reduction isn’t within the playing cards. In different phrases, a recession within the U.S. remains to be on the desk.

EXPLORE: Dave Portnoy’s New Meme Coin Went 100,000% But What Is The Best Meme Coin to Buy?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

-

Are we going right into a recession? 42% of mortgage refinance functions are being rejected, probably the most in historical past. -

International collectors, led by China, are dumping U.S. mortgage bonds, injecting new anxiousness into surging mortgage charges.

Source link