By Lananh Nguyen, Pete Schroeder and Tatiana Bautzer

NEW YORK (Reuters) – U.S. banking giants are pushing for a swath of lighter laws from President Donald Trump’s administration, and say they’re heartened by alerts that regulators are listening.

Financial institution bosses wish to lower reporting necessities on some transactions, restrict regulators’ enforcement powers, pace up deal approvals and overhaul capital guidelines, 4 trade executives advised Reuters. These asks would come with elevating the bar on an anti-money-laundering rule requiring reporting of $10,000 money transactions and limiting using confidential regulatory warnings, often called Issues Requiring Consideration, two of these sources mentioned. One other main change may very well be watering down annual stress exams, a type of sources mentioned.

The trade has gotten encouraging indicators from public statements from the administration, whilst bankers look ahead to head regulators to be put in.

“There was receptivity to our issues,” mentioned Kevin Fromer, head of the Monetary Providers Discussion board, which represents the most important world banks and has been pushing for lighter capital and supervisory controls. “We’re on the early phases of that dialog.”

Public statements by regulators have indicated a change of focus. Treasury Secretary Scott Bessent advised the Financial Membership of New York this month that the monetary regulatory agenda wanted “a basic refocusing of supervisors’ priorities,” whereas Travis Hill, performing FDIC head, mentioned at a bankers convention in Washington that regulators have to be “extra targeted on the true basic monetary dangers and fewer on the administration round that.”

REGULATORY CHANGE

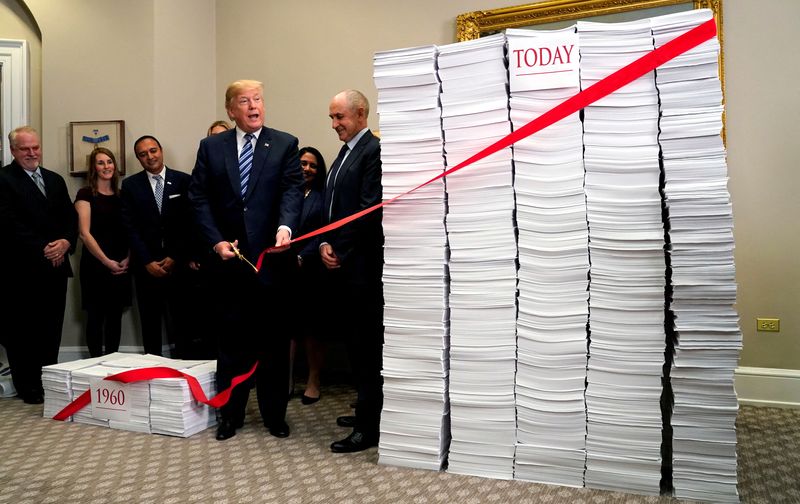

The adjustments being pushed might quantity to among the most important financial institution deregulation in years. Most just lately, some bigger banks noticed rule reduction in 2019 below a “tailoring” undertaking undertaken within the first Trump administration.

The wishlist for sweeping regulatory adjustments comes after the trade fought Biden-era regulators who sought to implement stricter capital guidelines often called Basel endgame final yr. The proposal was successfully scrapped in a significant victory for banks, and now the trade is in search of additional reduction.

Some bankers contend that regulators in recent times have been unfairly heavy-handed whilst massive establishments report strong earnings and present resilience via the pandemic and 2023 trade turmoil, when three regional lenders failed.

Nonetheless, proponents of more durable guidelines argue they supply essential guardrails for the monetary system, defending shoppers and the broader financial system.

“Monetary guidelines defend Foremost Road households whereas weakening them enrich Wall Road bankers,” mentioned Dennis Kelleher, head of the advocacy group Higher Markets, which pushes for stricter monetary guidelines.

Treasury spokespeople didn’t reply to a request for remark.

Spokespeople for companies that supervise banks – the Federal Deposit Insurance coverage Company, and Federal Reserve – declined to remark. The White Home didn’t reply to a request for remark.

SUPERVISION, ENFORCEMENT

Financial institution bosses have a broader, bold aim to water down supervision and enforcement, three of the sources mentioned. The trade seeks to rein in regulators’ focus to materials monetary dangers that may be quantified.

Banks have complained for years that examiners expanded scrutiny far past core monetary issues and into areas corresponding to company governance, laptop techniques and compensation, in accordance with the Financial institution Coverage Institute, a commerce affiliation representing massive U.S. lenders.

Trade leaders goal to water down MRAs handed down by regulators such because the Federal Reserve and the Workplace of the Comptroller of the Forex (OCC), three sources mentioned. Lenders deal with MRAs as pressing issues, devoting many workers to restore work to keep away from fines or different punishments.

BPI mentioned some MRAs represented “unlawful overreach” by regulators, who ought to focus on materials dangers to banks’ monetary situation.

Bessent echoed that concern in his New York speech, calling on companies to “drive a tradition that focuses on materials monetary danger fairly than field checking.”

Lenders are additionally pushing for a broad overhaul of the Fed’s so-called stress exams, an annual train aimed to measure banks’ talents to deal with potential crises. The Fed signaled late final yr it was open to adjustments to make the examination extra clear. BPI led a lawsuit towards the Fed late final yr demanding such adjustments.

‘OUTDATED’ CASH RULE

One of many best laws to regulate may very well be an anti-money laundering (AML) rule requiring banks to file studies on clients who make greater than $10,000 in money transactions in a day, in accordance with one of many sources, an trade govt who declined to be recognized discussing supervisory issues. That might require rewriting a rule inside The Treasury Division.

AML has been cited by foyer teams as contributing to ‘debanking’, or when a financial institution closes a person’s account. President Donald Trump publicly complained of ‘debanking’ of conservatives earlier this yr.

“The necessities that we have now … below the anti money-laundering legal guidelines and the varied sanctions regimes, the final legal guidelines globally are fairly onerous,” mentioned Kathryn Ruemmler, Chief Authorized Officer and Basic Counsel of Goldman Sachs at a convention this month.

The trade has lengthy complained that the restrict is outdated and generates pointless filings. It might welcome a better threshold corresponding to $75,000 and even $100,000, the supply mentioned.

One main financial institution regulator has endorsed the concept. Rodney Hood, the performing head of the Workplace of the Comptroller of the Forex, which screens nationwide banks, mentioned in an announcement to Reuters that the present restrict is “outdated and burdensome,” and backed a rise amongst different rule easings.

Congress is ready to query Jonathan Gould, Trump’s choose to completely lead the OCC, on Thursday.

(Reporting by Lananh Nguyen, Tatiana Bautzer in New York, Pete Schroder in Washington, extra reporting by Chris Prentice; modifying by Megan Davies and Nick Zieminski)