Professor David Maimon is director of the Proof-Primarily based Cybersecurity Analysis Group at Georgia State College.

He and his group are properly accustomed to what occurs on the darkish internet, which consists of internet sites that appear like peculiar web sites however could be reached solely utilizing particular browsers or authorization codes and are sometimes used to promote unlawful commodities.

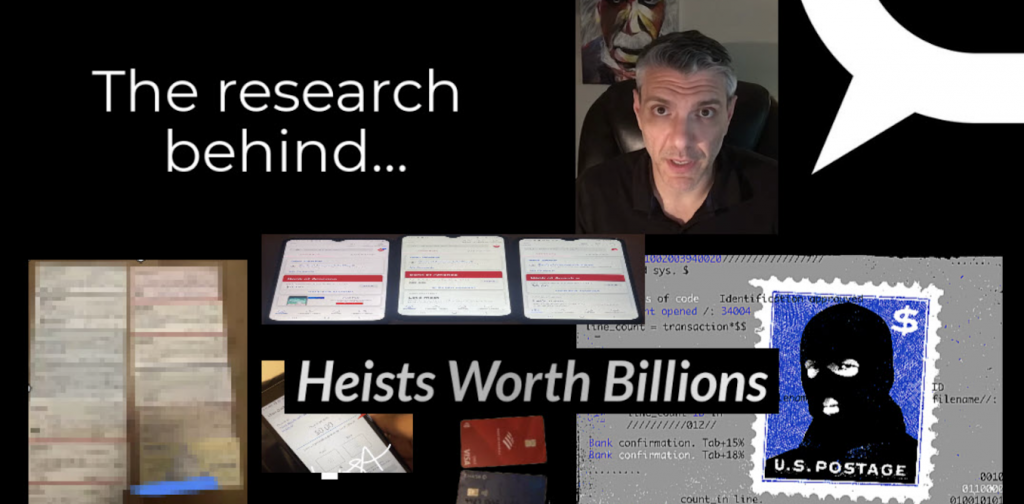

On this behind-the-story video, Maimon reveals a few of the a whole bunch of hundreds of bank-related photographs that he and his workforce have collected from the darkish internet and textual content message purposes, and the analysis these discoveries spurred them to do. That analysis sparked the investigative story Heists Worth Billions, which Maimon teamed as much as write with The Dialog’s senior investigative editor Kurt Eichenwald. Right here’s how Maimon and colleagues uncovered the crimes, and his remarks from a follow-up interview.

Maimon’s group was monitoring photographs posted on the darkish internet when it discovered the preliminary clues that one thing massive was afoot.

My group and I spend numerous time on underground markets wherein criminals promote all types of illicit commodities. We see numerous counterfeit merchandise. We see numerous identities. And in mid-2021 we began to see numerous checks flooding the markets.

These checks led us down a path the place we realized that hundreds of sham financial institution accounts have been being created to steal and launder cash.

The group’s first realization was concerning the quantity of deposits.

People have been utilizing a number of accounts concurrently to deposit the excessive quantity of checks. They have been merely buying from the markets and depositing on completely different accounts.

For instance, three checks can be deposited into three completely different financial institution accounts by a single felony.

Group members related one other clue that confirmed them how the criminals have been gaining access to a number of accounts.

We noticed quite a few debit playing cards and realized that the criminals have been utilizing these debit playing cards to deposit all of the checks they stole or bought.

Then, in June 2022, the group made a key statement.

Criminals have been posting screenshots from financial institution accounts with balances displaying zero.

We realized that these screenshots of zero-balance financial institution accounts have been ads – they have been promoting financial institution accounts that had zero balances.

This led the group to an investigation.

Over six months we tracked a single felony, counting the variety of photographs of bank cards and the variety of screenshots of financial institution accounts displaying zero balances that he posted.

We’re seeing this rising development from one single actor and, after all, being on the market within the ecosystem, we’re capable of see an increasing number of copycats: an increasing number of people like the person we’re monitoring, providing their providers.

And a conclusion about what allowed this to occur.

If a felony opens a bank card below another person’s identify, when the individual realizes one thing is mistaken and freezes the bank card, the felony can’t use that id anymore.

However with financial institution accounts, it’s a unique story, as a result of the credit score freeze doesn’t have an effect on your potential to determine a brand new checking account below another person’s identify.

Maimon offers some recommendation on the best way to defend your id.

Ensure you freeze your credit score. Ensure you buy some form of id theft safety plan, which is able to warn you each time somebody is utilizing your id. And easily monitor your checking account every day, monitor your bank card.

Freezing your credit score ensures that nobody can entry your credit score report until you actively elevate the freeze.

He talks about what’s subsequent for his analysis group.

We’re making an attempt to know how all these identities are literally getting used within the context of cash laundering and, extra particularly, sports activities betting.

And he sounds the alarm.

It is a significant issue that’s largely being ignored. It’s our hope that exposing the magnitude of this may assist spur motion, as a result of far too many individuals are dropping far an excessive amount of cash to the sort of crime.

This text accompanies Heists Worth Billions, an investigation from The Dialog that discovered felony gangs utilizing sham financial institution accounts and secret on-line marketplaces to steal from virtually anybody – and uncovered simply how little being achieved to fight the fraud.

• How to protect yourself from drop account fraud – tips from our investigative unit.

Source link