The U.S. financial system could possibly be at a essential level.

For years, the U.S. authorities has embraced breakneck spending, inflicting bigger deficits and hovering debt ranges which will require trillions of {dollars} in curiosity funds over the approaching many years.

The financial scenario might have a dire affect if it means the federal government is pressured to restructure its debt, one thing billionaire Ray Dalio has beforehand steered.

Related: Billionaire Ray Dalio’s blunt message on economy turns heads

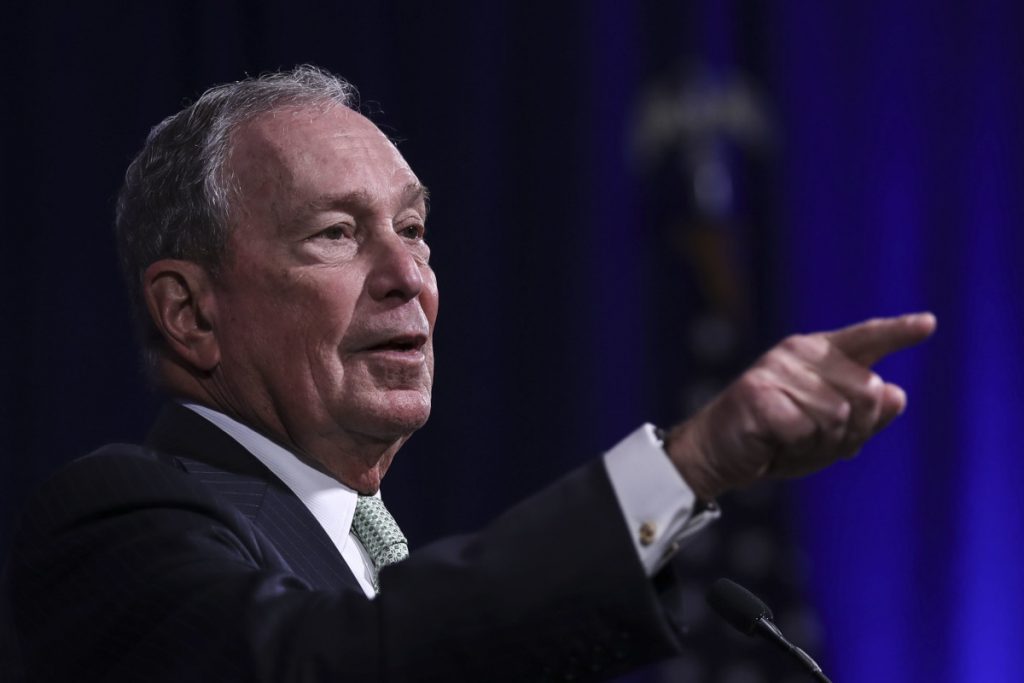

The chance of a possible financial reckoning isn’t misplaced on those that have seen a factor or two over many years of analyzing markets, together with Michael Bloomberg, the billionaire founding father of the Bloomberg terminals generally discovered on the desks of most main hedge funds, mutual funds, and buying and selling operations.

Bloomberg just lately weighed in on the financial challenges, delivering a blunt evaluation that each investor ought to think about.

The Federal Reserve has put itself in a nook.

In 2021, Fed Chairman Jerome Powell tried to argue that inflation was transitory, solely to backtrack shortly afterward because the Fed launched into essentially the most restrictive and hawkish financial coverage since Fed Chair Paul Volcker battled inflation within the early Nineteen Eighties.

Related: Jim Cramer offers blunt one-word reaction to 20% tariffs

Powell’s struggle on inflation labored, but it surely got here at a value. Whereas inflation has retreated under 3% from over 8% in 2022, increased rates of interest’ affect on financial progress has led to unemployment climbing to 4.1% from 3.5% as just lately as 2023.

The upturn in joblessness prompted the Fed to decrease its benchmark Fed Funds Fee within the fourth quarter of 2024. Nonetheless, we’ve but to see any enchancment within the jobs market, and the speed cuts seem to have re-sparked inflation, given the Client Value Index confirmed inflation at 2.8% in February, up from 2.4% in September.

Worse, sticky inflation and job loss are coming alongside a deceleration in financial progress.

The Atlanta Fed’s GDPNow forecasts a first-quarter GDP of destructive 3.7%. Whereas that’s probably to enhance as extra knowledge turns into out there, it seems very probably that the first-quarter GDP will likely be far shy of the three.1% tempo throughout the second and third quarters final yr.

Given shopper confidence ranges, issues might worsen. The Convention Board’s Client Expectations Index is 65, far south of the 80 stage that has signaled recessions up to now.

The short-term outlook for the financial system is tenuous. Nonetheless, the long-term outlook could possibly be downright harmful.

Source link