Bitcoin has discovered itself in a difficult place, struggling to reclaim the coveted $100,000 mark after a fast shift in market sentiment. Simply weeks in the past, optimism dominated the panorama, with costs surging towards new heights. Nonetheless, the narrative has taken a pointy flip, as concern now grips the market following a sudden correction.

Associated Studying

Presently buying and selling under $100K, Bitcoin’s worth motion displays elevated uncertainty amongst buyers. High analyst Axel Adler lately shared his insights on X, emphasizing the importance of the $90,000 stage as a sturdy help zone. In line with Adler, this zone extends to a decrease vary of $79,000, providing a security internet ought to additional declines happen. He highlights that sustaining this help is essential for Bitcoin to stabilize and regain bullish momentum.

Whereas the present sentiment leans towards warning, historic tendencies counsel that Bitcoin often thrives after testing key support levels. The market’s focus has now shifted as to whether BTC can defend this crucial zone and stage a restoration. Within the coming days, the $90K mark will likely be a pivotal battleground, figuring out whether or not Bitcoin can regain its footing or proceed its descent. Traders and analysts alike are carefully monitoring these developments, awaiting the subsequent main transfer.

Bitcoin Discovering Demand Under $100K

Bitcoin’s worth motion has shifted from testing new all-time highs to discovering strong demand under the $100,000 mark. This zone will decide whether or not the rally resumes or the market confirms a deeper correction. Amid this uncertainty, high analyst Axel Adler has provided critical insights on X, shedding mild on key ranges shaping Bitcoin’s trajectory.

Adler’s evaluation highlights the importance of the $79,000 stage, which lately recorded the most important unrealized revenue and loss (P/L) up to now decade. This information means that the $79K zone will not be solely a psychological benchmark but additionally a vital help stage with vital market exercise.

Moreover, he emphasizes the $90K mark as a sturdy help space, with its decrease boundary set at $79K. Adler notes that holding above $90K within the coming weeks would bolster bullish momentum, making a surge previous $100K extremely possible.

Associated Studying

Nonetheless, Adler additionally cautions in regards to the potential for a sideways consolidation part. Such a transfer may function a cooling-off interval for the market, permitting it to digest latest positive aspects earlier than resuming its upward trajectory. For now, Bitcoin’s worth motion stays at a pivotal crossroads, with its skill to take care of help ranges dictating whether or not the subsequent part will likely be a breakout or a correction. Traders are watching carefully.

Technical Evaluation: Key Ranges To Maintain

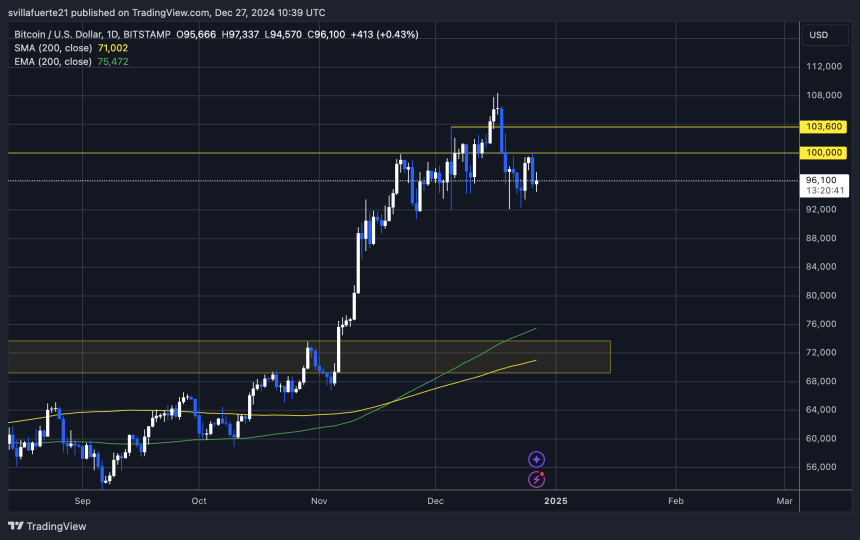

Bitcoin is presently buying and selling at $96,200, reflecting days of indecision and sideways worth motion that has left merchants unsure in regards to the subsequent transfer. Regardless of this consolidation part, BTC stays inside a crucial vary, with its subsequent route prone to rely upon whether or not bulls or bears take management.

For bullish momentum to return, Bitcoin should break decisively above the psychological $100,000 mark. Reaching this milestone would sign renewed power and will pave the best way for additional worth discovery, probably igniting one other leg of the rally. On the flip facet, holding above the $92,000 stage would nonetheless keep a bullish narrative, because it demonstrates resilience at a vital help zone.

Nonetheless, issues a few potential downturn persist amongst analysts. Some specialists predict that Bitcoin may drop as little as $70,000 within the coming weeks if the $92K help fails to carry. This bearish situation would characterize a major correction and will shake market sentiment.

Associated Studying

Within the present setting, Bitcoin’s worth is at a pivotal level, with bulls needing to reclaim management to push the market greater. Till then, the market stays weak to each bullish breakouts and bearish breakdowns, leaving buyers rigorously monitoring these key ranges for additional clues.

Featured picture from Dall-E, chart from TradingView

Source link