Bitcoin (BTC) has confronted heightened volatility in current weeks, initially pushed by Donald Trump’s proposed trade tariffs and later exacerbated by the newest Client Worth Index (CPI) knowledge. The inflation report despatched BTC plummeting to as little as $94,000 earlier than it managed to get well some losses. Nevertheless, based on crypto analyst Ali Martinez, Bitcoin should defend a crucial worth degree to keep away from a major correction.

Analyst Identifies Important Bitcoin Worth Degree

In an X post shared earlier at present, Martinez introduced consideration to the Pi Cycle High Indicator. For the uninitiated, the Pi Cycle High Indicator is a Bitcoin market instrument that goals to establish market cycle peaks.

Associated Studying

The indicator tracks the 111-day shifting common (MA) and a a number of – usually 2x – of the 350-day shifting common. When the 111-day MA crosses above the 2x 350-day MA, it traditionally alerts a market high.

Based on Martinez, Bitcoin tends to expertise steep worth corrections when it drops beneath the 111-day MA. At the moment, this shifting common stands at roughly $93,400. If BTC falls beneath this degree, it may set off a serious draw back transfer.

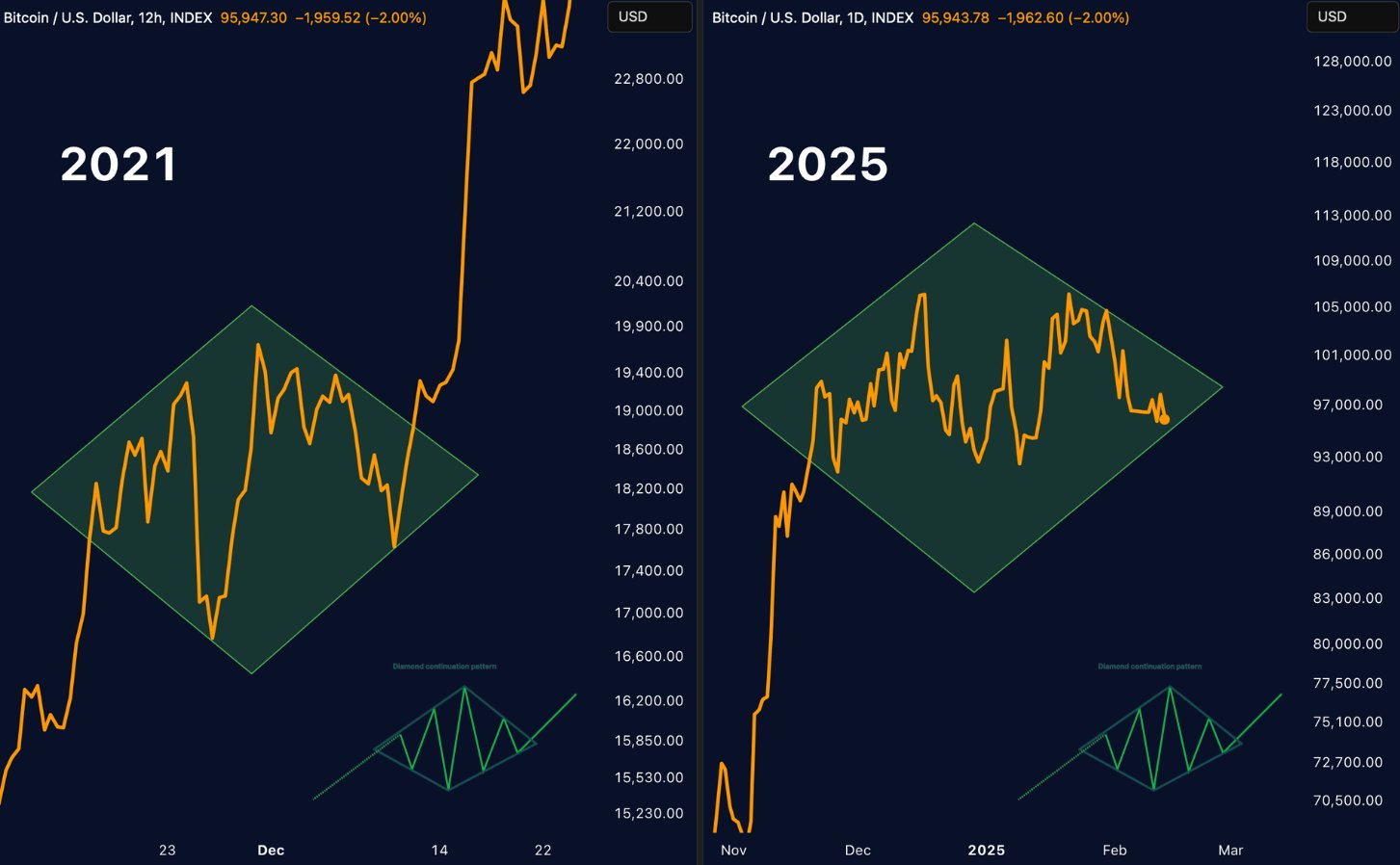

Fellow crypto analyst Merlijn The Dealer shared their ideas on the present BTC worth motion. The analyst shared the next chart which exhibits the similarity between BTC worth motion in 2021 and 2025.

Based on the chart, BTC is presently within the midst of finishing a bullish diamond sample. A profitable completion of this sample adopted by a bullish breakout could propel BTC to new all-time highs (ATH) past $120,000.

The place Is BTC Headed Subsequent?

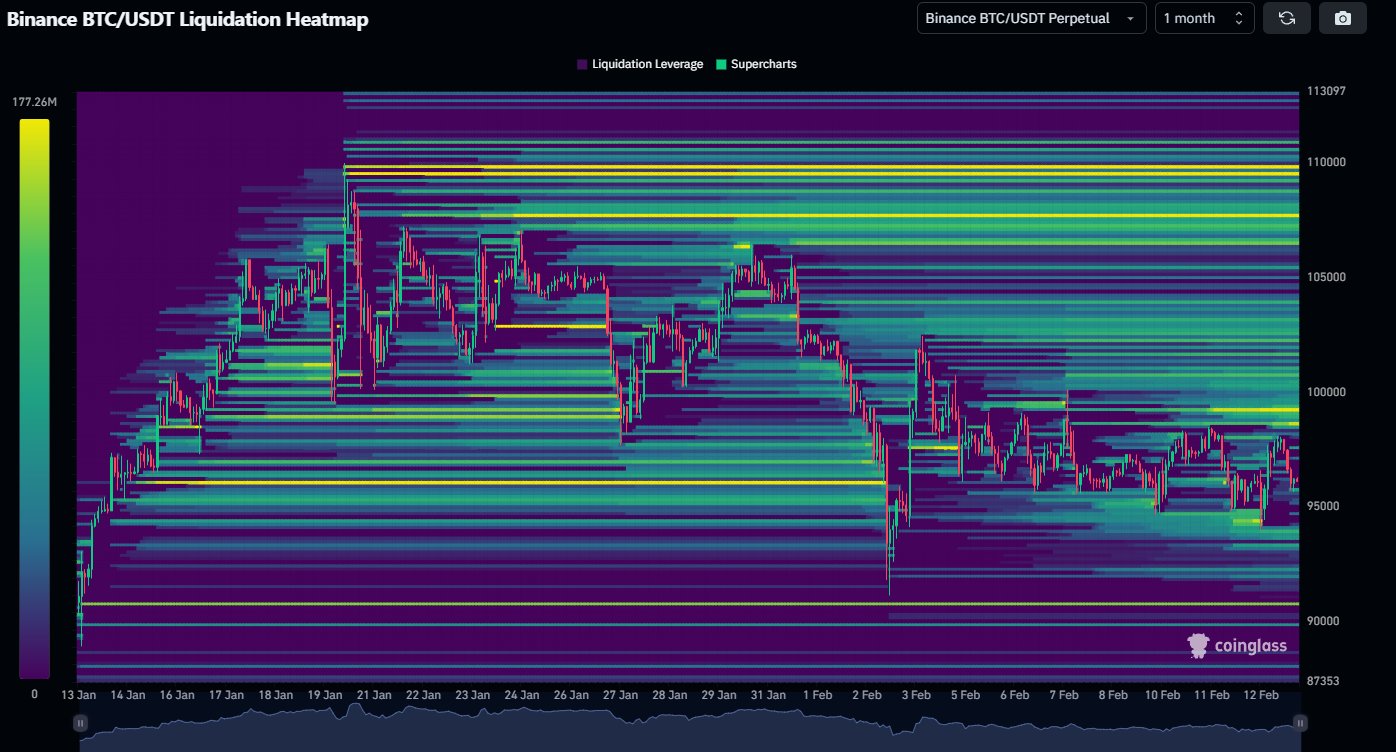

Crypto investor Daan Crypto Trades additionally analyzed Bitcoin’s newest worth motion, significantly in response to the CPI knowledge. The report confirmed that inflation stays sizzling within the US, decreasing the probability of additional rate of interest cuts from the Federal Reserve (Fed) within the close to future. Daan famous:

Many of the liquidity beneath was taken on the decrease time frames. There’s a whole lot of untapped liquidity sitting greater in any case these decrease highs the previous couple of weeks. If BTC can flip this native downtrend round, these may act as gas for the transfer greater.

The investor additionally warned that if BTC slides beneath $90,000, it may enter a “hazard zone.” This degree has served as a key help space, with Bitcoin rebounding from it a number of occasions. A decisive break beneath it may improve the chance of a bigger sell-off.

Associated Studying

Regardless of the current bearish developments, Bitcoin has held agency within the mid-$90,000 vary. Nevertheless, some market contributors stay cautious about the potential of a drop to $80,000 if promoting strain intensifies. At press time, BTC trades at $95,324, down 1% previously 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com

Source link