If you happen to’ve been round Bitcoin lengthy sufficient, you understand it strikes in cycles, and the halving cycle is a giant deal. It occurs roughly each 4 years, halts the block reward, and has traditionally kicked off main worth strikes. However right here’s the factor: it’s not simply the halving occasion that issues; it’s what holders do earlier than and after it.

Proper now, long-term holders who’ve been holding their BTC for 3–5 years are quietly stacking. Knowledge from Glassnode exhibits that after unloading greater than 2 million BTC in two huge waves earlier on this cycle, these holders are actually deep in reaccumulation mode.

Throughout the 2023–25 cycle, Lengthy-Time period Holders have distributed over 2M $BTC in two distinct waves. But, every has been adopted by sturdy re-accumulation, serving to take up the sell-side strain. This cyclical steadiness could also be stabilizing worth motion. pic.twitter.com/HAOZhG4q8o

— glassnode (@glassnode) March 31, 2025

Since mid-February, they’ve added round 363,000 BTC again to their wallets. That’s a robust sign: these aren’t merchants searching for a fast flip. They’re taking part in the lengthy sport and seem like positioning for what comes subsequent.

Whales Intensify Accumulation Efforts And Swoop on Undervalued BTC USD

In the meantime, the whales, wallets with over 1,000 BTC, have been busy too. At the start of April, Glassnode’s “accumulation rating” for giant whales hit an ideal 1.0, which means they have been going exhausting on shopping for for about two weeks straight.

Whales holding >10K $BTC briefly hit an ideal accumulation rating (~1.0) on the flip of the month, reflecting intense 15-day shopping for. The rating has since eased to ~0.65, nonetheless signaling regular accumulation.

In the meantime, cohorts from $BTC as much as 100 $BTC have intensified their… https://t.co/cEo3F7Paid pic.twitter.com/7udA7G8nSM— glassnode (@glassnode) April 7, 2025

It’s cooled barely since then (presently round 0.65), however that also displays aggressive accumulation in comparison with the common.

This habits usually indicators a quiet switch of cash from short-term holders or retail traders to longer-term, deep-pocketed gamers. Whether or not they’re getting ready for a bull run or simply hedging in opposition to macro uncertainty, it’s clear the huge gamers are treating this worth zone like a shopping for alternative.

Brief-Time period Holders Present Warning Submit Bitcoin Halving

Now flip the lens to the opposite aspect of the spectrum: short-term holders, wallets which have held BTC for just a few weeks to 6 months. These of us are performing extra skittish. Traditionally, this group sells each 8–12 months in waves. Their spending habits is presently close to the low finish of the vary. Translation? They’re holding… for now.

However that’s a double-edged sword. If the worth drops additional, these holders could panic and promote, fueling a possible draw back. So, sitting nonetheless right this moment, they may change into the primary domino to fall in a correction situation.

Market Sentiment Displays Underlying Uncertainty

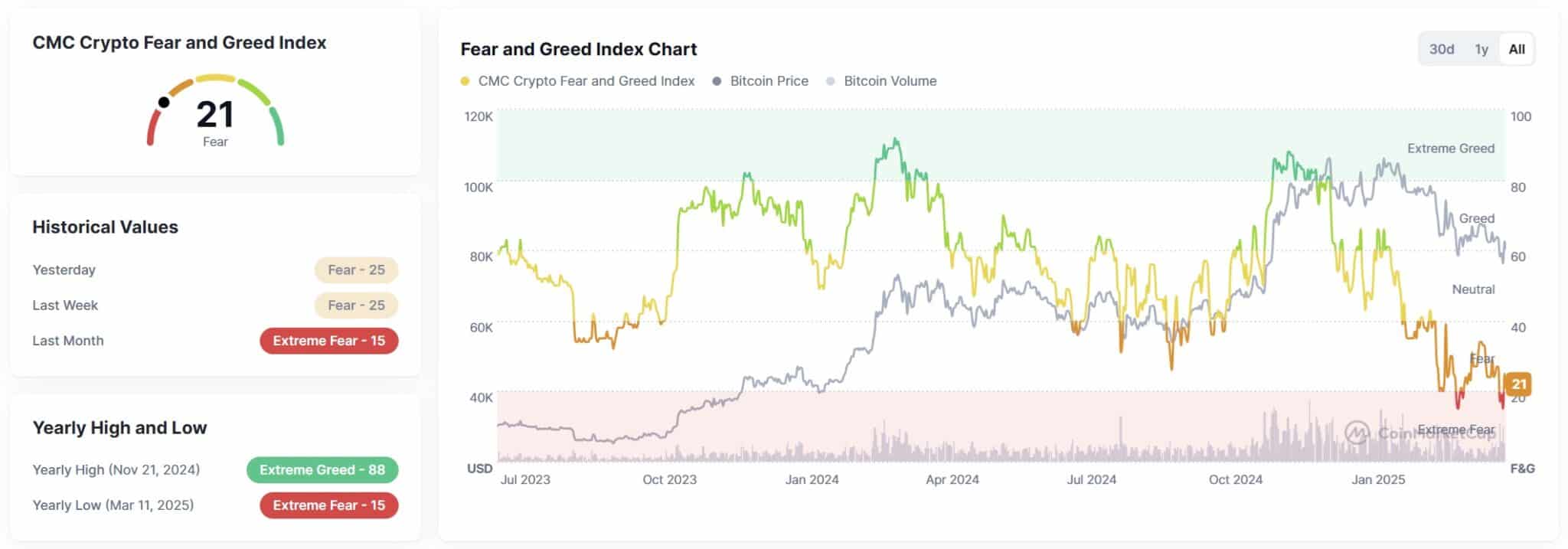

After which there’s sentiment, at all times the X think about crypto. The CoinMarketCap Fear & Greed Index has been sitting in “Worry” and “Excessive Worry” territory for weeks. The overall investor temper hasn’t caught up, even with accumulation occurring behind the scenes.

Whether or not it’s inflation fears, macro pressure, or post-halving fatigue, the market isn’t satisfied of the place we’re headed subsequent. And that sort of temper tends to maintain volatility excessive and conviction low.

Wanting Forward: Potential for Continued Development

So, the place does this depart us? Lengthy-term holders and whales are quietly accumulating, usually setting the stage for stronger worth motion. However we’re nonetheless in a transitional zone till sentiment shifts and short-term holders cease flinching at each purple candle.

Name it the calm earlier than the subsequent section. The halving is finished — now the ready (and watching) begins.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

-

Lengthy-term Bitcoin holders have resumed accumulation, including over 363,000 BTC since mid-February after earlier sell-offs. -

Whales with 1,000+ BTC confirmed peak accumulation in early April, signaling confidence within the present worth zone. -

Brief-term holders are displaying warning, with low spending exercise—however might set off draw back if panic promoting begins. -

Market sentiment stays in “Worry” territory, suggesting traders are unsure regardless of sturdy on-chain accumulation developments. -

With halving full and accumulation rising, the stage could also be set for the subsequent bull section—as soon as sentiment and momentum align.

Source link