Bitcoin open curiosity dropped almost 20% as speculators exited amid a $10,000 worth crash from the Trump tariff struggle. Considerations about rising inflation, stagflation, and a normal slowdown within the world financial system may result in a risk-on setting, forcing extra capital into bonds and money. Even so, may this be the precise time to Purchase BTCUSD?

Bitcoin and crypto costs are unstable. After a short lived push greater on April 7, costs edged decrease yesterday, confirming losses from final week and maybe setting the stage for even decrease costs within the coming days.

Whereas the momentary rebound to round $80,200 on April 8 could possibly be a optimistic sign, the turbulence in present market situations may rapidly erase it as broader macroeconomic pressures stay tense.

(BTCUSDT)

Discover: Best New Cryptocurrencies to Invest in 2025

Bitcoin Open Curiosity Drops Practically 20%

Within the subsequent few buying and selling days, Bitcoin costs will probably be topic to intense macroeconomic pressures, and geopolitical escalations will form market sentiment, impacting dangerous property, significantly crypto.

Given latest tendencies and the overall turmoil that has seen the world’s most respected coin shrink by over $10,000 since April 2, on-chain knowledge now confirms a large unwinding of leveraged Bitcoin positions throughout main perpetual exchanges like Binance, Bybit, and OKX.

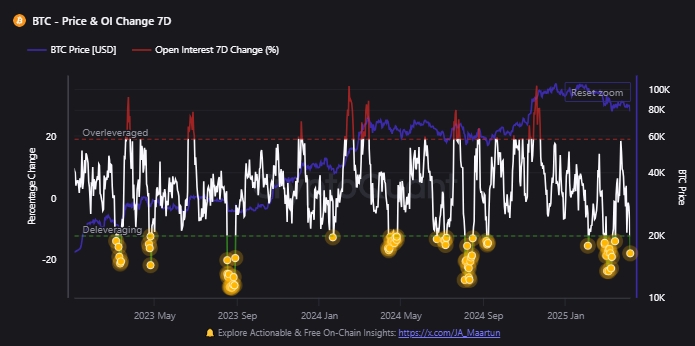

One analyst on X notes that Bitcoin open curiosity is down almost 20% up to now week of buying and selling, signaling an aggressive flush-out of leveraged merchants.

(Source)

The sell-off of the previous few days was primarily accelerated by liquidations—together with a $1.3 billion liquidation on April 7 alone—and sentiment is bearish at present spot charges.

This may throttle capital flowing into crypto and Bitcoin. The state of affairs might worsen additional as tensions from the Trump “Liberation Day” tariff struggle escalate quickly.

On-chain knowledge confirms a large 17.8% drop in Bitcoin open curiosity, signaling an aggressive flush-out of leveraged merchants. Billions in speculative positions have been closed in simply seven days—a traditional market reset that always precedes a recent wave of accumulation.

Nonetheless, with tensions from the Trump-era “Liberation Day” tariff struggle escalating quickly, the timing of any potential restoration stays unsure, additional impacting even among the best meme coins to buy in 2025.

Yesterday, China responded to Trump’s tariffs by dumping $50 billion in U.S. Treasuries.

In retaliation, the U.S. introduced an escalated tariff charge of 104% on Chinese language imports, efficient at present.

In response, Bitcoin costs dropped from round $80,200 to as little as $74,500 and proceed to face strain.

At this tempo, open curiosity will probably lower as merchants shut their positions. Others will probably cut back leverage quickly to fulfill margin necessities.

With this taking place, the market will turn out to be leaner and extra able to mounting a sustainable restoration, as historical past exhibits.

Each time sharp losses are accompanied by a double-digit drop in open curiosity, market costs are likely to get well as sensible merchants purchase the dip, profiting from higher costs.

Discover: 10 Best AI Crypto Coins to Invest in 2025

Time to Purchase the BTC/USD Dip?

In a distinct put up, one other analyst on X said the short-term holder market worth to realized worth (MVRV) ratio is at 0.85.

This contraction alerts that short-term holders—addresses that purchased Bitcoin up to now 155 days—are down 15%.

Parallel knowledge exhibits that almost 26% of all Bitcoin in circulation is in unfavourable territory.

Bitcoin in Loss: 5,124,348 BTC (25.8%)

That’s a major chunk of the circulating provide sitting within the pink.

Whereas it might sound alarming, it is not unprecedented.

In truth, we noticed comparable dips in 2024.

Jan 22, 2024: 24.1% – 4.72M BTC

July 06, 2024: 22.4% – 5.13M BTC… pic.twitter.com/PpmfAID3ZF

— CryptoQuant.com (@cryptoquant_com) April 7, 2025

Nonetheless, with the STH MVRV ratio at 0.85—beneath the 0.90 threshold—it could point out that Bitcoin is deeply undervalued.

When this metric fell beneath 0.90 in August and September 2024, Bitcoin costs recovered sharply. In flip, it drove much more capital to among the hottest crypto presales.

If historical past serves as a information, the Bitcoin worth could possibly be in textbook accumulation territory. Afterward, the coin may snap greater, above the $90,000 resistance.

DISCOVER: Next 1000x Crypto – 10+ Coins That Could 1000x in 2025

Bitcoin Open Curiosity Dropping: Will BTCUSD Get better?

-

Bitcoin worth drops pushed by a wave of liquidation -

Bitcoin open curiosity plunges almost 20% in every week, flushing out overleveraged merchants -

China dumps U.S. Treasuries as U.S. hikes tariffs on Chinese language items in response -

Is it time to purchase the BTCUSD dip in anticipation of worth good points?

Source link