Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has risen dramatically during the last 10 years towards gold, with an increase of an unimaginable 13,693%, in keeping with the monetary statistics shared by crypto entrepreneur Ted.

The figures exhibit the alarming divergence between the 2 property from April 2015 and April 2025. Particularly, this placing ascent of Bitcoin has caught the attention of traders unfold across the globe.

Associated Studying

Bitcoin Vs. Gold: From Equal Footing To Huge Hole

Ten years in the past, gold and Bitcoin have been at related costs. In April 2015, Bitcoin moved between $200 and $250, whereas gold was ranging round $1,200 to $1,300 per ounce.

The fortunes of those investments have since turn into completely totally different. Bitcoin has soared to about $84,000 per coin, up some 33,500% within the ten-year interval. The cryptocurrency briefly peaked at practically $109,000 throughout the timeframe.

If somebody tries to let you know gold is healthier than Bitcoin…

Simply present them this:

In 2015, 1 BTC = 1 ounce of gold.

At this time? That very same Bitcoin is up 13,693% in 10 years.

Let the numbers communicate. pic.twitter.com/8JipH5IsNr

— Ted (@TedPillows) April 17, 2025

Gold, however, has preserved its picture of reliability over volatility, slightly than providing spectacular beneficial properties. The valuable metallic elevated by solely 156% over the identical interval. From the market onlookers, gold’s value proposition continues to be anchored on its constant, inflation-proof conduct spanning very lengthy timescales.

Historic Context Demonstrates Divergent Patterns Of Development

Going again even farther reveals a fair higher disparity in the growth rates. In response to a market analyst on social media platform X, the value of gold was solely $20.67 per ounce in 1933. As for 2025, the value has gone up considerably to round $3,330 an oz., which is certainly a steep rise however a gradual improve over a interval of virtually a century.

Ted's evaluation on X.

Bitcoin has had a very totally different historical past. From a worth of $1 in 2011, it got here as much as $84,000 by 2025. With such fast appreciation charges, each pleasure and skepticism have been introduced forth by monetary analysts debating the worthiness of such growths.

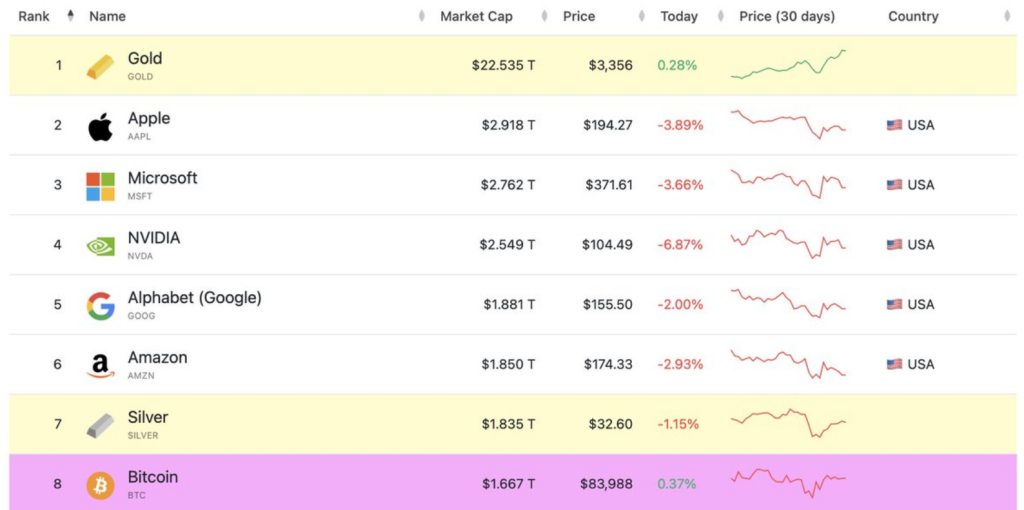

Sheer Disparity In Measurement

In response to analyst Belle, a stark distinction within the conduct is because of the sheer distinction within the dimension of their market. Gold has roughly a market capitalization of a little bit over $22 trillion. As a result of this nice dimension, gold offers a component of stability, rendering the market much less delicate to particular person transactions or flows of short-term investments.

GOLD added $1 trillion to its market cap in sooner or later.

That’s practically the whole worth of #Bitcoin proper now.This reveals how huge conventional markets are & how early we nonetheless are with Bitcoin.

Even a small shift into $BTC may ship it flying. pic.twitter.com/YsjSgOZKjx— Belle (@Bitt_Belle) April 17, 2025

Bitcoin’s market capitalization is at roughly $1.667 trillion—giant however nonetheless solely a fraction of gold’s. This decreased dimension makes Bitcoin extra delicate to capital flows. Gold lately noticed a formidable $1 trillion rise in market capitalization over sooner or later, however this was a a lot smaller proportion transfer than the identical greenback circulation would set off in Bitcoin’s worth.

Associated Studying

Similar Greenback Stream, Completely different Value Affect

In the meantime, the mathematics by way of market capitalization generates intriguing worth motion eventualities. Primarily based on calculations reported, if Bitcoin have been to get a $1 trillion increase in market capitalization—corresponding to the latest one-day improve in gold—its worth per unit would possibly rise from $84,000 to $135,000.

Featured picture from The Ledn Weblog, chart from TradingView

Source link