Discover

Worth 7d

latest value motion by in-depth Bitcoin technical evaluation. This text dives into key Bitcoin chart patterns, assist and resistance ranges, and buying and selling alerts driving cryptocurrency market development. With search curiosity peaking in late March 2025, we uncover what technical indicators like RSI, shifting averages, and quantity counsel about Bitcoin subsequent transfer. Whether or not you’re a seasoned dealer or crypto fanatic, achieve actionable insights into the forces shaping BTC value volatility and crypto buying and selling alerts.

$BTC provide hits 8 yr low as demand from whales intensifies pic.twitter.com/Q8BiVK8K3M

— The Crypto Professor (@TheCryptoProfes) March 29, 2025

The Bitcoin provide is nice to have a look at because the provide / demand dynamics apply for it as nicely. The extra curiosity there’s, the upper the value will develop. Identical to the housing market in the previous couple of years. Please check with last week’s article here for extra context.

Bitcoin Technical Evaluation for Finish of March

(BTCUSDT)

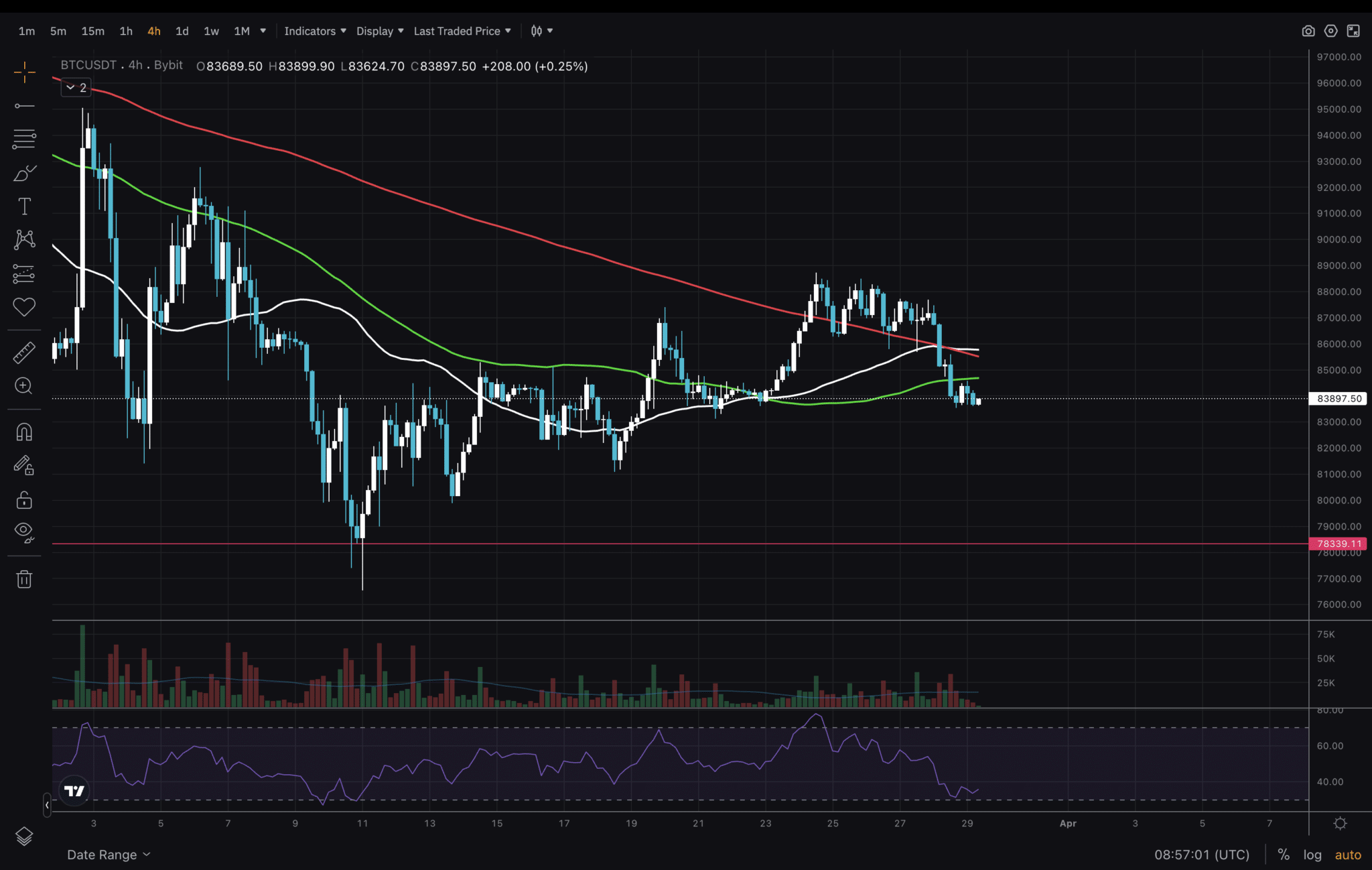

Bitcoin technical evaluation continues the cryptocurrency market development – upwards. We’re trying the 4H timeframe and the BTC value volatility has printed considered one of traders favorite Bitcoin chart patterns. Particularly, increased highs and better lows. What we’re seeing now could be regular – a retrace to check one of many earlier lows. And we actually don’t need value to go under $78,000.

DISCOVER: Top 20 Crypto to Buy in March 2025

(BTCUSDT)

Staying on the 4H timeframe, I would like us to present a fast look at RSI and the Transferring averages as nicely since these present crypto buying and selling alerts. Worth is hovering across the 50, 100 and 200 MAs and RSI has dropped to the extent it was after we noticed a dip under $78,000. This is able to counsel that we will count on a reversal to the upside someday within the subsequent few days. Ideally, we might proceed ranging and hop above and under the MAs in an effort to type a backside.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

(BTCUSDT)

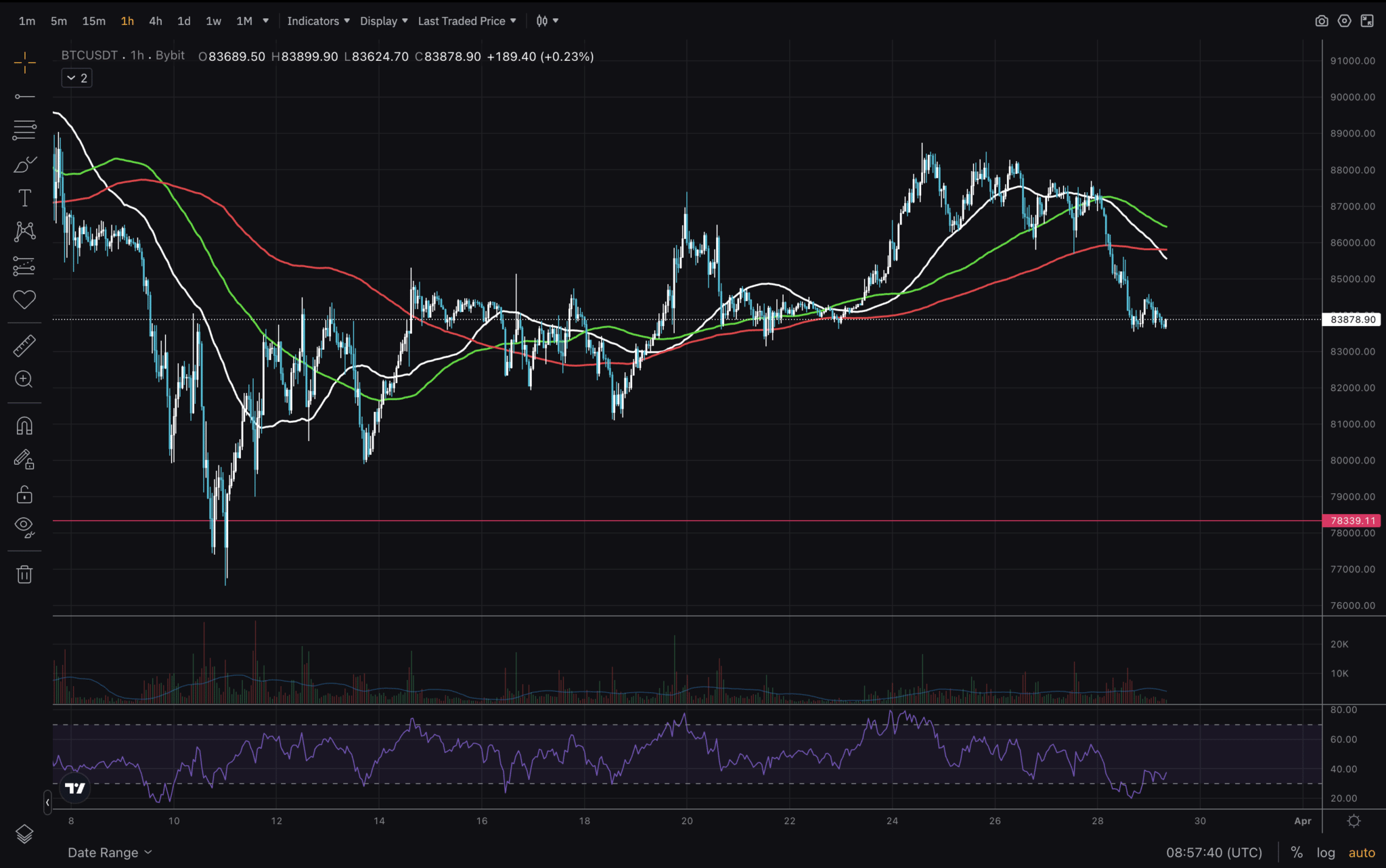

Final, we’ll discover the 1H timeframe. A low timeframe that would give us early crypto buying and selling alerts. That’s as a result of the Bitcoin chart patterns are nonetheless legitimate and there’s sufficient BTC value volatility to decode. Worth has damaged under all of the MAs on this timeframe as nicely and RSI appears to be like bottomed. Really there’s a bullish divergence seen on the RSI chart. Being at a earlier low stage, this could possibly be a great place for value to bounce off of. Hold an in depth eye on how value reacts when it reaches earlier lows and commerce with good threat administration.

That’s all for in the present day. Keep secure on the market!

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Bitcoin Worth Motion: Technical Insights from Current Tendencies

-

BTC value hovering round 4H and 1H MAs -

RSI bullish divergence on 1H -

We need to see value keep round present ranges for a backside to type

Source link