After a flash crash to $89,256 earlier this month, Bitcoin (BTC) made a swift restoration, reaching a brand new all-time excessive (ATH) of $108,786 on January 20. Nonetheless, in line with a crypto analyst, additional upside might be restricted till the Federal Open Market Committee (FOMC) assembly later this month.

Bitcoin To Stay Vary-Sure Till FOMC Assembly

The world’s largest cryptocurrency has been on a bullish trajectory since November, fueled by Donald Trump’s victory within the US presidential election. Over the previous three months, BTC has surged from roughly $67,000 to $104,536 on the time of writing, posting features of over 50%.

Associated Studying

Nonetheless, crypto analyst Krillin predicts that BTC might proceed to “chop” within the $100,000 to $110,000 vary till the FOMC assembly. The analyst means that until the Financial institution of Japan takes extraordinary coverage measures, BTC is unlikely to interrupt out of this vary earlier than the tip of the month.

At current, the CME FedWatch device indicates a 99.5% likelihood that the US Federal Reserve (Fed) won’t reduce rates of interest on the upcoming assembly. Krillin expects a market dump to observe the anticipated hawkish assembly, which can be partially offset by a dovish-sounding press convention hinting at future quantitative easing (QE).

For the uninitiated, QE is a financial coverage the place central banks inject cash into the financial system by buying authorities bonds and different monetary property to decrease rates of interest and stimulate financial exercise. This elevated cash provide can weaken fiat currencies, probably driving buyers towards property like BTC, boosting its worth as a hedge towards inflation and forex devaluation.

Krillin’s prediction aligns with a current market observation which states that BTC profit-taking has declined by 93% from its December peak, and that the long-term holders are again in accumulation mode, getting ready for the following leg up. Nonetheless, how lengthy the present consolidation section might final is anybody’s guess.

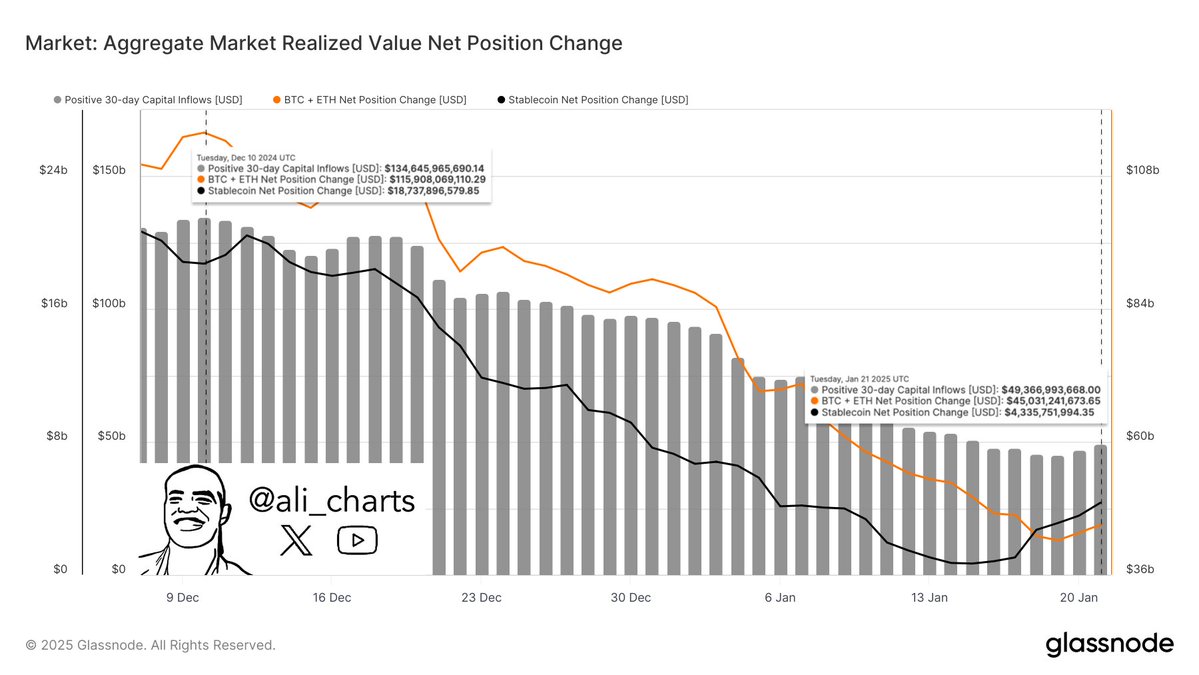

In the meantime, crypto analyst Ali Martinez notes a pointy decline in capital inflows into the digital property market, from $134 billion on December 10 to $43.37 billion. This low liquidity might lead to sharp worth swings, growing the danger of liquidations for leverage merchants.

Will BTC Peak In Q2 2025?

As BTC awaits the FOMC assembly to find out its subsequent worth development, some analysts stay optimistic that the cryptocurrency might hit its market cycle peak in Q2 2025 as extra establishments embrace the asset below beneficial laws.

Associated Studying

For instance, crypto analyst Dave The Wave just lately predicted that BTC will seemingly peak in the summertime of 2025. A report by Bitfinex helps this outlook, forecasting that Bitcoin might surge to $200,000 by mid-2025, albeit with minor corrections alongside the way in which.

That stated, Bitcoin should defend the $100,000 worth degree, as failure to take action might see the asset drop to as little as $97,500. At press time, BTC trades at $104,536, up 1.4% prior to now 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com

Source link