Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin value put in considered one of its strongest performances in current occasions over the previous week, rallying to above the $88,000 stage early on. Nonetheless, the premier cryptocurrency skilled a steep correction on Friday, March 28, following the newest February core inflation information.

With the value of BTC now hovering beneath $84,000, panic appears to be rising out there as traders worry additional correction for the world’s largest cryptocurrency. Apparently, the newest on-chain information present the essential help ranges for the Bitcoin value.

Is BTC At Danger Of A Fall To $71,000?

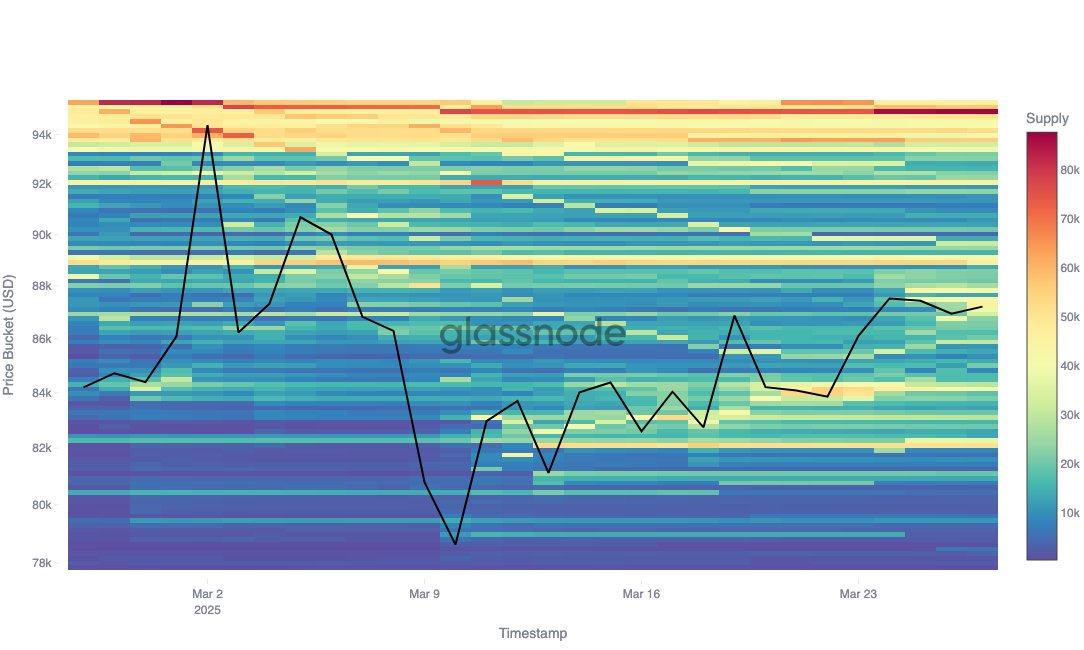

In a current put up on the X platform, blockchain analytics agency Glassnode explained the current investor conduct and the way it may influence the Bitcoin value motion over the following few days. This analysis relies on the fee foundation distribution information of traders across the Bitcoin value.

Associated Studying

In response to Glassnode, the fee foundation distribution information displays the overall Bitcoin provide held by addresses with a mean value foundation inside particular value buckets. As noticed within the chart under, the warmth map (colour depth) represents the magnitude of BTC provide in a value zone.

Supply: @glassnode on XGlassnode information reveals {that a} vital share of merchants bought roughly 15,000 BTC on the $78,000 stage on March 10 earlier than promoting on the current $87,000 native high. Following this newest spherical of redistribution, the BTC provide on the $78,000 stage is now skinny, weakening the support cushion.

It’s value noting, although, that the following essential help ranges lie round $84,100, $82,090, and $80,920, the place traders bought 40,000 BTC, 50,000 BTC, and 20,000 BTC, respectively. Nonetheless, the Bitcoin value could possibly be liable to a deep correction if it loses these ranges.

In case of a deeper correction, $78,000 won’t provide a robust sufficient cushion for the flagship cryptocurrency following the current sell-off by traders beforehand holding on the stage. Glassnode information reveals that the Bitcoin value may fall to as low as $74,000, the following vital help stage after $80,000.

The on-chain analytics platform highlighted $74,000 (the place traders purchased 49,000 BTC) and $71,000 (the place traders purchased 41,000 BTC) as the following help ranges ought to the Bitcoin value fall beneath $80,000. “These ranges replicate conviction-driven accumulation zones that would take in extra draw back strain,” Glassnode added.

Bitcoin Value At A Look

As of this writing, the value of Bitcoin stands at round $83,800, reflecting an nearly 4% decline up to now 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView

Source link