Bitcoin whale demand is surging, lifting Bitcoin costs. Is BTC USD set for $90,000? Within the final three months, costs plunged by almost 30% from all-time highs, triggering large liquidations. As costs choose up momentum, the Bitcoin hash fee can be trending greater, lately reaching all-time highs.

Though the Bitcoin worth pulled again yesterday, dropping from $82,000, on-chain information factors to energy. CryptoQuant analysts word that Bitcoin may be within the early stage of a better correction, lifting a number of the best Solana meme coins.

–

Worth

Market Cap

–

–

–

Of their findings, massive traders, or Bitcoin whales, are eager to purchase extra cash. Their demand has accelerated as extra stable proof builds, displaying that these entities are positioning themselves for the subsequent huge leg up.

Apparently, that is enjoying out simply as Bitcoin costs have been transferring sideways, shaking out weak arms. The involvement of huge and long-term holders—probably establishments or billionaires—at spot charges is a big confidence increase.

It could set the inspiration for the world’s most useful coin to race towards $90,000 and even to all-time highs of almost $110,000.

Bitcoin Whales Are Shopping for In Droves: How Will It Impact BTC USD

Per CryptoQuant, addresses holding between 1,000 and 10,000 BTC proceed to develop at a tempo far exceeding their 30-day common.

This growth implies that whales have been scooping up extra cash over the previous months, surpassing the imply typical of earlier months.

Giant investor demand for Bitcoin is accelerating.

Balances of wallets holding 1K–10K BTC rising quicker than their 30-day common.

Sometimes bullish, indicators robust investor confidence. pic.twitter.com/hR5Rumj6A6

— CryptoQuant.com (@cryptoquant_com) April 10, 2025

This bullish divergence is a transparent sign that high-net-worth people and establishments are accumulating cash at spot ranges, probably as a result of, of their evaluation, Bitcoin is undervalued.

CryptoQuant analysts added that costs have a tendency to maneuver greater at any time when this divergence types–a lift for altcoins and a number of the best cryptos to buy.

Bitcoin is underneath strain, down 27% from January 2025 highs of almost $110,000. In latest days, BTCUSD costs have been consolidating, caught in a good vary between $84,000 and $74,000.

Whereas $90,000 is a key liquidation degree that have to be convincingly damaged for Bitcoin bulls to focus on $100,000, the coin might plunge to Q2 2025 lows of round $74,500 or 2021 highs.

(BTCUSDT)

If Bitcoin whales are again and accumulating, shopping for on each dip, then an in depth above $88,000 and this week’s excessive would possibly catalyze demand, lifting sentiment and costs. Nevertheless, if this can be a bluff, Bitcoin might find yourself crashing beneath 2021 highs, reversing all This autumn 2024 features earlier than probably plunging to $50,000.

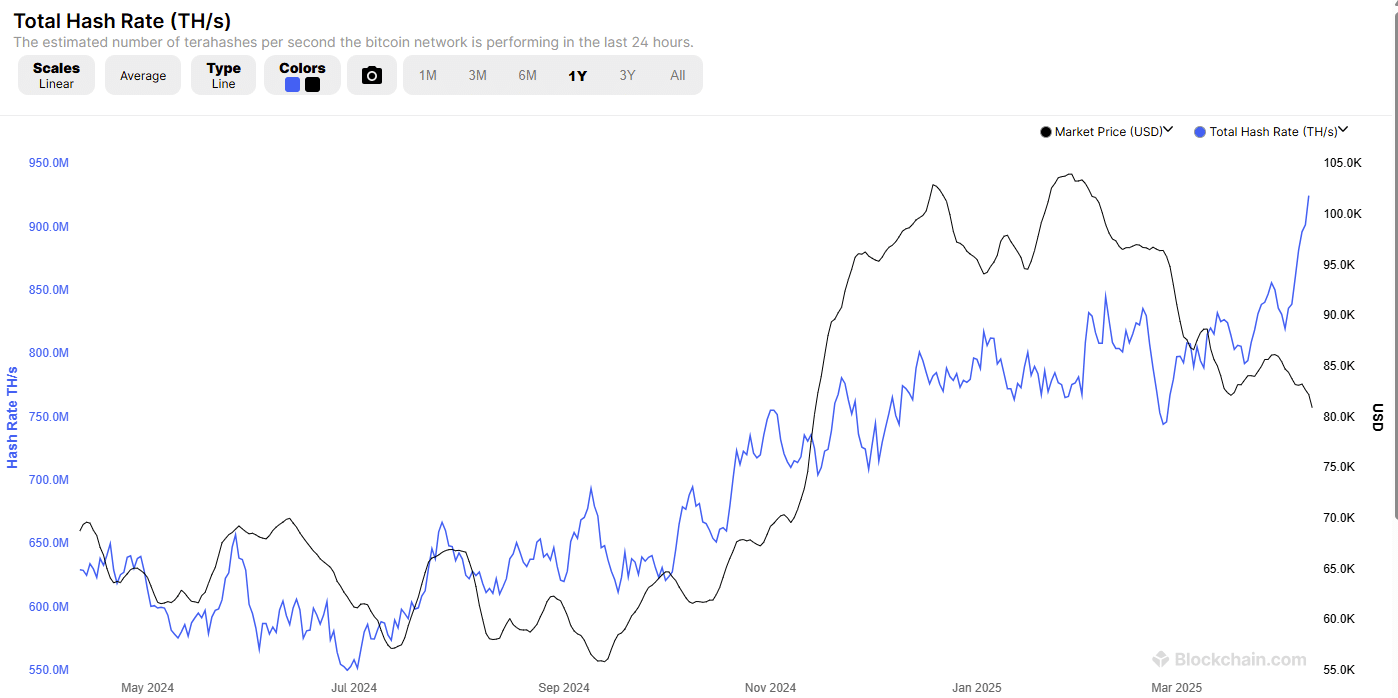

Bitcoin Hash Fee Rising: Miners Are Working Tougher Than Ever

The surge in hash fee to all-time highs coincides with Bitcoin whale curiosity. This metric measures the computational energy devoted to the community. By April 9, it stood at over 100 EH/s, printing an all-time excessive, in accordance with Blockchain.com information.

Miners like Marathon Digital typically buy gear and channel computing energy to course of transactions and make sure blocks for a share of block rewards.

(Source)

Regardless of the slowdown over the past three months, the divergence in hash fee and costs means that miners are assured that costs will rise. For that reason, they’re doubling down on buying extra energy-efficient gear, positioning them to course of extra blocks and, thus, generate extra income.

The rising hash fee amid falling costs additional reveals that the latest sell-off and international market uncertainty sparked by Donald Trump’s tariffs might be a wholesome correction—a chance for sensible traders to purchase the dip.

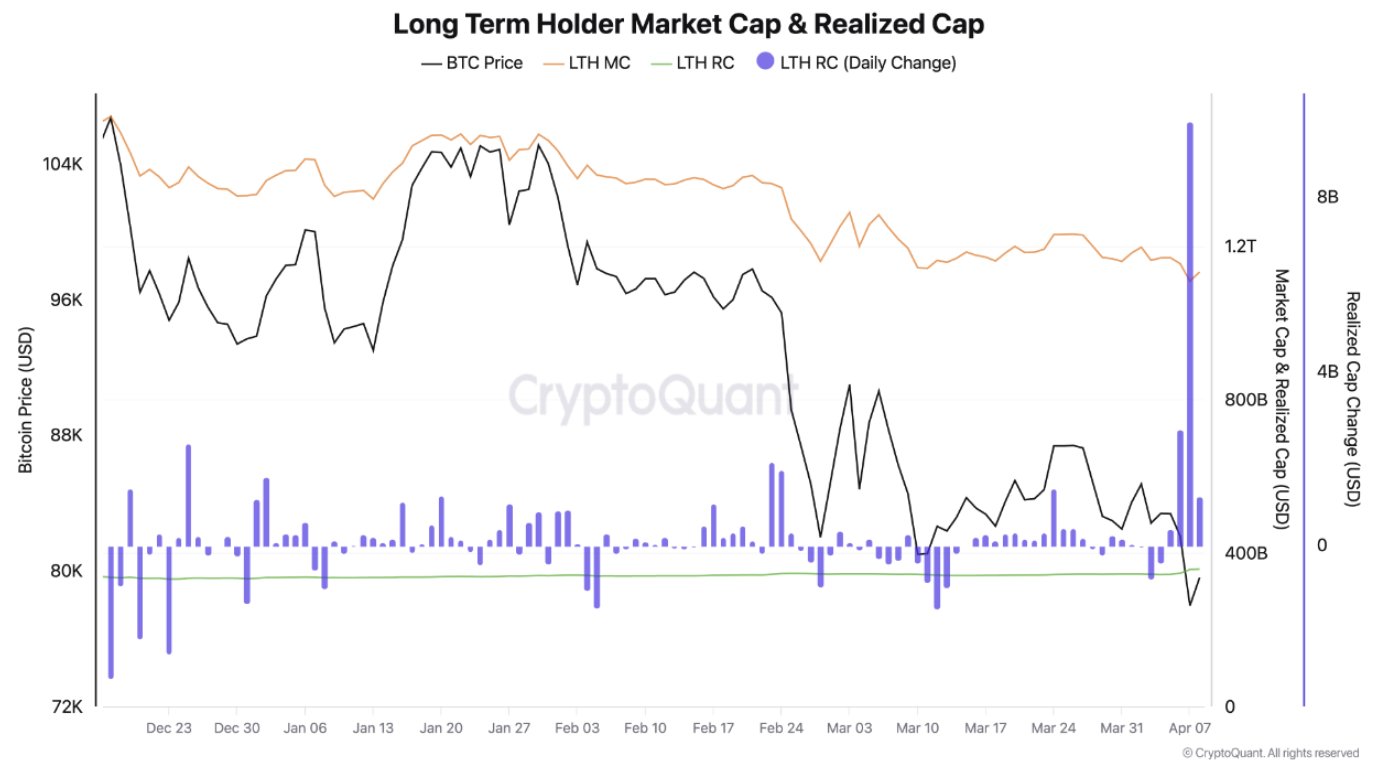

As information reveals, long-term holders are stepping in and shopping for the dip as speculators, largely short-term holders, are exiting, promoting at a loss.

(Source)

Lengthy-term holders are sometimes establishments and veterans, and their involvement at spot charges factors to a “basic redistribution conduct,” as one analyst notes.

DISCOVER: 16 Next Crypto to Explode in 2025: Expert Cryptocurrency Predictions & Analysis

Bitcoin Whale Demand Surging: Is BTCUSD Concentrating on $90,000?

-

Bitcoin worth agency as Bitcoin whales step in, shopping for the dip -

Bitcoin hash fee rising, spikes to all-time highs regardless of latest worth drop. -

Lengthy-term holders accumulating as speculators capitulate -

Is that this the very best time to purchase BTCUSD? Will costs hit $90,000?

Source link