Wall Road’s nerves are uncooked, and Jim Cramer threw gasoline on the fireplace. The CNBC host invoked the specter of 1987’s Black Monday, tying the turmoil to Trump’s “Liberation Day” tariffs. Cramer warned that the markets may buckle in methods we haven’t seen in many years until one thing shifts.

Say what you’ll about Cramer’s track record, however even a damaged clock is correct twice a day.

Is There Any Correlation to Black Monday?

Whereas Black Monday occurred within the Nineteen Eighties, specialists cite the Smoot-Hawley Act of 1930 as the primary historic reference.

That Black Thursday opened as a intestine punch, swith tocks crashing 11% earlier than cratering additional within the days forward. Merchants had been left selecting by way of the rubble, mourning a market that misplaced 25% of its worth inside 48 hours. What adopted was the ugliest financial chapter in historical past, culminating in a worldwide despair.

The Smoot-Hawley Act of 1930 turned the knife, elevating tariffs when nations had been already bleeding out.

Black Monday, occurring 50 years after the Despair, has an identical sample to at this time.

The 1987 crash was a intestine punch, erasing 22.6% of the Dow day by day, the sharpest drop in U.S. historical past. Trump’s Liberation Day—a blanket 10% import tariff alongside focused penalties of as much as 54% on buying and selling giants like China and India—is already shaking markets. By week’s finish, the losses had been on stark show:

- The S&P 500 dropped 6%, marking its steepest decline since March 2020.

- The Dow tumbled over 5%, reflecting rising investor fears.

- International markets, from Asia’s Nikkei to Europe’s DAX, skilled vital dips, signaling widespread apprehension.

Consultants like Cramer concern this may very well be a prelude to a bigger market occasion if corrective measures aren’t taken swiftly.

We’ve Been in a Recession, The Biden Admin Modified the Definition

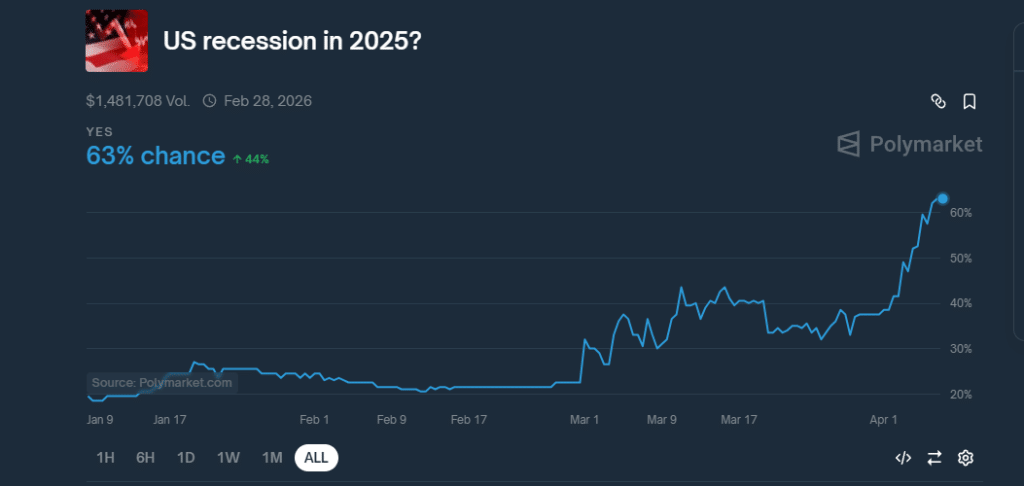

The purpose we’re making is that individuals like Jim Cramer are improper. We HAD a recession, and we’re heading into one irrespective of who turns into president. You gotta love the gaslighting.

Beneath Biden, GDP dropped two quarters straight in ‘22 which usually is a textbook recession. WH & NBER dodged the labelling although. Oh and in addition this occurred: pic.twitter.com/Z0SjbrAzbU

— David Nage

(@DavidNage) April 4, 2025

In 2022, the Biden administration redefined what constitutes a recession. For many years, two straight quarters of shrinking GDP had been the gold commonplace of downturn diagnostics—clear, easy, brutal.

To keep away from the unhealthy publicity, they rewrote the definition to say that GDP alone isn’t sufficient to name a recession, throwing labor markets, client spending, and company funding into the combo.

Okay, Let’s Say a Black Monday Occasion Occurs. What Are We Shopping for?

Canned beans, a gun, and ammunition? All jokes apart, this can be a clear backside alternative to load up on extra Bitcoin and main L1 alternate options like Sui, Solana, and Polkadot.

Cramer’s speak of a “Black Monday 2.0” stays speculative, however the warning lights are there. What ought to offer you pause is similar people who find themselves improper about every little thing are essentially the most vocal towards tariffs. Furthermore, quite a lot of that is already priced in.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

-

Wall Road’s nerves are uncooked, and Jim Cramer simply threw gasoline on the fireplace calling for Black Monday 2.0. -

Say what you’ll about Cramer’s track record, however even a damaged clock is correct twice a day. -

Black Monday, occurring 50 years after the despair, has an identical sample to at this time.

Source link