With BlackRock and its BUIDL fund surpassing $1b in AUM, buyers are actually in search of the following 100x RWA alternative. Enter ONDO and Landshare (LAND).

The BlackRock USD Institutional Digital Liquidity Fund, higher often called ‘BUIDL’, has surpassed $1 billion in property underneath administration (AUM), in line with a company announcement on Thursday (March 13).

This marks a major milestone for the tokenization sector as the primary tokenized fund issued by a Wall Avenue establishment to achieve the billion-dollar milestone.

On-chain finance is right here and it’s #BuiltOnBUIDL

We’re thrilled to announce that the @BlackRock USD Institutional Digital Liquidity Fund (BUIDL), tokenized by Securitize, has reached $1 billion in property underneath administration (AUM).This marks a major milestone within the… pic.twitter.com/Gt66Kdz2kx

— Securitize (@Securitize) March 13, 2025

Significance Of BlackRock’s BUIDL Fund Hitting $1 Billion

BUIDL was launched in March 2024 and is BlackRock’s first tokenized fund to be issued on a public blockchain. The world’s largest asset supervisor, with over $11 trillion in AUM, provides certified buyers the power to earn onchain US greenback yields.

Yields are paid day by day by way of dividends earned by way of its basket of short-term Treasury reserves. The BUIDL token is pegged to the US greenback, which means it operates like a revenue-earning different to stablecoins like USDT and USDC.

Till yesterday, Hashnote’s USYC was listed because the world’s largest tokenized cash market fund backed by tokenized Treasuries. DefiLlama information reveals that USYC has $851.81m in AUM whereas BUIDL now has a tad over $1 billion.

With BUIDL main the way in which for tokenized asset tasks, we are going to check out two premier RWA cryptocurrencies that everybody must be contemplating as a part of a balanced portfolio:

DISCOVER: Will Popcat Crypto Make a Comeback? POPCAT Price Shows First Signs of Life in Weeks

Finest RWA Crypto #1: Ondo Finance (ONDO) – Market Main Tokenized Asset Platform

Ondo Finance (ONDO) continues to develop. Just like BUIDL, ONDO simply surpassed $1 billion in total-value locked, the largest TVL of any particular person real-world asset (RWA) venture proper now.

The expansion in TVL for ONDO has been unbelievable, with its newest spike of over $1 billion, which means a 53% enhance month-on-month. This highlights two issues: one, the market’s urge for food for funding within the RWA sector. Two, ONDO’s exponential TVL progress reveals its place because the main tokenized asset venture available on the market.

The bullish catalysts for ONDO are seemingly unending because of the staff’s nonstop supply of its roadmap targets. It additionally helps that ONDO is owned by each BlackRock’s BUIDL fund and President Trump’s World Liberty Monetary venture.

ONDO is at the moment buying and selling at round $0.87, and plenty of analysts are calling for a surge again towards its February excessive of $1.42 as a short-term worth goal. As RWA sentiment continues to develop and ONDO is already effectively positioned as the blue-chip venture throughout the sector, count on a climb again towards its earlier all-time excessive of $2 within the coming months.

Finest RWA Crypto #2: Landshare (LAND) – Hidden Gem Main The Approach For Utility Initiatives On BNB Chain

Winners take note of promising tasks!

The ultimate dip earlier than full ship is right here!

I’ve my full conviction in $LAND. Actual property tokenization will develop exponentially and Landshare is the

pic.twitter.com/dr7qeUx79x

— Luke Mayfield (@may2_luke) February 28, 2025

Landshare (LAND) has over 4 years of actual property tokenization expertise, making it one of many extra established and skilled RWA groups. It maintains this standing whereas nonetheless being a low-cap, low-supply venture.

The LAND token is constructed on the Binance Sensible Chain. On a series usually recognized for its meme cash, akin to BROCCOLI, Landshare stands out as one of many premier utility-focused tasks on the Binance Sensible Chain.

By holding LAND, buyers achieve entry to crowdsourced actual property buys, renovations, and eventual gross sales. Buyers should buy and maintain shares in rental properties by holding the token. That is an attractive alternative for these in search of decentralized passive revenue and actual property publicity.

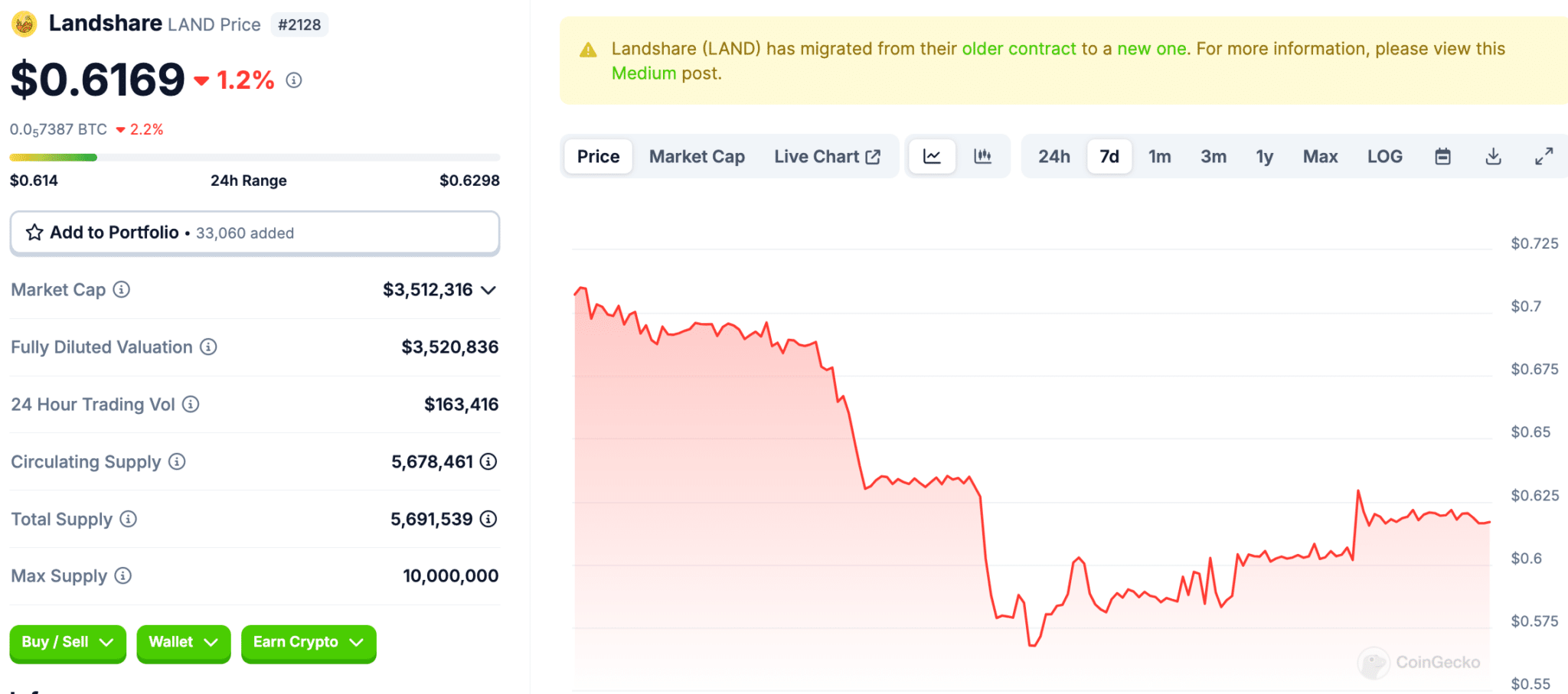

LAND is at the moment buying and selling for round $0.62 per token and represents a real microcap with a market cap of simply $3.5 million. With the staff’s long-standing presence and steady product supply, Landshare represents a very undervalued RWA play.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

BlackRock’s BUIDL RWA fund hits $1b in property underneath administration

-

This marks a key milestone for the tokenized asset sector as the primary fund to hit $1b -

The RWA sector is heating up, and buyers are looking for the following huge play -

Ondo Finance (ONDO) is already effectively positioned because the premier RWA venture available on the market -

Landshare (LAND) is a riskier RWA play with a better upside. With a longtime staff and over 4 years of expertise, this tokenized actual property venture is a steal at lower than $4m in market cap

Source link