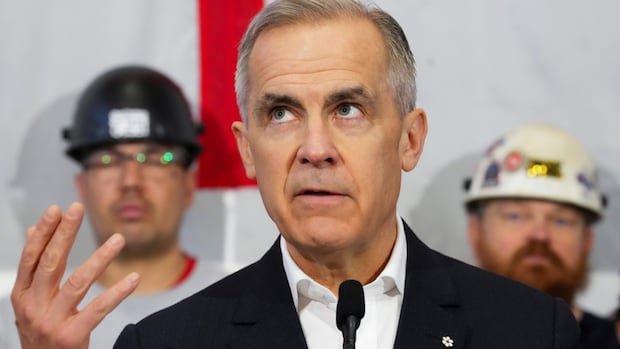

A $5-billion funding fund created underneath Mark Carney’s management at Brookfield Asset Administration was registered within the Cayman Islands tax haven, in response to data obtained by Radio-Canada.

That is along with two different funds totalling $25 billion that had been registered in Bermuda, one other offshore tax haven, when the Liberal chief was on the agency’s board of administrators from 2020 to 2025.

In all three instances, the constructions are authorized, respect worldwide tax requirements and are generally utilized by funding corporations. In addition they guarantee Canadian traders pay taxes on the earnings from their investments in Canada, and never in overseas international locations.

Brookfield declined to touch upon its use of tax havens as a part of the structuring of its funds. In previous public statements, the agency has insisted it doesn’t interact in tax avoidance, and that every one its entities pay all required taxes within the jurisdictions by which they function.

The Liberal Celebration directed inquiries to Brookfield.

“Mr. Carney labored for Brookfield from August 2020 to January 2025 and now not has any involvement within the agency,” stated Liberal spokesperson Mohammad Hussain.

Different political events have stated the agency’s use of tax havens raises questions on Carney’s actions within the non-public sector, and his doable administration of tax points if the Liberal Celebration wins the April 28 election.

The Conservatives additionally criticize the truth that Carney didn’t make public which property he positioned in a blind belief when he grew to become Liberal chief and prime minister final month, together with these he would have acquired throughout his time at Brookfield.

Earlier this week, Conservative Chief Pierre Poilievre minimized the worth of Carney’s time within the company world, alleging his Liberal counterpart benefited from his political connections to extend his private web price.

“He wants to instantly launch his private monetary holdings so Canadians can decide for themselves,” Conservative MP Michael Barrett stated in a press release.

A query of ‘effectivity’

In response to a number of questions from the media throughout the marketing campaign, the Liberal chief has stated the choice to register two Brookfield funds in Bermuda was a query of “effectivity,” not tax avoidance.

“The flow-through of the funds goes to Canadian entities who then pay the taxes appropriately, versus taxes being paid a number of instances earlier than they get there. In order that’s how now we have this construction. That is the construction that every one of our pension funds observe,” Carney stated on March 26.

Brookfield’s two funds registered in Bermuda are the Brookfield International Transition Fund ($15 billion) and the Brookfield International Transition Fund II ($10 billion), launched in 2021 and 2024 respectively.

The third fund registered within the Cayman Islands known as the Catalytic Transition Fund. Launched in 2024, it goals to take a position $5 billion within the area of “clear vitality and transition property.” In contrast to two different funds, the Catalytic Transition Fund particularly goals to put money into initiatives positioned in rising markets.

The fund’s preliminary investor was Altérra, financed by the United Arab Emirates and billed as the most important non-public local weather funding fund. The Caisse de dépôt et placement du Québec additionally ultimately invested within the fund, amongst others.

‘It means you are getting cash’

Tax skilled Jean-Pierre Vidal, a professor of accounting sciences at HEC Montréal, says the usage of tax havens stays poorly understood by many voters, particularly as a result of their use has been severely restricted in recent times.

“So far as Canada is worried, tax havens are used to cut back taxes paid in overseas international locations,” Vidal stated, explaining they assist firms pay extra taxes of their dwelling nation when their investments are repatriated.

Nonetheless, he stated jurisdictions with low or minimal ranges of company taxes assist scale back prices for firms like Brookfield.

“Canada was not a loser — in truth, it was a winner — however it’s sure that these firms made extra money as a result of they had been in these locations. That is what we imply by effectivity…. It means you are getting cash.”

The European Union publishes an inventory of “non-co-operative” jurisdictions for tax functions, however neither Bermuda nor the Cayman Islands has been on it since 2019.

In line with accounting agency PwC, there isn’t any company tax within the Cayman Islands, whereas Bermuda launched a 15 per cent company tax price this 12 months, with a sequence of exemptions for some company entities. Brookfield’s funds registered in Bermuda are non-public and their precise taxation standing is unknown.

Political opponents take goal

The Conservative Celebration has stored on elevating potential conflicts of curiosity stemming from Carney’s time at Brookfield, which is especially lively within the area of renewable vitality and inexperienced applied sciences.

The Conservatives additionally criticize the truth that Carney didn’t disclose the property that he positioned in a blind belief when he grew to become Liberal chief and prime minister final month, together with these he would have acquired throughout his time at Brookfield from 2020 to 2025.

Earlier this week, Conservative Chief Pierre Poilievre minimized the worth of Carney’s time within the non-public sector, alleging his Liberal counterpart benefited from his political connections to extend his private web price.

Carney has stated he created his blind belief in collaboration with the ethics commissioner, and that anti-conflict screens are in place to keep away from any dialogue affecting Brookfield.

Final week, the chief of the NDP promised to place an finish to tax agreements between Canada and jurisdictions like Bermuda.

“We lose tens of billions of {dollars} yearly due to tax havens, due to large firms avoiding international locations their justifiable share,” stated Jagmeet Singh.

Bloc Québécois chief Yves-François Blanchet known as on the Liberal chief to “reveal his overseas property.”

“Mr. Carney thinks that taxes are merely for regular folks, and never for millionaires or billionaires like him,” the Bloc chief stated.

Source link