Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The greenback is weakening this yr. As reported, the US greenback index declined 7% year-to-date, certainly one of its worst openings in latest historical past.

The greenback index measures the worth of the greenback towards six different main foreign currency. As tensions between the US and a number of other nations have elevated on the commerce entrance, worries concerning the long-term energy of the greenback are starting to emerge.

Associated Studying

Bitcoin Receives Extra Consideration From Traders

Because the greenback weakens, extra buyers are turning to Bitcoin as a possible hedge. Enterprise capitalist Tim Draper indicated that Bitcoin could function an insurance coverage coverage towards the failure of fiat currencies.

He thinks the digital forex will preserve appreciating in worth relative to the US greenback, significantly as worldwide confidence in fiat currencies falters.

In a remark he made on the X platform, he mentioned Bitcoin “is perhaps value an infinite quantity of USD.”

Bitcoin is perhaps value an infinite quantity of USD.

Through the Civil Battle, the south’s Accomplice Greenback went by way of hyperinflation.

After beginning 1:1 with USD, it ended the warfare at over 10 million to 1.

Individuals misplaced religion and scrambled to commerce their money in for USD.

However now… pic.twitter.com/qRTEKl4VkU

— Tim Draper (@TimDraper) May 1, 2025

Draper likened Bitcoin’s current surge to a change in financial conduct. He identified that in unsure occasions, people will shift their funds in direction of the property that make them really feel safer.

Whereas gold has performed that operate beforehand, Draper said that Bitcoin is beginning to fill the place due to its digital format and comfort.

A Civil Battle-Period Analogy Raises Eyebrows

As an instance his argument, Draper referred to American historical past. He cited the Accomplice States of America, which had printed its personal paper cash through the Civil Battle in 1861.

Initially, it was pegged at a 1:1 ratio with the US greenback. However in direction of the top of the warfare, the Accomplice greenback had disintegrated, exchanging at over 10 million to 1 in comparison with the US greenback.

Draper defined this illustrates how rapidly a forex can disintegrate when belief is misplaced. He cautioned that one thing like that may occur once more if people, companies, and even governments lose religion within the stability of the present system. In his opinion, Bitcoin stands to realize from that change.

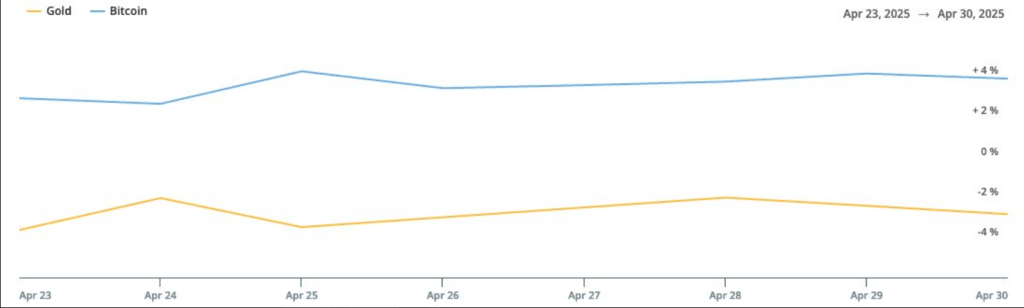

Bitcoin Versus Gold In A Altering Market

Gold will normally be the primary secure haven when there are monetary pressures, however Draper believes that it’s not primary. He famous that gold has points corresponding to large storage charges and bodily motion. Bitcoin, nevertheless, is a purely on-line existence and may simply switch rapidly throughout borders.

Associated Studying

He additionally said that Bitcoin possesses particular strengths—like restricted provide and autonomy from central banks—that make it extra engaging than typical property.

These traits, Draper defined, have gotten more and more troublesome to miss as the worldwide monetary system comes beneath larger stress.

Governments Begin To Take Discover

Draper claims that even some governments are looking for to seek out out if they need to preserve Bitcoin reserves. That marks a shifting sentiment in direction of how cryptocurrencies are perceived, not solely amongst personal buyers but additionally public establishments.

Featured picture from Unsplash, chart from TradingView

Source link