-

President Donald Trump stated this week Fed chair Jerome Powell’s “termination can’t come quick sufficient.” That’s led to a debate about whether or not the president has the facility to take away Federal Reserve management. Chicago Fed President Austan Goolsbee says this transfer may “undermine the credibility of the Fed.”

This week, President Donald Trump arrange a showdown with Federal Reserve chair Jerome Powell after the top of the central financial institution made a speech warning of the impacts of the president’s on-again, off-again tariffs.

“The extent of tariff will increase introduced up to now is considerably bigger than anticipated, and the identical is more likely to be true of the financial results, which is able to embrace greater inflation and slower progress,” Powell stated on Wednesday throughout a speech on the Financial Membership of Chicago.

Trump rapidly fired back the next day, criticizing Powell for not reducing rates of interest quick sufficient.

“‘Too Late’ Jerome Powell of the Fed, who’s all the time TOO LATE AND WRONG, yesterday issued a report which was one other, and typical, full ‘mess!’” Trump wrote in a social media publish. “Powell’s termination can’t come quick sufficient!”

Though Trump acts as if he has the power to remove the Fed chair, this comes as a direct problem to an almost 100-year-old precedent from a Supreme Court docket case wherein the court docket held that President Franklin Roosevelt couldn’t take away the heads of an unbiased company and not using a good motive corresponding to neglect or wrongdoing. In the meantime, many critics additionally worry a transfer by Trump to take away Powell would decimate confidence within the U.S. economic system.

Fed presidents don’t touch upon politics as a way to uphold the central financial institution’s stance as an apolitical establishment, however one fears what may occur if Trump have been to determine a technique to take away Powell.

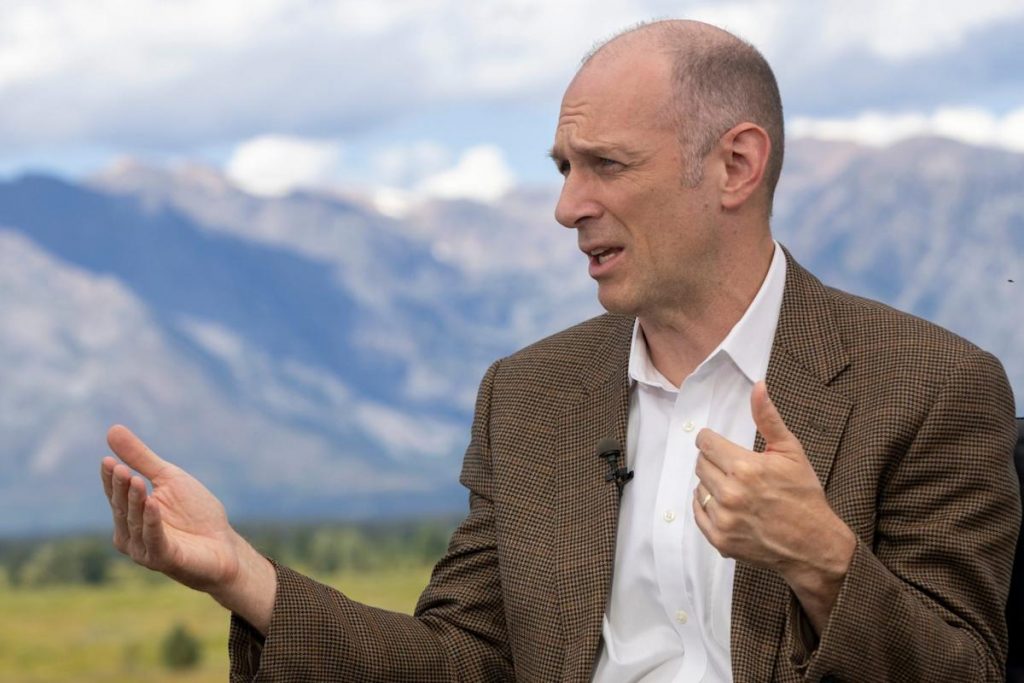

“I strongly hope that we don’t transfer ourselves into an surroundings the place financial independence is questioned,” Chicago Fed President Austan Goolsbee told CBS’s “Face the Nation with Margaret Brennan” on Sunday. “As a result of that may undermine the credibility of the Fed.”

Goolsbee additionally famous there’s “digital unanimity” amongst economists that the Fed ought to have financial independence from political interference.

“They got here to that not as a concept, however simply by trying around the globe at locations the place they do not have financial independence,” Goolsbee stated. “The [stance] that the Fed or any central financial institution be capable to do the job that it must do is actually vital.”

Powell has additionally appeared assured he can’t be fired by Trump, and when requested if he would go away if the president requested him to, he stated no.

“Typically talking, Fed independence may be very broadly understood and supported in Washington, in Congress, the place it actually issues,” Powell stated on the Financial Membership of Chicago.

Trump was additionally the one to nominate Powell in 2017, however has criticized just about every little thing he’s performed together with lowering interest rates, raising interest rates, and keeping them steady.

Nonetheless, there’s debate about whether or not Fed independence is actually protected. Some consultants argue financial independence is extra of a norm than a regulation.

“Legal guidelines additionally depend upon individuals and who they’re, how they interpret issues, and what they’re prepared to do. I feel there may actually be some discount within the extent of the independence of the Fed going ahead,” Itay Goldstein, finance division chair on the College of Pennsylvania’s Wharton College, told Fortune’s Greg McKenna. “Hopefully not.”

This story was initially featured on Fortune.com

Source link