-

China hit the US with a 125% tariff on imports on Friday.

-

The transfer is the newest in a sequence of tit-for-tat tariff will increase.

-

China accused the US of “bullying” and mentioned it’s turning into a “joke” on the world stage.

China hit again on the US with a 125% tariff on imports, the newest escalation within the commerce struggle between the 2 superpowers sparked by President Donald Trump‘s trade tariffs.

In a fiery assertion printed on Friday, China’s finance ministry accused the US of “bullying” and mentioned it risked turning into a “joke” on the world stage.

“The US’s arbitrary imposition of abnormally excessive tariffs on China severely violates worldwide financial and commerce guidelines, disregards the post-World Conflict II world financial order constructed by the US itself, and violates primary financial legal guidelines and customary sense. It’s utterly unilateral bullying and coercion,” the assertion mentioned.

“Even when the US continues to impose increased tariffs, it can not make financial sense and can change into a joke within the historical past of the world economic system.”

The brand new tariffs will come into impact on Saturday, the ministry mentioned. It added that it could not reciprocate with additional tariff will increase ought to the US retaliate once more.

“If the US continues to play the tariff numbers recreation, China will ignore it,” the assertion mentioned.

Beforehand, China had mentioned the tariff rate on US imports would be 84%, a stage imposed on Wednesday.

On Thursday, Trump’s White Home clarified that the mixed tariff price being imposed on China was 145%, not the 125% that had beforehand been reported.

The White Home clarified that the mixed tariff price imposed on China was 145%, not 125%.Chip Somodevilla/Getty Pictures

Neither are displaying indicators of backing down

Analysts at Deutsche Bank wrote in a be aware on Friday that the distinction between the 2 figures is “negligible in any sensible financial sense. ” Nevertheless, they outlined that the markets reacted to an elevated decoupling of two of the world’s largest economies.

“Neither the US nor China are displaying indicators of backing down, with President Trump expressing confidence in his tariff plans yesterday, whilst he acknowledged potential ‘transition issues,'” the analysts mentioned.

Earlier within the week, Trump introduced that he would pause a large swathe of his tariffs for 90 days, although many — together with tariffs on China — remained in impact.

Mark Haefele, chief funding officer at UBS International Wealth Administration, mentioned on Friday that the president’s willingness to vary his stance on tariffs in response to fairness and bond market turmoil exhibits some sensitivity to market turbulence.

“To make sure, the numerous tariffs on China will trigger financial disruption if they continue to be in place,” he mentioned. “However whereas draw back dangers do stay, we imagine the chance of a extra extreme financial downturn is now extra restricted.”

“In some unspecified time in the future, hopefully within the close to future, China will understand that the times of ripping off the usA., and different Nations, is not sustainable or acceptable,” Trump wrote on Fact Social on Wednesday.

Inventory markets stutter

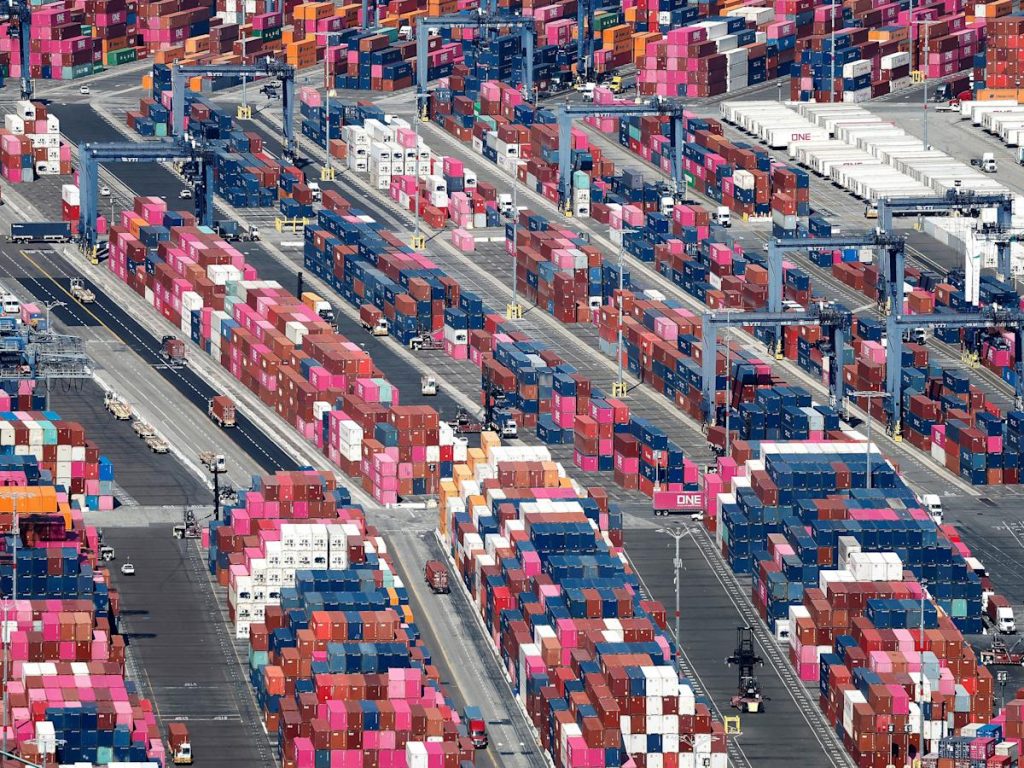

The Trump administration estimated the US operating a commerce deficit of $295 billion with China in 2024, with the US importing $440 billion of products from China and China importing $145 billion of products from America.

China’s announcement of recent retaliatory tariffs had a blended affect on European shares on Friday, although the affect was much less important than strikes earlier within the week.

Germany’s DAX was down 1.5% by round 1:30 p.m. native time (7:30 a.m. ET), whereas Britain’s FTSE 100 was up round 0.4%. Europe‘s broad Stoxx 600 fell 0.6%.

US futures had been buying and selling a little bit increased, with the Dow, S&P 500, and Nasdaq all set to open up by round 0.2%

Japan’s Nikkei 225 tumbled nearly 3% by the top of the buying and selling day, and South Korea’s Kospi misplaced 0.5%.

“Each China and the US have despatched clear messages, there isn’t any level of elevating tariffs additional,” Zhiwei Zhang, president and chief economist at Pinpoint Asset Administration, wrote in a be aware on Thursday.

“The following stage is to watch and consider the injury to financial actions within the US and China.”

Learn the unique article on Business Insider

Source link