(Bloomberg) — China has advised state-owned companies to carry off on any new collaboration with companies linked to Li Ka-shing and his household, based on folks conversant in the matter, after the Hong Kong billionaire irked Beijing along with his plan to promote two Panama ports to a world consortium.

Most Learn from Bloomberg

The directive was issued to state-owned enterprises final week on the behest of senior officers, the folks stated, asking to not be recognized discussing personal issues. Present tie-ups aren’t affected, they added.

Beneath the directive, state enterprises wouldn’t instantly get approval for enterprise actions linked to the tycoon. The regulators are additionally reviewing what investments the household has in China and overseas in a bid to raised perceive the breadth of their enterprise dealings, the folks stated.

CK Hutchison Holdings Ltd., CK Asset Holdings Ltd., Horizons Ventures Ltd. and Pacific Century Group didn’t reply to requests for remark. The State-owned Belongings Supervision and Administration Fee, an company overseeing Chinese language state corporations, and the Ministry of Commerce additionally didn’t reply.

The order to pause new dealings doesn’t essentially imply Beijing will bar state companies from working with companies linked to Li. Nevertheless it does ratchet up strain on the 96-year-old billionaire after CK Hutchison’s cope with a BlackRock Inc.-led consortium to promote ports in Panama and elsewhere put his conglomerate’s flagship entity within the crosshairs of US-China tensions.

CK Hutchison’s shares briefly erased positive factors after the report, solely to climb again up once more as traders look ahead to developments on April 2, the date the events plan to signal the sale settlement. CK Asset, however, declined 1.09%.

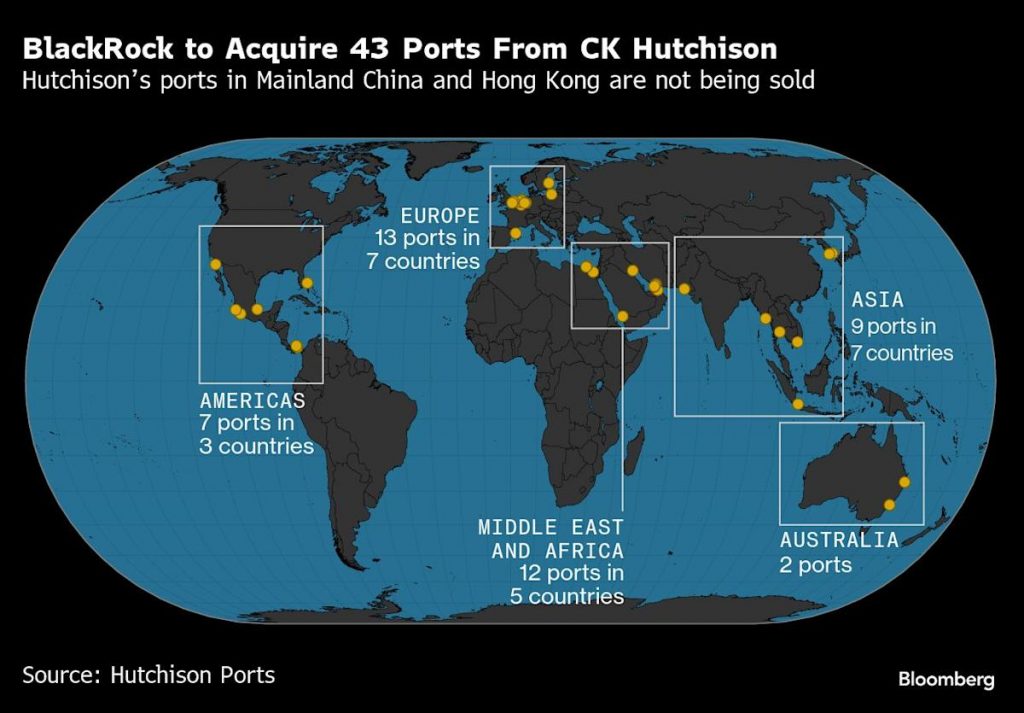

The ports sale, which is predicted to web CK Hutchison greater than $19 billion in money proceeds, triggered scrutiny in Beijing after US President Donald Trump hailed it because the US reclaiming the strategic waterway from Chinese language affect, although the Panama ports are simply two out of 43 services being divested globally.

China can also be trying into the sale for potential nationwide safety and antitrust violations, Bloomberg reported earlier this month. But it’s unsure how a lot leverage Beijing has, provided that Chinese language and Hong Kong ports aren’t included within the transaction. The impression on CK Hutchison from a halt on new enterprise with state-owned corporations may be restricted.

Source link