By Samuel Shen and Tom Westbrook

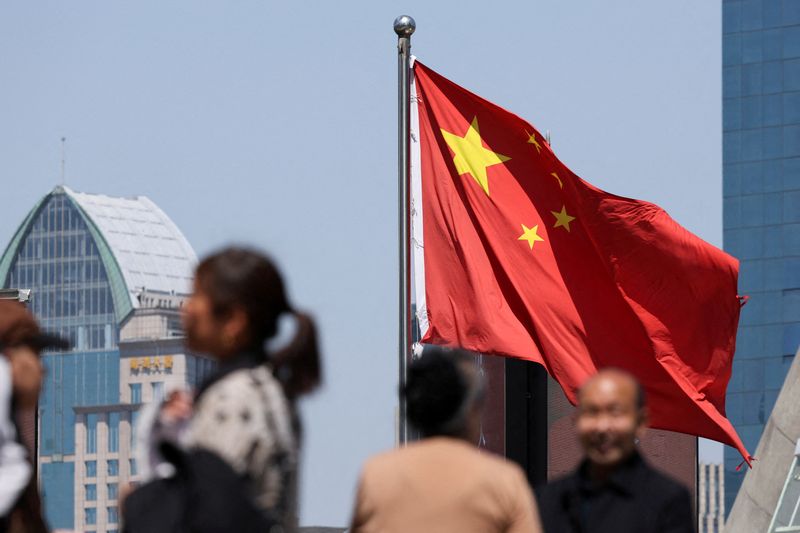

SHANGHAI/SINGAPORE (Reuters) – Cao Mingjie had by no means traded shares earlier than Donald Trump’s “Liberation Day”.

The house designer from China’s southern Guangdong province modified his thoughts after April 2, when the U.S. president introduced “reciprocal tariffs”, intensifying a commerce warfare together with his nation.

Eager to point out solidarity with Beijing, Cao determined he would make investments 2,000 yuan ($274) within the native inventory market each month.

“The objective is not to generate profits. It is about contributing to my nation,” stated Cao. He stated he opened buying and selling accounts after the upper tariffs hit Chinese language shares. On this commerce warfare, “each particular person ought to stand by the nation till the tip”.

Like Cao, many retail buyers are becoming a member of the state-backed “nationwide workforce” to defend the inventory market – one other battlefield within the broadening Sino-U.S. battle, merchants and brokers say. Shopping for has been centered on sectors set to learn from China’s nationwide agenda, similar to defence, shopper and semiconductors.

The patriotic fervour is uncommon in small buyers, infamous for his or her on line casino mentality, and a welcome change for authorities in search of to counter the panic attributable to the commerce warfare and stabilise capital markets.

For the reason that rout on April 4, China’s share markets have obtained 45 billion yuan in web retail inflows, knowledge from monetary data supplier Datayes exhibits. That compares with six straight classes of outflows totalling 91.8 billion yuan forward of Trump’s “Liberation Day”.

Beforehand, non-public and state buyers clashed throughout the 2015 market crash and within the aftermath of Beijing’s crackdown of know-how corporations, undermining market rescue efforts.

However now, their pursuits seem aligned as Trump threatens eye-popping import tariffs that China has described as “bullying”, even when some retail buyers are merely opportunistic and using on Beijing’s swift and resolute intervention.

As China shares plunged 7% on April 7, state-backed institutional buyers publicly vowed to purchase extra shares, high Chinese language brokerages pledged to regular costs, and a slew of listed corporations unveiled share buyback plans.

Final week, Chinese language Premier Li Qiang urged authorities officers to strengthen efforts to regular the inventory market.

China’s inventory market has bounced 8% from seven-month lows hit early April, and is down simply 1.3% thus far this month. That compares with a droop of greater than 8% for U.S. shares.

“We predict China’s A-share market is of higher strategic significance,” stated Meng Lei, China fairness strategist at UBS Securities. Patriotic bets have “meaningfully improved investor sentiment”, Meng stated.

‘BEING PATRIOTIC MEANS HOLDING ON’

Zhou Lifeng, from China’s northwestern Ningxia area, has vowed to pour extra cash into shares even when he incurs losses.

“Being patriotic means holding on to your shares,” stated Zhou, a mountain climber. Zhou stated he owns principally shopper and defence shares value 3 million yuan and has 7 million yuan money in his warfare chest.

Restaurant operator Shu Hao stated he had additionally invested a number of million yuan in Chinese language shares and that he was impressed by efforts made by home retail giants to assist exporters bruised by the commerce warfare.

JD.com, Alibaba-owned Freshippo, and grocery store operators CR Vanguard and Yonghui Superstores have introduced measures to assist exporters pivot to the native market.

“Persons are expressing patriotism in numerous methods,” stated Shu. He stated he had purchased know-how and shopper shares.

The shares and sectors individuals are shopping for into displays nationalistic delight. They’re principally areas wherein Beijing has self-sufficiency targets or have native champions which can be being shut out of world markets because of the tariffs.

Reflecting this, shopper and chipmaking shares have risen since Trump’s “Liberation Day” regardless of weaker broader markets, whereas tourism and agriculture-related shares have recovered rapidly.

Trade-traded funds, an more and more fashionable funding conduit in China, have obtained piles of cash.

For the reason that April 7 droop, Chinese language ETFs have obtained greater than 230 billion yuan of flows, pushing the entire measurement of the phase previous 4 trillion yuan for the primary time, state media has reported. The info doesn’t present how a lot of these inflows have been from retail buyers, versus the “nationwide workforce”.

‘WAR … WITHOUT GUN SMOKE’

Patriotism can be reshaping the portfolio of some skilled buyers.

Hedge fund supervisor Yang Tingwu stated he ploughed all of the money left in his portfolio into shares.

“That is warfare, solely with out gun smoke,” Yang, portfolio supervisor at Tongheng Funding stated, referring to the spiralling commerce battle between China and the U.S. that has seen tit-for-tat levies surging previous 100%.

“You are putting bets not simply in your portfolio, but additionally on the destiny of your nation,” stated Yang, who has wagered on farming, power, finance and defence shares.

Founding father of Shanghai-based Minority Asset Administration, Liam Zhou, stated he had invested his $1 billion portfolio totally in China shares.

The commerce warfare has even turned some Chinese language buyers nationalistic.

“My portfolio is bleeding, however I do not care. I am going to stand agency with the federal government within the struggle towards U.S. bullying,” stated Nancy Lu, a instructor in jap Jiangsu province. She vowed to by no means go to Starbucks or put on Nike once more, in a boycott of American manufacturers.

“I will not promote a single inventory. I am going to assist defend the marketplace for our nation. I’ve by no means felt so proud as a retail investor,” she added.

($1 = 7.2917 yuan)

(This story has been corrected to say that restaurant operator Shu Hao invested a number of million yuan in Chinese language shares, not a number of hundred million, in paragraph 16)

(Reporting by Samuel Shen in Shanghai and Tom Westbrook in Singapore; Enhancing by Vidya Ranganathan and Himani Sarkar)