Buyers have flocked to crypto mining shares—assume Marathon Patent Group, Riot Blockchain, and SOS Ltd.—as a method into the booming cryptocurrency market. However is mining the higher play, or does direct funding win out? Right here’s the breakdown.

When Bitcoin began, anybody may mine with an average laptop. However because the community expanded, the calculations required to mine new blocks grew to become too advanced for fundamental machines.

Why Are Crypto Mining Shares Useful?

At present, mining Bitcoin is an entire totally different ball of wax… that’s a gross metaphor. It calls for high-tech {hardware} referred to as ASIC miners, or what most name “mining rigs.”

The very best rigs use the latest, highest-powered GPUs, making scorching objects like Nvidia’s 2080s and 3080s scarce and dear.

The No.1 Motive to Make investments In Crypto Mining Over BTC

Whereas retail buyers in most jurisdictions should buy crypto for themselves, the scenario is totally different for large banks, funding corporations, insurance coverage companies, hedge funds, and so on.

Since crypto is a brand new trade, many nations lack a authorized framework permitting corporations to put money into cryptocurrencies in a regulated method. Generally, these shares are additionally positioned to outperform Bitcoin.

Whereas shares like RIOT and MARA are immediately tied to the worth of Bitcoin, additionally they have their very own metrics for achievement, together with complete BTC mined and eco-friendly manufacturing crops.

Hold Your Eye On These Three Shares

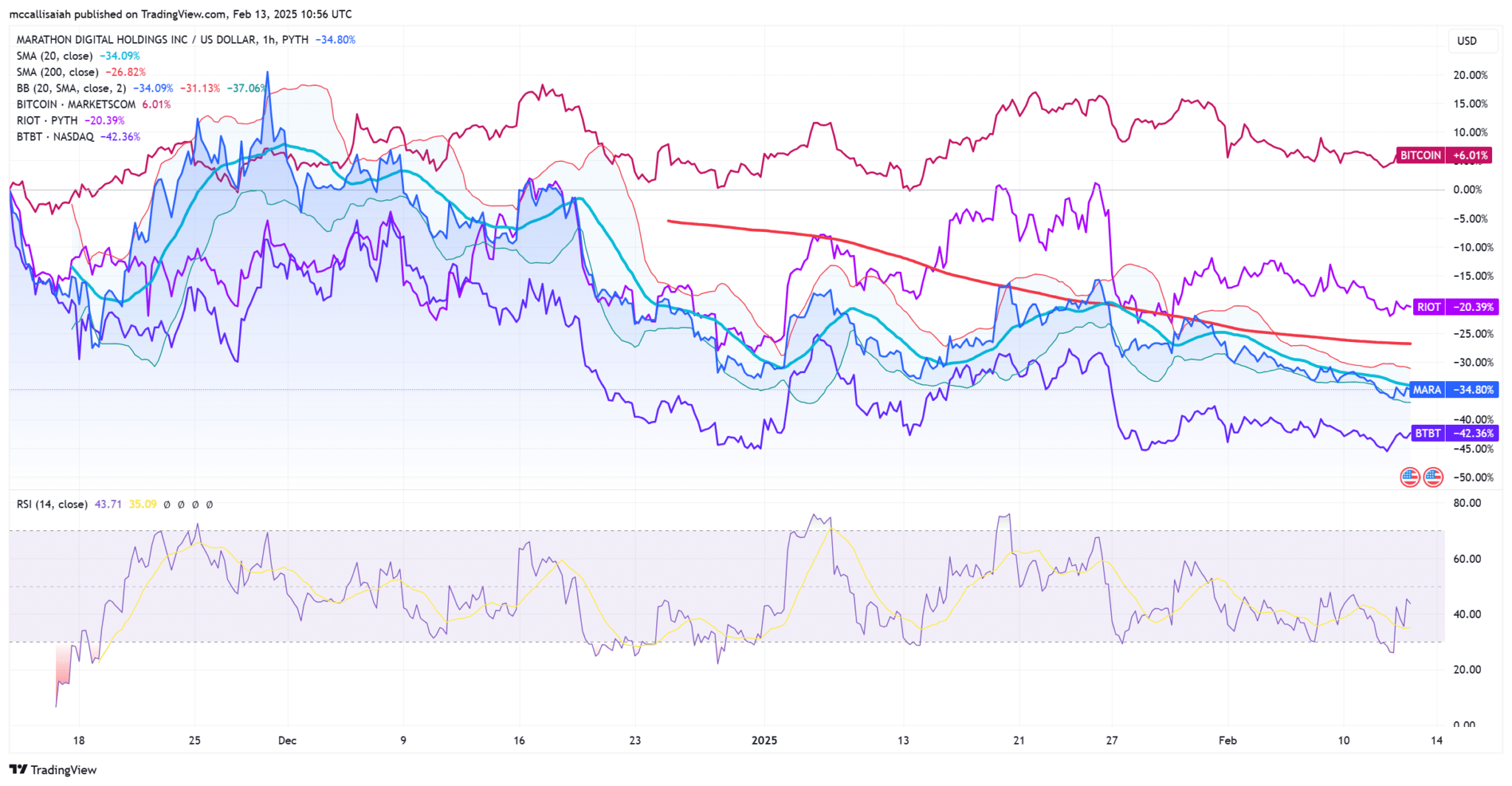

- Riot Blockchain (RIOT): Operating its operations deep within the coronary heart of Texas, it stays a prime mining inventory in 2025. It’s not the largest by market cap, however the identify holds sway in most households dabbling in crypto investments.

- Marathon Digital Holdings (MARA): Conversely, leads the pack with an energized hash fee of 53.2, outpacing Riot and securing its dominance in hash energy.

- Bit Digital (BTBT): In the meantime, New York Metropolis-based Bit Digital (BTBT) made waves in 2020, persistently outperforming Bitcoin’s value development quarter after quarter.

Below Trump, North America is primed to grow to be a hub of crypto mining, which is why mining shares are persevering with to thrive.

EXPLORE: 15 New & Upcoming Coinbase Listings to Watch in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Crypto mining shares shouldn’t be thought of competitors or a alternative for cryptocurrencies.

- Quite they are often thought of a supplementary asset with necessary use instances.

- Shares like RIOT, MARA, and BTBT are value wanting into if you wish to make investments exterior Bitcoin and conventional cash.

The publish Crypto Mining Stocks Vs Bitcoin: Why Not Both? appeared first on 99Bitcoins.

Source link