Understanding Cryptocurrency Exchanges

In navigating the world of cryptocurrency, understanding the sorts of exchanges out there is important. Every sort serves totally different wants and preferences for cryptocurrency merchants and traders.

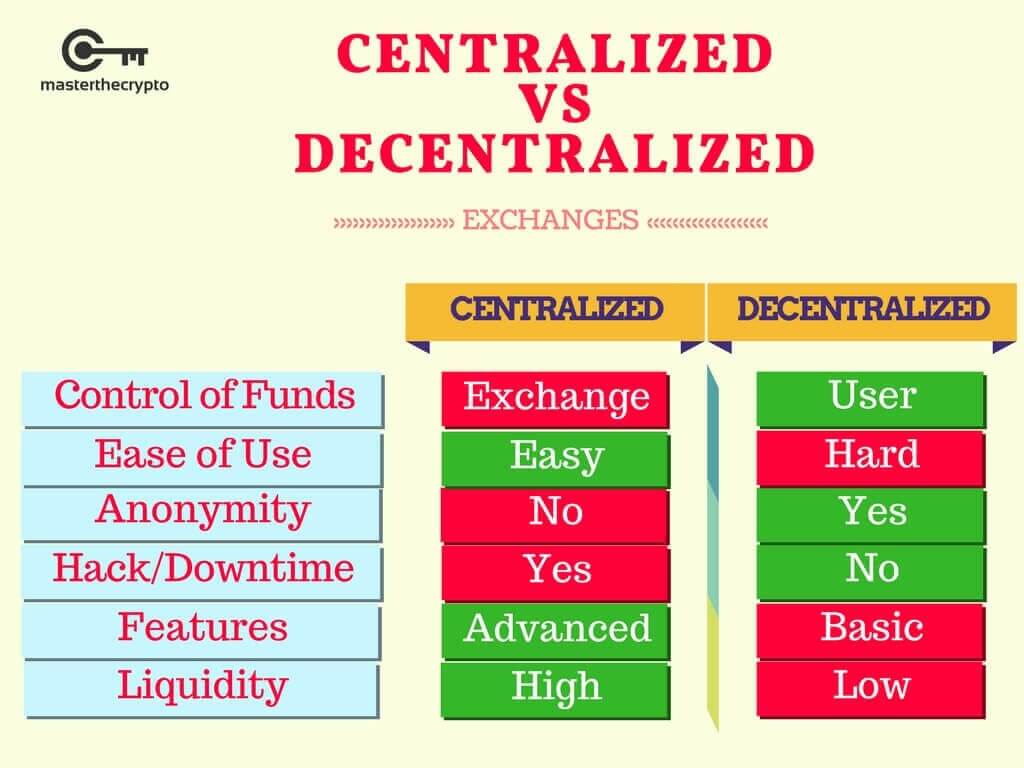

Centralized vs. Decentralized Exchanges

Centralized exchanges (CEXs) like Coinbase and Binance act as intermediaries for customers, facilitating the buying and selling course of. These platforms typically supply user-friendly interfaces, making it simple to purchase and promote cryptocurrencies, particularly for novices. Nonetheless, there’s a big caveat: customers wouldn’t have direct entry to their personal keys when storing cryptocurrency on these platforms, which might expose them to dangers corresponding to hacks and bankruptcies.

Alternatively, decentralized cryptocurrency exchanges (DEXs) enable for peer-to-peer buying and selling with out the necessity for a intermediary. They make the most of sensible contracts on blockchain networks, enabling direct transactions between customers’ wallets (SoluLab). Whereas DEXs uphold the rules of decentralization and person autonomy, they could lack the convenience of use and buyer assist options typically present in centralized exchanges.

| Function | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

|---|---|---|

| Management of Non-public Keys | No | Sure |

| Person Interface | Person-friendly | Typically much less intuitive |

| Safety Danger | Excessive (dangers of hacks/chapter) | Decrease (however susceptible to sensible contract points) |

| Regulatory Compliance | Sure | Varies |

| Buyer Assist | Sure | Restricted or absent |

Significance of Non-public Keys

Non-public keys are a vital part of anybody’s cryptocurrency buying and selling journey. These distinctive keys grant entry to 1’s digital property. In centralized exchanges, because the platform holds the personal keys, customers relinquish direct management over their property. This will result in important points if an trade turns into compromised or faces operational challenges (CoinLedger).

Decentralized exchanges empower customers by guaranteeing they maintain their personal keys, permitting for full management over their cryptocurrency. This independence is interesting to many seasoned merchants who prioritize safety and management. Nonetheless, managing personal keys comes with its obligations, as dropping a personal key typically leads to the irreversible lack of entry to property.

The choice to decide on between centralized or decentralized exchanges hinges on particular person preferences and threat tolerance. These leaning towards user-friendly experiences might choose centralized platforms, whereas people targeted on safety and management might go for decentralized choices. For extra comparisons of varied exchanges, take a look at our cryptocurrency exchange comparison and cryptocurrency exchange reviews.

Decentralized Change Options

Decentralized cryptocurrency exchanges (DEXs) supply distinctive options that set them other than conventional exchanges. Understanding these options will help people make knowledgeable choices when buying and selling.

Peer-to-Peer Buying and selling

One of the important benefits of DEXs is the power to interact in peer-to-peer buying and selling with out the necessity for a intermediary or centralized authority. That is achieved by means of the usage of sensible contracts on blockchain networks, enabling direct transactions between customers’ wallets (SoluLab).

Here’s a fast comparability of the peer-to-peer buying and selling course of versus conventional exchanges:

| Function | Peer-to-Peer Buying and selling (DEX) | Conventional Exchanges |

|---|---|---|

| Mediator | No | Sure |

| Transaction Pace | Instantaneous | Varies |

| Management of Funds | Person retention | Held by the trade |

| Privateness Degree | Excessive | Low |

This direct buying and selling mechanism not solely offers extra management over funds but additionally enhances privateness, as customers can commerce with out disclosing private data.

Liquidity and Transaction Occasions

Liquidity refers back to the ease with which an asset will be purchased or bought available in the market with out affecting its value. DEXs usually expertise diverse liquidity ranges relying on the buying and selling pairs out there and the amount of merchants. Since many DEXs have decrease charges in comparison with centralized exchanges, they entice frequent merchants, which might enhance liquidity (SoluLab).

Transaction occasions on DEXs will be swift however may additionally rely upon the blockchain community’s visitors. As an example, Ethereum-based DEXs like Uniswap face fuel charges that may generally enhance transaction occasions and prices (Coinbase). It’s important to think about the next data relating to transaction effectivity:

| Change Sort | Transaction Time | Typical Charges |

|---|---|---|

| DEX | Typically quicker | 0.3% on Uniswap |

| Centralized | Varies, may very well be delayed | Larger charges |

Total, the benefits of peer-to-peer buying and selling and potential for decrease charges make decentralized exchanges an interesting choice for these seeking to make investments or commerce in cryptocurrency. Exploring DEX choices additional will help people discover the most effective platform to go well with their buying and selling wants. For an in depth comparability of various platforms, go to our cryptocurrency exchange comparison.

Advantages of Decentralized Exchanges

Decentralized cryptocurrency exchanges (DEXs) supply a number of benefits that may improve the buying and selling expertise for customers. Two important advantages are enhanced safety and person privateness, in addition to a discount in counterparty dangers.

Safety and Person Privateness

One of the interesting options of DEXs is the elevated safety they supply. Since these exchanges function in a decentralized method, customers retain management over their personal keys. Which means I wouldn’t have to deposit my cryptocurrency into an trade account, which is usually a potential goal for hackers. As an alternative, I can have interaction in peer-to-peer buying and selling immediately between wallets, decreasing the chance of dropping my funds resulting from a breach on the trade.

Moreover, DEXs prioritize person privateness. Not like centralized exchanges, which often require customers to supply private data for verification, DEXs enable me to commerce without having to reveal delicate data. This anonymity will be notably interesting for individuals who wish to preserve their privateness whereas buying and selling.

| Function | Decentralized Exchanges | Centralized Exchanges |

|---|---|---|

| Management over personal keys | Sure | No |

| Person privateness | Excessive | Low |

| Danger of hacks | Decrease | Larger |

Diminished Counterparty Dangers

DEXs considerably reduce counterparty dangers. In conventional exchanges, there’s at all times a chance of default from the opposite get together concerned within the commerce. Nonetheless, on decentralized exchanges, trades happen immediately between wallets. This direct interplay reduces my publicity to the default threat of a counterparty (SoluLab).

Moreover, DEXs can typically supply decrease charges resulting from their lack of intermediaries. As a frequent dealer, this cost-effectiveness is engaging, permitting me to maximise my returns with out incurring excessive transaction prices. For a comparability of varied choices, you possibly can test our cryptocurrency exchange comparison web page.

The mixture of enhanced safety, person privateness, and diminished counterparty dangers makes decentralized cryptocurrency exchanges an interesting selection for a lot of customers within the crypto area.

In style Decentralized Exchanges

Decentralized cryptocurrency exchanges (DEXs) present a novel buying and selling atmosphere by permitting me to work together immediately with different customers without having a government. Two of the most well-liked DEXs presently out there are Uniswap and PancakeSwap.

Uniswap and Ethereum

Uniswap is the most important decentralized trade constructed on the Ethereum blockchain. It boasts a complete worth locked (TVL) of greater than $4 billion, making it a frontrunner amongst DEXs. Uniswap facilitates the swapping of varied cryptocurrency tokens, notably Ethereum and ERC-20 tokens, and has excessive liquidity and low slippage (Koinly).

One notable side of Uniswap is its transaction charges. It sometimes costs a 0.3% price on trades, which is distributed amongst liquidity suppliers. Extra charges might apply sooner or later, and it’s additionally necessary to think about the fuel charges related to Ethereum transactions, which might generally overshadow the DEX’s charges (Coinbase).

| Function | Particulars |

|---|---|

| Complete Worth Locked | $4 billion |

| Charge Construction | 0.3% per transaction |

| Platform | Ethereum and helps a number of blockchains like BNB Good Chain and Polygon |

PancakeSwap for Binance Good Chain

PancakeSwap is the most well-liked decentralized trade on the Binance Good Chain, with a TVL of $2.13 billion. It permits me to swap BEP-20 tokens simply and provides varied options for incomes rewards, corresponding to farms, staking, and lotteries (Koinly).

The user-friendly interface and decrease transaction charges in comparison with Ethereum-based exchanges make PancakeSwap a pretty choice for these seeking to have interaction in decentralized buying and selling. Its DEX mannequin permits me to commerce tokens immediately from my pockets without having to register or confirm my id.

| Function | Particulars |

|---|---|

| Complete Worth Locked | $2.13 billion |

| Token Compatibility | BEP-20 tokens |

| Additional Options | Farms, Staking, Lotteries |

Each Uniswap and PancakeSwap play important roles within the quickly evolving panorama of decentralized exchanges, enabling customers to commerce with no intermediary whereas offering distinctive options tailor-made for particular blockchain architectures. To be taught extra about how these DEX platforms function, test our article on cryptocurrency exchange comparison.

Exploring DEX Choices

When contemplating decentralized cryptocurrency exchanges (DEXs), it’s important to guage particular platforms that cater to numerous buying and selling wants. Two notable choices are Curve, designed for stablecoin buying and selling, and dYdX, which focuses on perpetual choices buying and selling.

Curve for Stablecoin Buying and selling

Curve is a widely known DEX that makes a speciality of the safe buying and selling of stablecoins and pegged cryptocurrencies. With a Complete Worth Locked (TVL) of $4.22 billion, it persistently ranks among the many high platforms within the decentralized finance area.

Curve excels in guaranteeing low slippage and minimal charges when buying and selling stablecoins, making it splendid for customers who search effectivity of their transactions. The platform’s algorithm is particularly optimized for swapping property that preserve a steady worth, which is especially helpful for stablecoin merchants. Right here’s a quick view of how Curve operates:

| Function | Description |

|---|---|

| Sort | Stablecoin DEX |

| TVL | $4.22 billion |

| Slippage | Low |

| Charges | Minimal |

For these fascinated by evaluating varied platforms, you possibly can test our complete cryptocurrency exchange comparison.

dYdX for Perpetual Choices

dYdX is one other pioneering DEX, primarily targeted on perpetual buying and selling choices. Supporting over 35 cryptocurrencies, it provides customers the power to commerce with leverage of as much as 20X. The platform boasts a TVL of $352 million and permits contributors to earn rewards by means of buying and selling and staking DYDX tokens.

dYdX offers a strong platform for these seeking to have interaction in derivatives buying and selling with out sacrificing the decentralization advantages. Customers can entry options like margin buying and selling and superior buying and selling instruments that rival centralized exchanges.

| Function | Description |

|---|---|

| Sort | Perpetual choices DEX |

| TVL | $352 million |

| Leverage | As much as 20X |

| Rewards | Earn by buying and selling and staking DYDX tokens |

For customers fascinated by evaluating safety features and functionalities, I like to recommend checking the checklist of the most secure crypto exchanges in addition to studying detailed cryptocurrency exchange reviews to make knowledgeable choices.

Choosing the proper DEX is essential for efficient buying and selling methods and may considerably impression the general buying and selling expertise.

DEX Operational Particulars

Exploring the operational mechanisms of decentralized exchanges (DEXs) is essential for understanding how they perform. Two key areas of focus are the charges related to buying and selling and the modern fashions platforms like Balancer supply.

Charges and Rewards

When partaking with decentralized cryptocurrency exchanges, it’s necessary to concentrate on the charges concerned. Completely different DEXs have various price buildings, which might affect my buying and selling choices. Typically, transaction charges are paid within the cryptocurrency I’m buying and selling, and these prices can rely upon community congestion and the particular DEX getting used.

Beneath is a desk summarizing frequent price varieties related to DEXs:

| Charge Sort | Description | Instance DEX |

|---|---|---|

| Buying and selling Charges | A proportion of the commerce quantity that goes to liquidity suppliers. | Uniswap |

| Fuel Charges | Charges required to course of transactions on the blockchain, paid to miners. | Ethereum Community |

| Withdrawal Charges | Charges charged for withdrawing funds from the trade. | PancakeSwap |

As I navigate by means of totally different platforms, understanding these charges will assist to estimate the full prices of transactions and the potential rewards from collaborating in liquidity swimming pools.

Index Fund Mannequin with Balancer

Balancer stands out amongst decentralized exchanges resulting from its distinctive index fund mannequin. With a complete worth locked (TVL) of $1.1 billion, it permits customers to create diversified portfolios by means of liquidity swimming pools that may embody as much as eight totally different cryptocurrencies (Koinly). This construction reduces the chance of impermanent loss for liquidity suppliers, which is a typical concern within the decentralized finance (DeFi) area.

A key advantage of Balancer is that it permits me to put money into a diversified method without having to handle every asset individually. This may be notably interesting for these simply beginning in cryptocurrency buying and selling, because it simplifies the funding course of.

To place it into perspective, right here is how Balancer’s liquidity swimming pools will be structured:

| Pool Title | Allotted Property | Proportion (%) |

|---|---|---|

| Stablecoin Pool | USDC, DAI, Tether, BUSD | 25% every |

| Governance Token Pool | Uni, AAVE, MKR, SNX, COMP | 20% every |

| Multi-Asset Pool | ETH, BTC, LINK, LTC, DOT, SOL | 15% every |

By investing in diversified liquidity swimming pools on Balancer, I can mitigate dangers related to value volatility whereas nonetheless probably incomes rewards by means of transaction charges. This makes Balancer an intriguing choice for these seeking to enterprise into the world of decentralized exchanges.

For extra data on the right way to navigate totally different exchanges, think about testing our cryptocurrency exchange comparison or studying cryptocurrency exchange reviews.

Elements Influencing Change Selection

When selecting a cryptocurrency trade, a number of elements come into play, notably person expertise and regulatory compliance. Understanding these concerns will help me make knowledgeable choices whereas navigating the world of decentralized cryptocurrency exchanges.

Person Expertise Concerns

Person expertise is an important side when choosing an trade for buying and selling cryptocurrencies. Centralized exchanges like Coinbase are well-known for his or her user-friendly interfaces. They sometimes present handy options for getting, promoting, and buying and selling cryptocurrencies, making them appropriate for novices (CoinLedger). As compared, decentralized exchanges might supply fewer assist choices and a steeper studying curve.

Listed below are some key person expertise elements to think about:

| Function | Description |

|---|---|

| Interface | The structure and navigation ease of the platform. |

| Buyer Assist | Availability and responsiveness of assist providers. |

| Buying and selling Options | Instruments for analyzing trades or executing orders. |

| Instructional Assets | Tutorials or guides to help novices in understanding the platform. |

| Pace of Transactions | How shortly orders are executed on the platform. |

As I consider choices, I discover {that a} easy interface and good buyer assist could make a big distinction, particularly for these new to buying and selling in cryptocurrency.

Regulatory Compliance Consciousness

Regulatory compliance is one other necessary issue to think about when evaluating cryptocurrency exchanges. Centralized exchanges corresponding to Coinbase work carefully with regulators to make sure adherence to cryptocurrency legal guidelines. They supply options that assist regulatory compliance, together with id verification and buyer assist (CoinLedger). This makes them a well-recognized and safe choice for a lot of customers.

Alternatively, decentralized exchanges don’t at all times have the identical degree of regulatory oversight. Whereas they provide larger privateness and management over my funds, they could lack buyer assist for compliance-related inquiries.

When contemplating regulatory compliance, I replicate on elements corresponding to:

| Compliance Side | Centralized Change | Decentralized Change |

|---|---|---|

| Regulation | Works carefully with regulators | Restricted regulatory oversight |

| Buyer Assist | Accessible for compliance questions | Usually minimal assist |

| Person Familiarity | Excessive, as customers are inclined to belief established manufacturers | Combined, customers typically want to coach themselves |

Deciding whether or not to prioritize person expertise or regulatory compliance will rely upon my particular person wants. For individuals who worth ease of use and direct assist, centralized exchanges could also be preferable. Nonetheless, if privateness and management are major issues, a decentralized trade is perhaps the higher choice.

For added insights, I can discover our articles on cryptocurrency exchange reviews and cryptocurrency exchange comparison to collect extra detailed data.

Way forward for DEXs

Development in Decentralized Buying and selling

The panorama of decentralized cryptocurrency exchanges (DEXs) is constantly evolving, exhibiting important development potential. DEXs have gained immense recognition, notably in growing economies, resulting from their options corresponding to peer-to-peer lending, speedy transactions, and the promise of anonymity. With only a smartphone and an web connection, anybody can entry these platforms, making them extremely inclusive.

When it comes to buying and selling exercise, decentralized exchanges primarily facilitate trades between cryptocurrency tokens slightly than fiat currencies, which aligns with the rising development of an all-digital monetary ecosystem. The reliance on sensible contracts and liquidity swimming pools ensures that trades happen effectively, thereby contributing to the general enhance in decentralized buying and selling quantity.

| Function | DEXs |

|---|---|

| Peer-to-Peer Buying and selling | Sure |

| Pace | Excessive |

| Anonymity | Sure |

| Fiat Buying and selling | No |

Potential Impression on Conventional Exchanges

Decentralized exchanges pose a novel problem to conventional exchanges. By enabling trades immediately between wallets, DEXs considerably scale back counterparty dangers. This minimization of threat implies that customers might choose DEXs over centralized platforms, which are sometimes susceptible to cyberattacks or service outages. Consequently, many merchants might decide to shift to DEXs for his or her transactions, impacting the amount and income conventional exchanges generate (SoluLab).

Along with diminished dangers, DEXs sometimes supply decrease charges in comparison with centralized exchanges resulting from their lack of intermediaries (SoluLab). For frequent merchants, this cost-effectiveness can present a compelling cause to change. Conventional exchanges might have to adapt by reducing their charges, enhancing their safety measures, or including options that replicate the benefits of DEXs to retain their person base.

As my understanding deepens, the way forward for DEXs alerts a shift in energy dynamics throughout the cryptocurrency ecosystem. I foresee an rising adoption price amongst customers, which might problem the normal trade mannequin. When you’re fascinated by evaluating varied platforms, take a look at our cryptocurrency exchange comparison for extra insights.

Source link