Dogecoin skilled a modest rally yesterday, breaking previous its native highs and reaching $0.484. The transfer excited the DOGE group, because the meme coin appeared prepared for additional features. Nevertheless, the worth has since retraced barely, failing to verify a breakout above this crucial resistance.

Prime analyst and dealer Cheds shared his insights on X, revealing that Dogecoin is urgent in opposition to its vary highs. In accordance with his technical evaluation, a confirmed breakout above these ranges may set the stage for a big rally, probably driving DOGE towards new all-time highs.

Associated Studying

Whereas the latest worth motion has sparked optimism, the market stays cautious, with bulls needing to maintain momentum for any significant upside. Cheds highlights the significance of breaking above these crucial resistance ranges, emphasizing {that a} profitable transfer may pave the best way for DOGE to reclaim its bullish narrative.

With Dogecoin at a crucial juncture, the subsequent few days will decide whether or not the worth continues to climb or settles into additional consolidation. All eyes are actually on the $0.484 mark as merchants await affirmation of a breakout or indicators of renewed promoting strain.

Dogecoin Testing Key Ranges

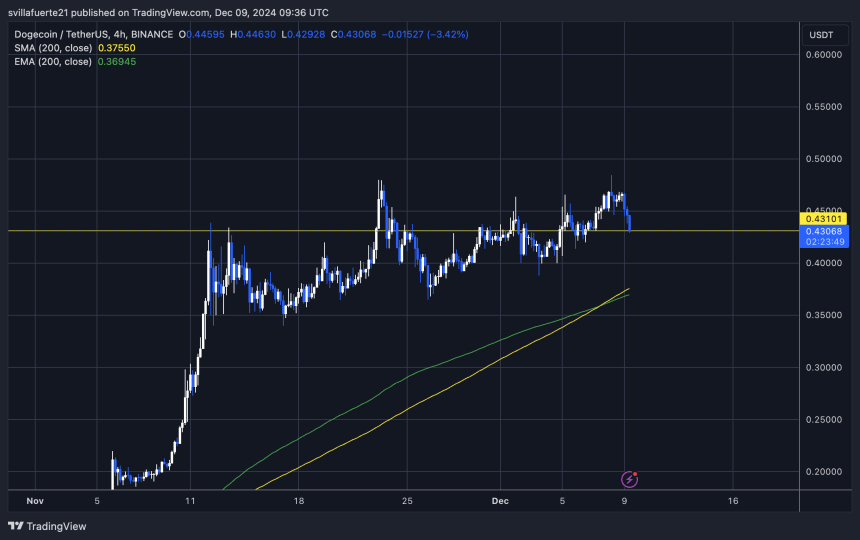

Dogecoin is presently testing key liquidity ranges round $0.44 and under the crucial $0.50 mark, sparking intense curiosity amongst merchants. These ranges have acted as each help and resistance, making them essential for figuring out DOGE’s subsequent vital transfer. Analysts imagine a transparent path to new highs will emerge if Dogecoin can break above these thresholds.

Prime analyst and dealer Cheds shared a detailed technical analysis on X, highlighting Dogecoin’s ongoing battle with its vary highs since November 24. Regardless of a number of makes an attempt, DOGE has struggled to verify a decisive breakout, which might sign the start of a brand new rally. In accordance with Cheds, as soon as the meme coin clears these key ranges, a large surge is more likely to observe, probably propelling the worth to problem its all-time highs for the primary time since 2021.

This outlook aligns with Dogecoin’s latest worth dynamics, which present resilience regardless of broader market volatility. The upcoming days are crucial as merchants await whether or not DOGE can solidify its breakout and maintain upward momentum.

Associated Studying

Breaking above $0.50 and holding that stage for a number of days will catalyze Dogecoin’s rally. If bulls succeed, the market may witness one other parabolic transfer, reviving the thrill that has traditionally pushed DOGE to unprecedented highs.

Final Stage Of Provide Earlier than A Rally

Dogecoin is buying and selling at $0.43 after weeks of sideways consolidation and repeated failed breakouts, leaving traders more and more pissed off with its stagnant worth motion. Regardless of makes an attempt to achieve upward momentum, DOGE has struggled to surpass key resistance ranges, and the shortage of a decisive breakout is testing the persistence of market members.

Presently, all eyes are on the $0.44 stage, a crucial threshold for Dogecoin’s worth trajectory. If DOGE manages to carry above this stage within the coming days, a breakout may lastly materialize, probably resulting in a surge towards increased resistance zones and reigniting investor enthusiasm.

Nevertheless, the draw back threat stays vital. Ought to Dogecoin fail to take care of its present ranges, it may face a deeper retracement, testing decrease demand zones as traders reassess their positions. This could probably dampen sentiment additional, leaving the meme coin weak to continued consolidation and even bearish strain.

Associated Studying

The subsequent few days can be essential for DOGE because the market awaits a transparent directional transfer. Whether or not it secures a breakout or retreats to decrease ranges, Dogecoin’s efficiency on this vary may set the tone for its worth motion heading into the top of the 12 months.

Featured picture from Dall-E, chart from TradingView

Source link