(Bloomberg) — President Donald Trump’s fickle commerce insurance policies are elevating considerations about US financial stability, and the shares most reliant on the power of the American shopper are beginning to really feel the pinch.

Most Learn from Bloomberg

From retailers to airways to restaurant operators, companies that rely on discretionary spending are having an more and more tough time, which is weighing on their backside strains. Buyers are reacting, sending the S&P 500 Shopper Discretionary Index down for a fourth straight week. The sector is down 15% up to now month, nearly double the decline within the broader S&P 500 Index.

A slew of disappointing earnings forecasts from retailers sparked the latest rout, and outlook cuts by the largest US airways earlier this week accelerated the selloff. Shopper firms have been contending with budget-conscious People pressured by years of elevated inflation. And now they’re going through uncertainty over the Trump administration’s insurance policies round commerce and authorities spending.

US shopper sentiment fell to a greater than two-year low in a preliminary March studying of College of Michigan information issued Friday, whereas long-term inflation expectations jumped by probably the most since 1993.

“We and others accepted the consensus view that the Trump administration can be very pro-growth usually, and even when that benefited the best revenue households probably the most, there can be a common elevate,” mentioned Patrick Kaser, portfolio supervisor at Brandywine World Funding Administration. “On condition that what we’ve seen out of Washington has been disruptive to stability, confidence and development, completely our view has deteriorated on the safety of the US shopper.”

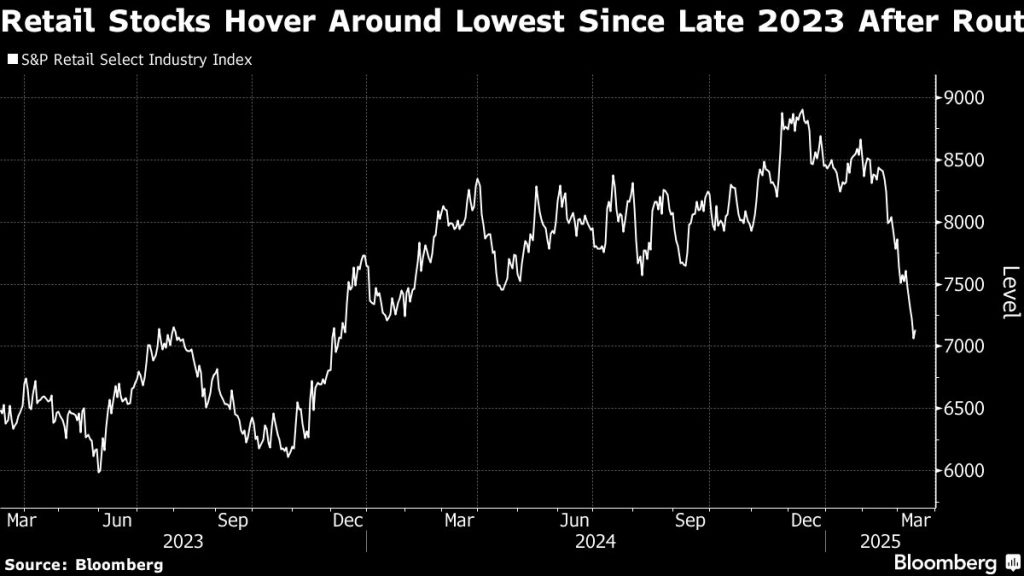

The S&P Retail Choose Trade Index suffered its worst week since March 2023 after earnings studies from Kohl’s Corp. and Dick’s Sporting Items Inc. fueled worries about People’ spending energy. Each retailers issued weaker-than-anticipated annual forecasts, following related disappointments at Walmart Inc., Finest Purchase Co. and Abercrombie & Fitch Co. up to now month.

“The outlooks are usually a bit extra cautious at the beginning of the 12 months,” mentioned John Zolidis, founding father of consumer-focused funding adviser Quo Vadis Capital. “We’re seeing that, however firms are speaking about extra uncertainty.”

Some firms flagged softer tendencies on the finish of February, Zolidis famous. And though the month is commonly a lower than very best gauge since spending sometimes is slower after the vacations, it’s one thing he’s maintaining a tally of. US Commerce Division information on February retail gross sales is anticipated on Monday.

Brandywine’s Kaser mentioned the traditional large-capitalization worth technique portfolio he co-manages has dialed again its shopper discretionary holdings in latest weeks, trimming a place in an auto producer amid uncertainty round tariffs. In the meantime, it’s chubby shopper staples firms, which have engaging fairness valuations and provide important items for customers. Kroger Co., Greenback Basic Corp. and Tyson Meals Inc. are amongst present holdings.

Greenback Basic mentioned Thursday that a few of its prospects are underneath a lot monetary pressure that they’re pulling again on important objects, whereas higher-income customers are shifting to purchasing at low cost chains.

Worries about shopper demand have additionally plagued shares tied to the journey and leisure business. Delta Air Strains Inc. earlier this week reduce its income and revenue expectations for the present quarter, citing macro considerations and an ensuing slowdown in leisure demand. Then, American Airways Group Inc. and Southwest Airways Co. echoed these warnings at an business convention. All instructed, a gauge of airline shares is down 8.1% this week after tumbling 11% final week, its worst droop in two years.

“It’s laborious to see how the ‘short-term ache’ attributable to the White Home doesn’t influence the approaching quarters,” wrote TD Cowen analyst Tom Fitzgerald. “We’re coming into the time of 12 months when many individuals e-book their summer season journey, which looks like it may very well be in danger if customers are involved a couple of recession and/or their employment.”

Considerations over softer reserving tendencies have pushed shares of resort operators, on-line journey companies and cruise strains decrease. An S&P index monitoring these industries dropped 6% this week after sinking 7.4% final week.

Subsequent week, traders will flip their consideration to earnings from Nike Inc. Whereas the sportswear big is within the midst of a turnaround effort underneath new management, the outcomes ought to provide clues on shopper spending because it sells to many alternative revenue demographics, Quo Vadis Capital’s Zolidis mentioned.

Strain on middle- and low-income customers will probably imply much less spending on the whole lot associated to leisure journey, comparable to motels, eating places and rental automobiles, in line with Bloomberg Intelligence analyst George Ferguson. The S&P Composite 1500 Eating places Index skilled its worst weekly drop since October 2020 with a 5.8% decline.

“For that backside 60% or so of American customers, it truly is a troublesome surroundings getting more durable,” Brandywine’s Kaser mentioned. He mentioned the percentages of a US recession have risen during the last 4 to 6 weeks, with commerce wars threatening to have a “significant influence” on gross home product.

(Updates with closing costs all through.)

Most Learn from Bloomberg Businessweek

©2025 Bloomberg L.P.