Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

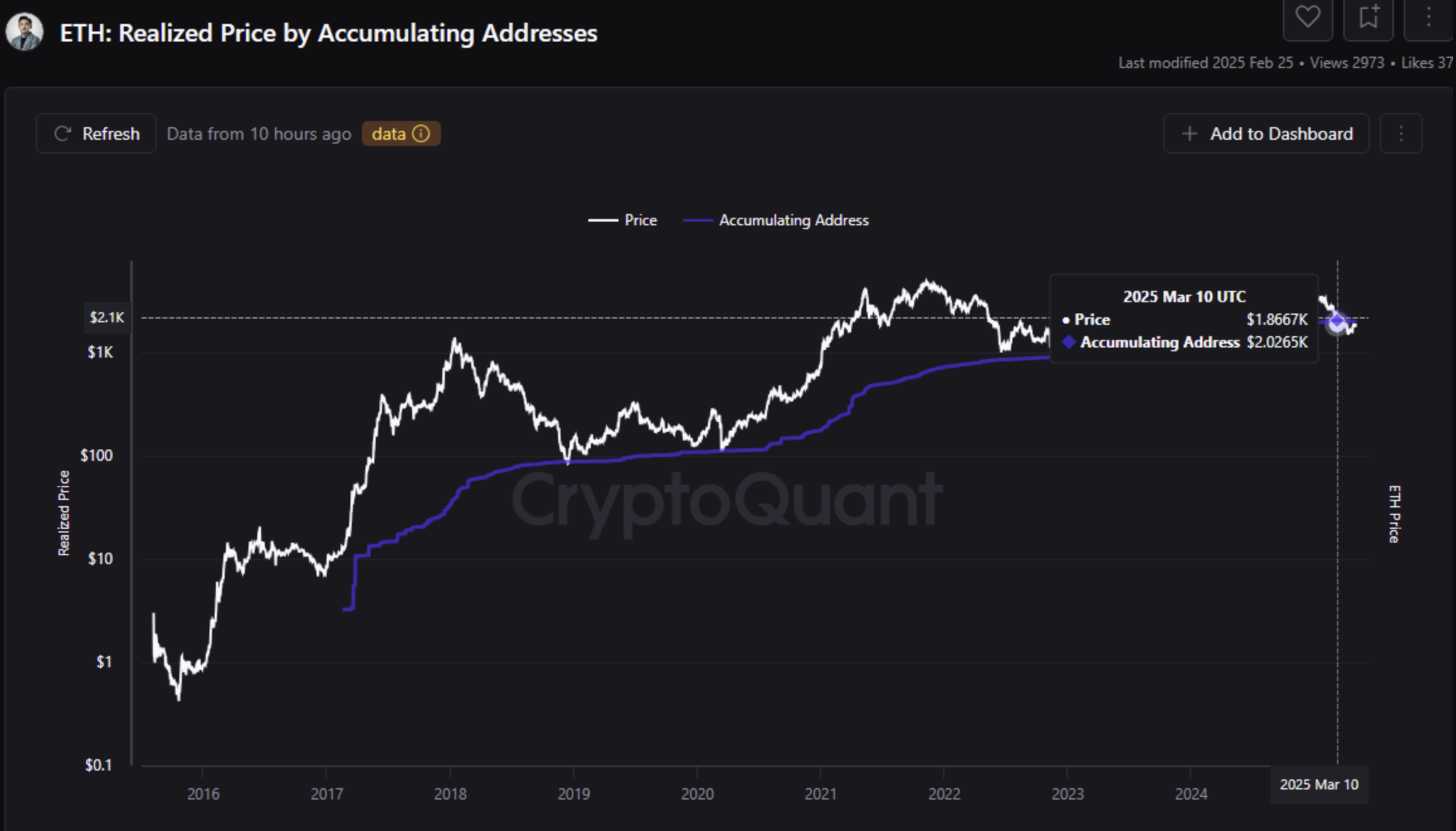

In accordance with a latest CryptoQuant Quicktake post, Ethereum (ETH) accumulation addresses are persevering with to stack ETH regardless of mounting unrealized losses. Within the evaluation, CryptoQuant contributor Carmelo Aleman famous that these addresses have elevated their publicity to ETH, even because the asset trades nicely under latest highs.

Ethereum Holders Are Staying Put Regardless of Unrealized Loss

Since reaching its cycle excessive of $4,107 in December 2024, ETH has skilled a pointy pullback of over 50%, at the moment buying and selling across the $1,800 mark. Regardless of this steep correction, long-term ETH holders – significantly these behind accumulation addresses – haven’t been deterred. As a substitute of exiting their positions, they proceed to carry agency.

Associated Studying

Apparently, since March 10, on-chain knowledge reveals that many of those accumulation addresses have entered unrealized loss territory. For context, ETH fell to an area low of $1,866 whereas its Realized Worth stood at $2,026.

For the uninitiated, an accumulation tackle is a crypto pockets that steadily receives and holds a selected asset – like Ethereum – with out sending it out. These addresses are usually long-term holders, ones who’ve held ETH for greater than 155 days.

When accumulation addresses proceed to accumulate belongings within the face of declining costs, it typically indicators that buyers anticipate a bullish reversal within the close to future. These wallets primarily symbolize “robust palms” out there.

Equally, Realized Worth is the typical worth at which all cash in a cryptocurrency community had been final moved, calculated by dividing the full realized market cap by the circulating provide. It displays the mixture price foundation of holders and is usually used to evaluate whether or not the market is in revenue or loss.

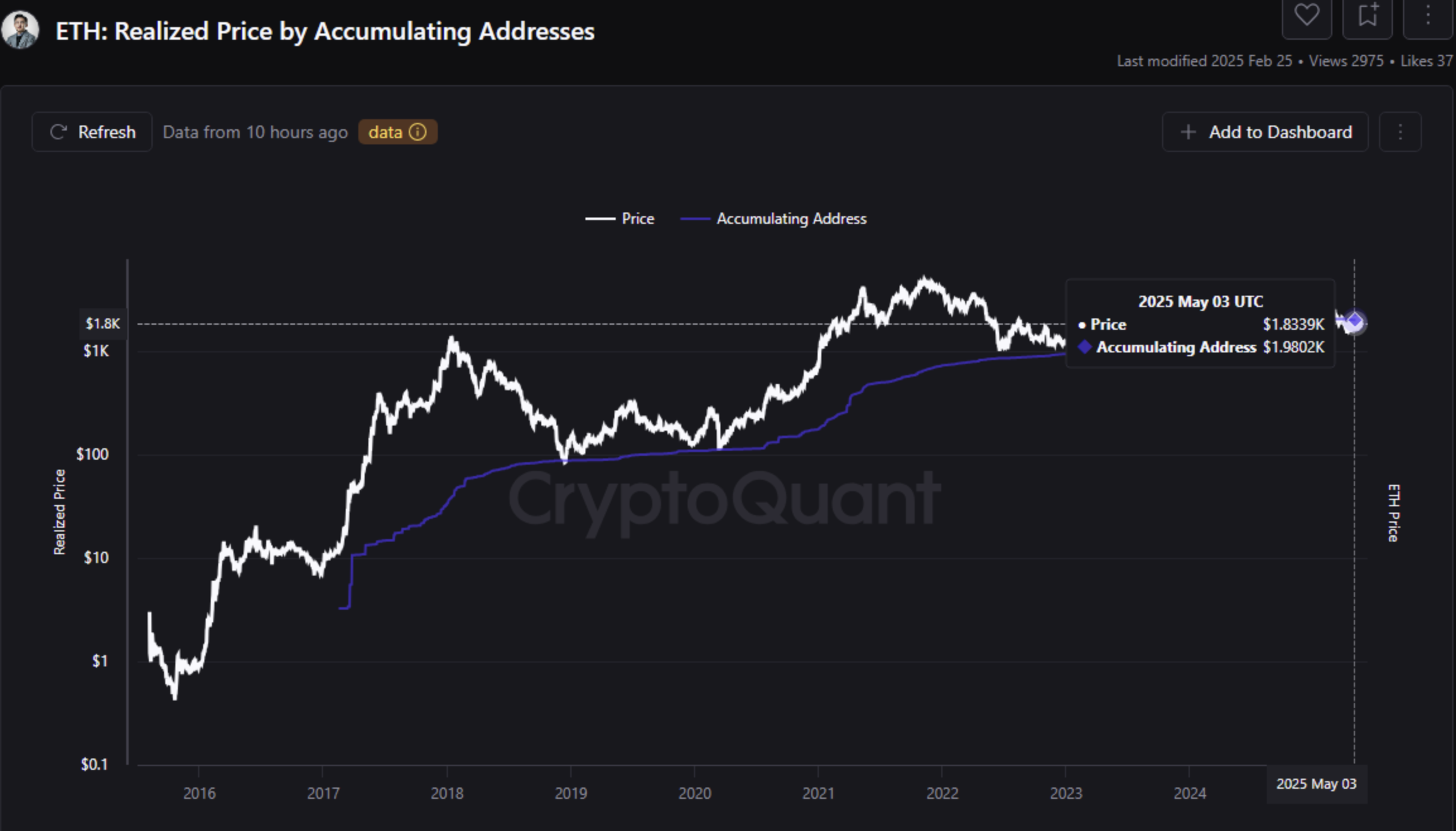

Since March 10, the Realized Worth for these addresses has dropped by 2.32%, from $2,026 to $1,980 as of Could 3. But, slightly than scaling again, these addresses have elevated their ETH holdings considerably. Aleman provides:

Regardless of the continued downtrend, and even whereas in unrealized losses, accumulating addresses haven’t deserted their technique. As a substitute, they elevated their ETH publicity: on March 10 they held 15.5356M ETH, and by Could 3 this rose to 19.0378M ETH, a 22.54% improve, as seen within the ETH Cohort evaluation and Steadiness on Accumulation Addresses.

Has ETH Hit Market Backside?

Whereas some analysts warn that ETH may fall further – presumably to as little as $1,200 – others imagine that the second-largest cryptocurrency by market cap could have already bottomed out for this cycle.

Associated Studying

Including to the optimism, ETH just lately formed a golden cross on the every day chart, a bullish technical sign that usually precedes upward momentum. As press time, ETH is buying and selling at $1,801, down 1.4% up to now 24 hours.

Featured picture created with Unsplash, charts from CryptoQuant and TradingView.com

Source link