Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is buying and selling above the $1,600 mark after a turbulent interval marked by heightened volatility and rising uncertainty surrounding world commerce insurance policies. As US President Donald Trump’s tariff measures proceed to shake investor sentiment, crypto markets have struggled to search out course. Ethereum, just like the broader market, is trying to stabilize after weeks of aggressive promoting stress and macroeconomic headwinds.

Associated Studying

Regardless of indicators of weak point, bulls at the moment are attempting to regain management. Nevertheless, value motion nonetheless suggests the downtrend might not be over but. ETH should reclaim key ranges to verify short-term momentum for any significant restoration to unfold. Till then, warning dominates the market outlook.

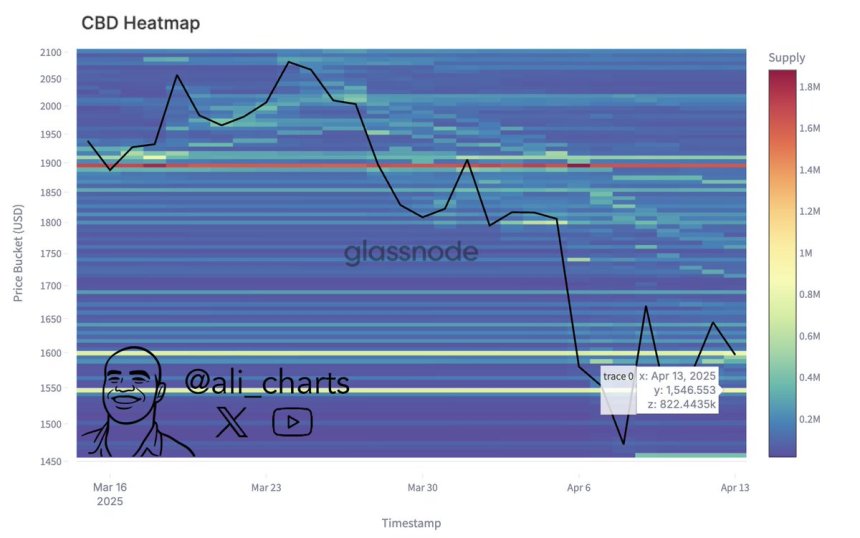

Glassnode information gives a hopeful perspective for Ethereum bulls. In line with on-chain metrics, probably the most crucial help stage at the moment sits at $1,546.55—the place whales accrued over 822,440 ETH. This stage might function a powerful basis for a bounce if examined once more, as traditionally, zones with heavy accumulation have a tendency to draw renewed shopping for curiosity.

The approaching days shall be essential for Ethereum’s trajectory. Holding above this help whereas pushing into larger resistance might be the catalyst wanted to reignite bullish sentiment and reverse current losses.

Ethereum Assessments Key Resistance As Bulls Eye Restoration

Ethereum has surged greater than 20% since final Wednesday’s low close to $1,380, producing renewed optimism amongst buyers hoping for a broader market restoration. At present buying and selling round key resistance ranges, ETH seems to be forming a base for a possible breakout that would mark the start of a brand new upward part. Nevertheless, the trail ahead stays unsure as world macroeconomic circumstances proceed to weigh closely on market sentiment.

Rising hypothesis of a coverage shift following US President Donald Trump’s announcement of a 90-day tariff pause for all nations besides China sparked the current surge. This determination triggered a short lived risk-on sentiment throughout world markets, with cryptocurrencies benefiting from the momentum. Nonetheless, considerations about long-term US international coverage and lingering commerce tensions have left many buyers cautious.

Whereas some analysts consider that Ethereum has already priced within the worst of the selloff, others warn that we could solely be within the early phases of a broader bear cycle. Regardless of the divergence in outlooks, on-chain information suggests {that a} main help stage has fashioned.

According to analyst Ali Martinez, probably the most crucial help for Ethereum sits at $1,546.55—an space the place greater than 822,440 ETH had been beforehand accrued. This stage is being carefully monitored as a possible pivot zone. If bulls can keep value motion above this threshold and efficiently push by present resistance, it might set off a powerful continuation rally and restore confidence within the altcoin market.

Till then, Ethereum stays at a crossroads, with the subsequent transfer more likely to be formed by a mix of market momentum, geopolitical developments, and investor conviction.

Associated Studying

ETH Value Struggles at Resistance: Bulls Should Reclaim $1,875

Ethereum is buying and selling at $1,630 after setting a contemporary 4-hour excessive round $1,691, barely above the earlier native peak. The short-term value construction means that bulls are attempting to regain momentum, however the restoration stays unsure with no clear breakout above key resistance ranges. For Ethereum to verify a real reversal and enter a bullish restoration part, it should reclaim the $1,875 stage — a zone that aligns with each the 4-hour 200-day transferring common (MA) and exponential transferring common (EMA).

This crucial stage has acted as a serious barrier because the downtrend started, and breaking above it could sign a shift in development and market sentiment. Nevertheless, failing to push past this vary might ship ETH again to retest the $1,500 help zone and even decrease.

Associated Studying

The $1,600 stage now acts as a key psychological and technical threshold. Holding above it’s important for bulls to maintain short-term momentum alive and stop one other sharp selloff. As macroeconomic uncertainty and market volatility proceed, Ethereum’s subsequent transfer relies upon closely on whether or not bulls can defend present help and construct sufficient energy to interrupt above the $1,875 resistance zone.

Featured picture from Dall-E, chart from TradingView

Source link