Wednesday morning, the day earlier than Thanksgiving, Mae awoke, set her hair in curlers and switched on her laptop computer. The display froze and a message appeared. It stated her Safari net browser had encountered an issue, and a hyperlink supplied to attach the 83-year-old to the Apple Laptop Firm. Mae clicked it.

She didn’t realize it but, however Mae, like millions of Americans every year, had fallen into the grip of fraudsters. Over the subsequent 10 hours, the criminals would strive a number of strategies to steal her cash. The one which labored with out a hitch was getting her to purchase reward playing cards. The frequent playing cards, from retailers reminiscent of Goal, Apple and Amazon, are bought on racks in drugstores and supermarkets. They’re higher than money for a fraudster, extra moveable and simply as nameless. As soon as criminals have the reward card numbers, they use them to buy items on-line, at shops all over the world, or sell or trade them in illicit marketplaces on the dark web, Telegram or Discord.

David P. Weber

An estimated US$8 billion is stolen yearly from seniors age 60 and older via stranger-perpetrated frauds, according to AARP. More and more, reward playing cards are a number one fraud cost technique reported by older adults, according to the Federal Trade Commission.

Mae’s story is one in all many such circumstances that prompted us – a fraud and forensic accounting professor who’s a former high monetary regulator, and a Pulitzer Prize-winning investigative reporter – to discover how cracks within the monetary regulatory system dating to the Civil War have been exploited by fraudsters and firms.

The investigation exhibits that federal regulators have persistently failed to guard the general public from reward card fraud and have failed to offer reward playing cards client protections like these afforded to credit score and debit playing cards. Congress, in flip, has largely deferred to those regulators. In the meantime, efforts to rein within the trade on the state and federal degree have been met with profitable opposition from lobbyists and reward card commerce teams. When fraud does happen, reward card retailers are sometimes lower than useful in aiding regulation enforcement in serving to to trace down the criminals.

One among us discovered about Mae’s case in his work as a fraud examiner and has seen dozens of comparable circumstances. Mae, who lives in Maryland, is unwilling to publish her final identify for worry of being revictimized, in addition to sheer embarrassment, however she nonetheless desires individuals to know the story in order that they don’t make the identical errors.

In reward card fraud, everyone however the sufferer makes cash: fraudsters, reward card firms and retailers. The criminals exploit a quickly evolving funds trade that’s shrouded in secrecy, designed to make sure simple transactions and missing in client protections.

The expertise firms that present the infrastructure that allows the reward card economic system are privately held and launch little data publicly. They facilitate funds behind the scenes, out of the view of shoppers who see solely the model identify of the cardboard and the pharmacy or grocery store the place they purchase it. Whereas retailers who promote reward playing cards may do extra to thwart fraud, the secretive expertise firms that arrange and handle reward playing cards are greatest positioned to cease rampant criminality, however they don’t. There’s no authorized requirement to take action, and so they earn cash off the crime.

Name this quantity

When Mae known as the quantity that appeared on her display, a person answered and recognized himself as Mac Morgan, an “Apple excessive safety technician.” He gave her his worker ID quantity, which she dutifully wrote down. The issue appeared to originate from her financial institution, he instructed her. She volunteered that she banked with M&T, a Northeast financial institution headquartered in Buffalo, N.Y. Name them, he stated, and supplied a telephone quantity.

The lady who answered stated her identify was Alivia, from the M&T Financial institution Fraud Unit. Alivia instructed Mae {that a} European pornographer and scammer had tried to achieve entry to her account and withdraw $20,000 throughout the night time. A maintain had been positioned on the withdrawal, however Mae wanted to come back all the way down to the financial institution and retrieve the cash earlier than the fraudsters did.

Nervousness rising in her voice, Mae instructed the girl she hadn’t even had a cup of espresso but; she nonetheless had curlers in her hair. Alivia suggested her to take away the curlers and, soothingly, promised to remain on the telephone with Mae via the whole course of.

Refined schemes

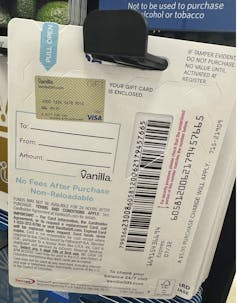

Reward playing cards are simply the most recent in fraudsters’ seemingly limitless arsenal of instruments that assist them steal cash from individuals via deceptions like romance scams, faux IRS notices and phony funding schemes. Along with client swindles just like the one which focused Mae, reward playing cards, together with these which can be reloadable, have additionally been hit with an epidemic of card draining, the place criminals both steal barcodes from reward playing cards on the rack or swap in new barcodes they already management.

When shoppers put cash on a compromised card, the criminals are alerted as a result of they’re monitoring the barcodes utilizing automated on-line account stability inquiries. They will repeatedly examine the balances on 1000’s of barcodes at a time. As quickly as cash hits a card, the criminals use the account quantity to buy objects on-line or in shops, utilizing runners or “mules” to bodily go into shops.

David P. Weber

The reward card draining drawback is widespread enough that it attracted the eye of the Department of Homeland Security and sparked hearings in the U.S. Senate in April 2024. Two months later, Maryland handed the nation’s first law targeting card draining, which mandates safe packaging geared toward thwarting criminals who steal or tamper with the numbers on reward playing cards.

Individuals ages 18 to 49 are more likely than older adults to lose cash in reward card fraud, but adults over the age of 80 lose three times as much as younger adults. The average reported amount lost is $1,000, however greater than 100 shoppers have reported reward card fraud losses to the Federal Commerce Fee in extra of $400,000 every between 2021 and 2023, in line with data supplied by the FTC via a public data request.

Falling sufferer to a monetary rip-off ranks second in American fears about criminality, after identification theft, far exceeding issues about violent crime, according to Gallup. Regardless of these fears, there doesn’t seem like an correct authorities quantity on precisely how a lot monetary fraud is happening. The reward card and reloadable card trade additionally doesn’t preserve knowledge on the sum of money shoppers lose via the legal use of its merchandise.

On the identical time, many reward card firms are usually not publicly traded. As such, they aren’t required to file quarterly or annual monetary stories with the U.S. Securities and Exchange Commission, which might point out the dimensions of the trade and would possibly define the quantity of fraud, amongst different dangers. Consequently, nailing down a precise determine for the full quantity of fraud involving reward playing cards and reloadable playing cards is difficult.

To trace traits, regulators rely on victims self-reporting to gauge the scope of the issue.

But the overwhelming majority of people that fall sufferer to monetary scams by no means report their losses to regulation enforcement. Most victims are too embarrassed or pessimistic about their probabilities of recouping losses and so don’t complain. And infrequently they’re involved that their grownup kids, caregivers or authorities reminiscent of grownup protecting companies might conclude that guardianship or institutionalization is necessary to guard them. Whereas this can be very troublesome to know what number of elders report monetary fraud, a 12-year-old study that’s nonetheless generally cited, together with by federal authorities, estimates it at 4.2%.

About $550 billion is added onto reward playing cards yearly within the U.S., in line with Jordan Hirschfield, a present card analyst at Javelin Strategy & Research. He estimates that between 1% and 5% of all reward card gross sales might be fraudulent not directly, however as a result of nobody retains monitor, it’s troublesome to reach at a precise quantity. If the 1% to five% determine is right, the quantity of fraud is between $5.5 billion and $27.5 billion per yr.

A sufferer’s worry bubble

Mae had entered what AARP calls a fear bubble, an induced state of panic that makes rational thought troublesome, if not not possible. It is a greater risk for seniors, as a result of as individuals become older they experience anger and fear more vividly. The fraudsters who manipulate this panic describe placing their victims “under the ether.” Frightened past purpose, the sufferer is manipulated into transferring massive sums of cash to the fraudster to push back the conjured hazard.

Anybody can fall sufferer. In February, a former New York Occasions enterprise columnist wrote about losing $50,000 in a fear-induced scam. Mae had graduated summa cum laude from an elite non-public college. She is a no-nonsense retired nurse and lives independently. Now she was speeding, panicked, to her financial institution on the course of a fraudster.

As Mae drove, Alivia suggested her to prepared a narrative in case the teller balked at giving her the cash. Mae determined to inform them that she wanted the $20,000 to purchase a used automotive and it was a matter of urgency.

Frictionless and nameless

Reward playing cards have skilled speedy and immense development as a result of they’re a win-win, an progressive comfort for buyers and a threefold boon for retailers. The reward card racks are mini billboards for retailers.

The Dialog, CC BY-ND

Shoppers generally spend one- to two-thirds greater than the precise worth of the cardboard after they use it, stated Ben Jackson, chief working officer for the Innovative Payments Association, one in all a number of commerce teams that symbolize the trade. And generally shoppers don’t spend the gift cards. Phrases and situations of the reward playing cards, regularly in small print or obtainable solely on-line, might permit retailers to retain the stability after a minimal of five years. It’s a tidy reward to retailers amounting to billions of dollars.

The Nationwide Retail Federation routinely ranks reward playing cards as the No. 1 thing buyers plan to purchase. “You don’t need friction in your reward giving,” Jackson stated.

Offered by Ben Jackson, annotated by The Dialog

He has traced the primary reward card to a glove firm in Oregon in 1908. The corporate extolled the comfort of this new innovation: “Reward givers needn’t fear about selecting the correct dimension or coloration glove; give the recipient a card and allow them to select for themselves.”

Within the trendy period, plastic gift cards have been created by Neiman Marcus, however film rental firm Blockbuster first displayed the playing cards for purchasers. Often known as a closed-loop card, it may be spent for items solely from that specific retailer.

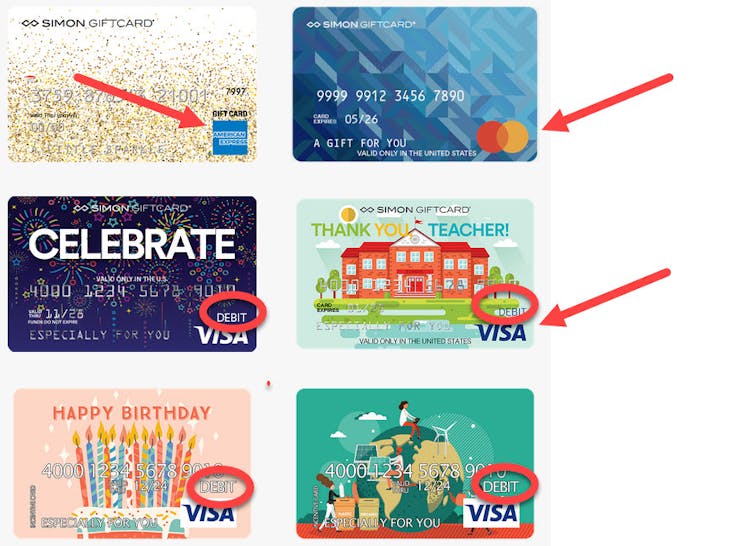

In distinction, open-loop reward playing cards will be spent at a number of retailers and infrequently have a bank card emblem from firms reminiscent of Visa or Mastercard, however they don’t supply the same protections afforded precise bank cards, reminiscent of requiring an ID on file for the cardboard. Some open-loop playing cards establish as debit playing cards though in addition they lack the fraud protections of financial institution debit playing cards. If the cash is swindled, there’s no obligation for the corporate to reimburse the cardholder.

Annotated screenshot by The Conversation

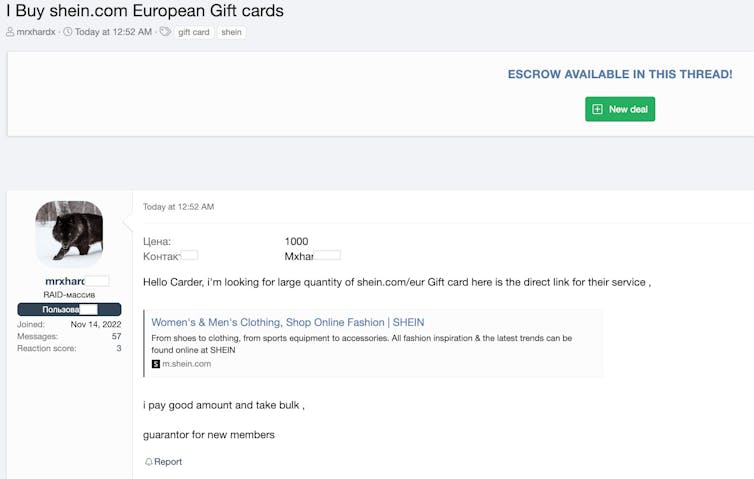

Open-loop playing cards work in every single place debit and bank cards do and may generally be reloaded with funds. Purchasers will pay by money to stay nameless. Criminals love them. Within the locations the place fraudsters lurk – on the dark web, which is made up of websites that resemble abnormal web sites however are accessible solely utilizing particular browsers or authorization codes, and on Telegram and Discord messaging apps – open-loop and closed-loop reward playing cards are supplied as cost for every thing from payroll to the acquisition of apparatus wanted to perpetrate extra frauds.

SOCRadar

The primary open-loop card originated with retail malls and foreshadowed how the reward card trade would later sport regulators. In 2004, Indianapolis-based Simon Property Group and Financial institution of America created a stored-value card that might be spent at any retailer within the 159 Simon malls all through the U.S.

SOCRadar

The cardboard activation payment was as a lot as $6.95. Simon additionally deducted a payment when a card went unused for six months and charged 50 cents every time a buyer checked the cardboard stability after the primary inquiry. The charges ran counter to the patron safety legal guidelines of some states the place Simon operated, and three states sued Simon. However the mall operator efficiently contended that as a result of it was working with a nationwide financial institution, federal regulation and rules, which had no restriction on these charges, preempted state regulation to permit the charges. Whereas the playing cards did not cease on-line purchasing from eclipsing the American mall trade, it will definitely roused federal lawmakers into limited action.

In the meantime, one other reward card innovation had launched in California. In 2002, an in-house unit of Safeway supermarkets trying to promote nontraditional items to Safeway prospects created the reward card kiosk. It was so profitable {that a} yr later the unit grew to become a Safeway subsidiary known as Blackhawk Community. By 2007 there have been Blackhawk kiosks in 60,000 retail places, projecting sales of $100 million that yr. Seven years later, Safeway spun off Blackhawk as a stand-alone public firm.

And in 2018, with assist from Blackhawk insiders, a personal fairness agency known as Silver Lake Companions and a hedge fund named P2 Capital Companions took the company private in a transaction price $3.5 billion. In 2023, Blackhawk Network Holdings had an estimated annual revenue of $2.8 billion.

Blackhawk and its important competitor, Atlanta-based InComm Payments, put playing cards in drugstores and grocery store chains all through the U.S. Every card is a separate, non-public bespoke settlement negotiated between the cardboard proprietor and the distributor, in line with Jackson.

Sometimes, the distributor negotiates a small low cost, often below 10%, off the cardboard’s face worth. The low cost is cut up between the distributor and the shop promoting the cardboard.

SOCRadar

The distributor handles card activation so {that a} retailer like Goal will acknowledge that the cardboard is energetic within the obtainable quantity. In some circumstances, the distributor additionally handles the back-end expertise that enables shoppers to spend the cash loaded on the cardboard.

Beginning as a small trade somewhat greater than 20 years in the past, the closed- and open-loop reward card enterprise has change into an enormous enterprise involving a whole bunch of billions of {dollars}, a pageant of frictionless commerce that can be beloved by criminals for its comfort and anonymity.

Mae will get cussed

The financial institution teller tried to dissuade Mae from withdrawing $20,000 in money. Finally, the financial institution supervisor joined the dialog and recommended she take a cashier’s examine as an alternative. Mae insisted that the man promoting her the automotive had demanded money. After about quarter-hour, she wore them down. They gave her the money.

The financial institution supervisor adopted Mae to her automotive to make sure she was OK and to strive yet one more time to get her to rethink. Mae waved the supervisor off. As soon as she was alone once more, Mae picked up the telephone. Alivia had remained on the road the whole time however instructed Mae to go away her cellphone within the automotive whereas she went into the financial institution.

A patchwork system of assist

In Maryland, the banker had no possibility however at hand Mae her cash. That’s not the case in different states. In Florida, a state that contends with elevated incidents of fraud on seniors, the Legislature passed a law in Could permitting monetary establishments to delay disbursements or transactions of funds to individuals over 65 if there’s a well-founded perception that they’re being exploited. In return, the banks obtain immunity from any ensuing administrative or civil legal responsibility.

The delay, which expires after 15 enterprise days, requires that the monetary establishment launch a right away assessment and get in touch with these the account holder has designated as individuals of confidence. A court docket might shorten or prolong the size of the pause. Anecdotal proof from regulation enforcement means that even a number of hours of delay can pop the worry bubble fraudsters create. As quickly because the persuasive ether of the fraudster lifts, most individuals understand they’ve been scammed. A delay additionally makes time for the goal to speak to somebody they belief who would possibly dissuade them from parting with their cash.

In New Jersey in 2021, state Sen. Nellie Pou sponsored a bill that proposed a 48-hour delay earlier than utilizing or validating a present card price greater than $100 and proposed extending the protections to reward playing cards that bank cards obtain below federal legal guidelines and rules: If a client reported fraud, the funds could be frozen, and if the fraud investigation have been upheld, the cash could be returned to the shopper. The invoice additionally proposed a fraud incident hotline for shoppers, exempted small companies and levied a $1,000 civil penalty for card issuers that violated its provisions.

The Innovative Payments Association lobbied towards the New Jersey invoice. The laws would hurt New Jerseyans, it wrote lawmakers, by “discouraging reward card suppliers to situation and promote such playing cards within the state.” The affiliation argued that the ready interval “defeats the aim of getting a present card,” which is to permit the recipient “to exit and get what they need/want instantly.” The laws handed the state Senate however died within the Meeting and wasn’t reintroduced.

A number of states have additionally handed or are contemplating legal guidelines requiring retailers promoting reward playing cards to submit warning indicators, together with Delaware, Iowa, Nebraska, Pennsylvania, Rhode Island and West Virginia, however none go so far as the New Jersey invoice.

David P. Weber

Ready intervals and warning indicators are usually not the one instruments that reward card firms may use towards fraud. The distributors have already got a expertise in place that will be much more efficient: velocity limits.

If unusually large numbers of reward playing cards are being bought at a drugstore or grocery store, for example, a distributor like Blackhawk may freeze the sale and alert the retailer. They’ve completed this occasionally, however our investigation exhibits this doesn’t occur with consistency. If sale freezes and alerts occurred persistently, shoppers could be much less more likely to be reporting on the FTC database massive quantities of cash misplaced to reward card scams.

Reward playing cards may be required to make use of geofencing. If a card is bought in Maryland however redeemed on the identical day in California or China, that might be a purple flag for fraud as a result of the probability that somebody like Mae would be capable of get reward playing cards to faraway buddies or household so rapidly is slim. Geofencing would freeze redemption outdoors a sure geographical space.

And extra merely, retailers may require that reward playing cards be bought with a credit score or debit card moderately than money to make it simpler to reimburse a buyer within the occasion of fraud.

In 2022, across the identical time New Jersey was making an attempt to rein in reward card fraud all by itself, Congress handed the Stop Senior Scams Act. The invoice created an advisory group of trade members, regulators and regulation enforcement that’s run by the FTC and tasked with learning methods to curtail fraud. Included within the mandate was a give attention to expertise. The advisory group created a Technology and New Methods Committee subcommittee with about two dozen members, together with Blackhawk and the Revolutionary Funds Affiliation. Within the two years for the reason that invoice was handed, the principle committee has met only twice. Suggestions by federal advisory committees are not binding. Though the Federal Advisory Committee Act requires that committee conferences be open to the general public and their data obtainable for public inspection, it’s not a requirement for subcommittees.

The committee is aiming to disrupt fraud, notably amongst older adults, by extra effectively sharing data, knowledge and different intelligence, in line with committee member Jilenne Gunther, nationwide director of AARP’s BankSafe Initiative.

The trade has pushed consumer education as the very best response to the reward card fraud epidemic, whilst signage and public service bulletins have proven questionable effectiveness. “Client training … places the burden of safety on the targets of fraud,” Marti DeLiema, assistant professor of social work on the College of Minnesota, testified at an Elder Justice Coordinating Counsel listening to in 2022. On the identical time, “fraud targets are sometimes in states of emotional misery.”

Some retailers are additionally training their cashiers to be alert to seniors inexplicably shopping for fistfuls of reward playing cards, however these efforts are usually not all the time standardized throughout the trade. Anticipating a clerk incomes minimal wage to stop a fearful senior from legally shopping for reward playing cards is probably going unrealistic.

Blackhawk didn’t reply to a number of requests for interviews and declined to reply emailed questions. InComm Funds declined to make anyone available for an interview and didn’t reply detailed emailed questions.

In its letter opposing the New Jersey bill the Revolutionary Funds Affiliation argued that the trade was “extremely regulated,” required to stick to federal necessities and “strict federal anti-money laundering rules.”

In observe, that’s not the case.

The criminals direct Mae to crypto

Earlier than sending Mae to purchase reward playing cards, the fraudsters tried one other scheme. Alivia directed Mae to a Shell fuel station with a Cash2Bitcoin ATM inside and instructed her that if she put her cash into crypto it could be secure. Mae had by no means earlier than seen a Bitcoin ATM. Alivia talked her via registering for an account, together with importing her driver’s license, a know-your-customer requirement that doesn’t exist for reward playing cards.

AP Photograph/Ted Shaffrey

As Mae fed 1000’s of {dollars} into the machine, one other aged girl stood behind her impatiently. I have to get cash to ship to my nephew, she instructed Mae. A lot later, Mae would understand that the girl was in all probability being scammed, too. At $15,000, the ATM hit its restrict on deposits. The cash Mae was feeding into the ATM went flying. She jammed the receipts into her purse and hurriedly gathered money off the ground.

The fraudsters then despatched Mae to the world’s two different crypto ATMs, however neither labored. It was 5 p.m. and getting darkish. Mae hadn’t eaten all day. Alivia requested if Cash2Bitcoin had despatched her a receipt for the $15,000. No, Mae replied, forgetting she had shoved it into her purse. Alivia instructed her to name and discover out what the holdup was. Mae’s telephone dialog with Cash2Bitcoin was regarding sufficient that the person on the change froze Mae’s cash.

Stymied, Alivia handed the decision off to her “supervisor,” Mike Ross. Confronted with a crypto useless finish, however unwilling to relinquish an opportunity on the remaining $5,000, Ross directed Mae to a Ceremony Assist close to her home to purchase reward playing cards.

Loopholes and laggards

Reward card firms could make the declare they’re “extremely regulated” due to laws that occurred after the 2008 monetary disaster. The uproar after Simon Property Group flouted state client safety legal guidelines led Congress to pass the Credit CARD Act in 2009. The regulation eradicated most of the rubbish charges on reward playing cards and prohibited playing cards from expiring for a minimum of 5 years. It additionally inspired states to legislate their very own reforms by permitting state regulation to preempt federal regulation. However the regulation didn’t prolong present credit score and debit card client fraud protections for reward card purchasers.

As a part of the wave of monetary reform, Congress also created a single regulator for client monetary safety: The Consumer Financial Protection Bureau. It eliminated regulation-writing authority from the Federal Reserve and gave enforcement and rule writing authority solely to the bureau. It additionally took away examination and enforcement of all nonbank monetary merchandise from the Fed, the FDIC and the Workplace of the Comptroller of the Forex. Federal client safety – financial institution or nonbank – would ostensibly now be regulated solely by this new single regulator.

Within the 15 years for the reason that Client Monetary Safety Bureau was created, there was a rise in consumer financial products outside of banks, however the brand new company hasn’t stored up. As a part of the principles it issued in 2016 and 2018, it exempted most reward playing cards, open- and closed-loop alike, from regulation.

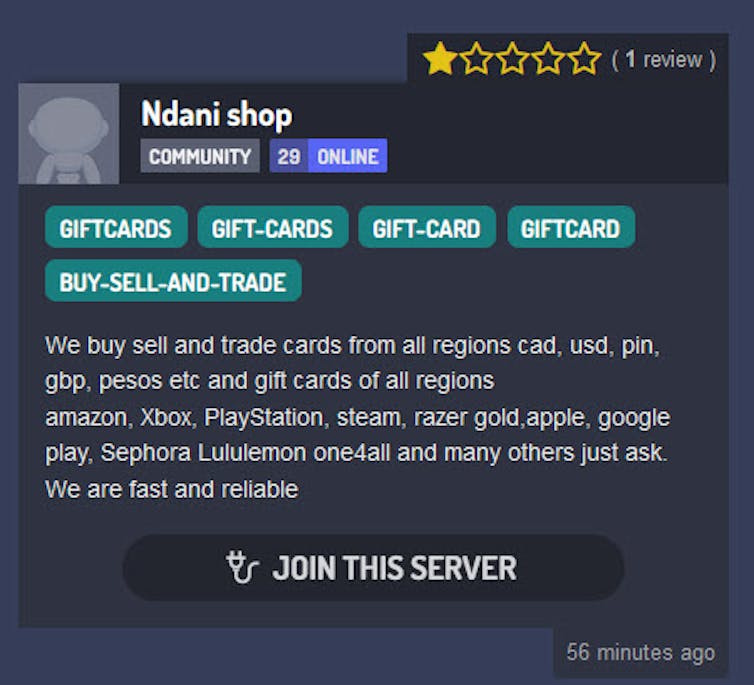

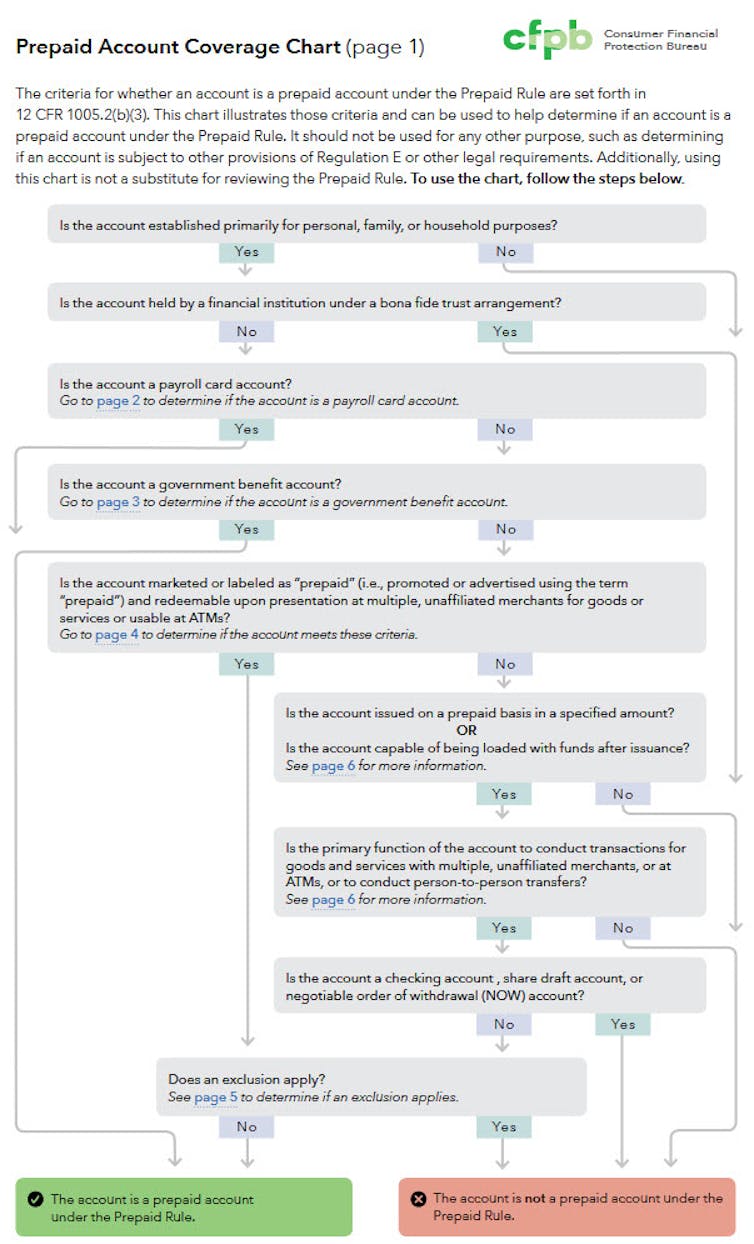

Whereas the bureau declined multiple requests to clarify why reward playing cards have been exempted from its client safety guidelines for fraud, it did level to sources together with a flowchart displaying what types of electronic payment methods would be covered below its guidelines. The chart, a near-incomprehensible tangle of arrows and eventualities, exhibits how most pay as you go reward playing cards are exempt from the fraud client safety rules frequent for debit and bank cards, together with all reward playing cards and branded reloadable playing cards bought in retail drugstores and supermarkets. This exemption exists though these pay as you go playing cards depend on digital activation and upkeep, which is the aim of present legal guidelines such because the Electronic Fund Transfer Act.

Consumer Financial Protection Bureau

The FTC’s authority

Other than the Client Monetary Safety Bureau, the FTC and the Treasury Division have tasks that might shield shoppers like Mae from reward card fraud. But, up to now, their actions regarding reward playing cards are spotty at greatest.

The FTC is the unique client safety company. It could possibly regulate “unfair or misleading” acts or practices in commerce and supplies annual statistics of consumer reports of fraud in all services. It supplies recommendation about avoiding scammers, and shoppers can fill out a form and be a part of different tragic tales in a growing database, however there’s little consequence for the businesses concerned. The FTC contends it has jurisdiction to convey enforcement actions towards reward card nonbank entities for unfair or misleading acts or practices, but the last time it appears to have done so was in 2007.

The FTC supplied a background interview and despatched a follow-up memo, but it surely declined to reply questions in regards to the variations between its authority and that of the Client Monetary Safety Bureau, or verify which company is the first federal regulator of reward playing cards.

Extra companies, little oversight

The Treasury may additionally get entangled. Two companies of the U.S. Division of Treasury sort out fraud that touches on nationwide safety, terrorism and transnational gangs. More and more, criminals from China, Iran, North Korea, Russia and the occupied areas of Ukraine goal Individuals with tacit, and generally specific, state help. These Treasury companies have additionally largely given reward playing cards a cross, exempting them from controls in place to fight these crimes, though there’s proof that the playing cards are being used by international criminals.

The Financial Crimes Enforcement Network, a bureau of the Treasury Division, requires two varieties of stories that may contain reward playing cards: currency transaction reports for transactions of $10,000 or extra which can be made in money, and confidential suspicious activity reports for a variety of transactions of any worth that the filer considers suspicious, including suspected elder financial exploitation.

Monetary establishments, together with banks and companies reminiscent of automotive dealerships, casinos, vintage sellers and cash service suppliers, are required to file the stories. These embody cash transmitters – firms reminiscent of Western Union and MoneyGram – that work via retail institutions reminiscent of supermarkets and Walmart to ship cash abroad or to a different metropolis moderately than utilizing a financial institution wire switch.

These companies should get hold of private identification data, reminiscent of a Social Safety quantity and driver’s license from the particular person conducting the transactions, for the report. Monetary establishments file millions of reports every year.

In 2011, with reward playing cards nonetheless of their infancy, the Monetary Crimes Enforcement Community issued a regulation to amend the cash service enterprise definition to address prepaid access products reminiscent of reward playing cards.

However regardless of regulation enforcement issues, the company exempted open-loop playing cards as much as $1,000 that weren’t used internationally and closed-loop reward playing cards as much as $2,000 from the money-laundering regulation. For closed-loop playing cards, there was no restriction on worldwide use.

The Monetary Crimes Enforcement Community additionally didn’t limit aggregation for gift cards. Banks and cash service companies are typically required to mixture transactions made on the identical day from a number of places and must report if the total amount goes over $10,000 for the day. For reward playing cards, nonetheless, there isn’t a mixture monitoring requirement, so fraudsters can direct seniors to a number of shops in a day – even shops from the identical chain – to purchase $2,000 price of reward playing cards at every, racking up tens of 1000’s of {dollars}.

The Monetary Crimes Enforcement Community’s rule specifies that “classes of pay as you go entry services have been exempted as a result of they pos[ed] decrease dangers of cash laundering and terrorist financing,” regardless of noting that regulation enforcement disagreed.

In response to our detailed questions, the Treasury’s Monetary Crimes Enforcement Community declined to say what number of, if any, regulatory examinations it or the IRS on its behalf has carried out of reward card suppliers. “Any data or statistics that we will share publicly are positioned on our web site,” Monetary Crimes Enforcement Community spokesperson Steve Hudak wrote in an electronic mail that additionally included resource links. “FinCEN declines additional remark.”

The ultimate company within the reward card regulatory puzzle is Treasury’s Office of Foreign Assets Control, which administers and enforces financial sanctions applications towards nations and teams of people, including foreign hackers and fraudsters focusing on america.

However as a result of reward card purchasers don’t have to point out identification and may present the cardboard quantity or a textual content image of the cardboard to somebody abroad, reward card firms can’t stop sanctioned people, groups or nations from utilizing their merchandise.

Just one enforcement motion seems to have been taken by the Workplace of Overseas Property Management towards a present card supplier.

In 2022, when Tango Card merchandise, now a division of Blackhawk, self-reported that playing cards had been used to buy items or companies in malign nations, together with Iran, North Korea, Syria and Russian-occupied areas of Ukraine, the bureau sanctioned the corporate $116,048.60.

The Office of Foreign Assets Control didn’t reply to repeated requests for remark.

Mae sends the police away

At Ceremony Assist, Ross instructed Mae to buy three varieties of reward playing cards: two $500 Nordstrom playing cards, two $500 Goal playing cards and one $200 Macy’s card.

David P. Weber

Given the dimensions of the acquisition, the Ceremony Assist cashier known as over the supervisor. Mae lied and stated she wanted the reward playing cards for her grandson. Seemingly because of the $2,000 restrict Ceremony Assist imposed on each day purchases of closed-loop reward playing cards, the pharmacy would promote her solely the 4 Nordstrom and Goal playing cards for a complete of $2,000. Again in her automotive, Mae scratched the again of the playing cards to disclose the numbers and browse them to Ross.

The Dialog, CC BY-ND

He was about to direct her to the subsequent cease when there was a knock on the automotive window. It was a police officer. Mae had been scheduled to cook dinner dinner for a gentleman good friend who had change into nervous by her absence and contacted the native police. They’d tracked down her automotive. Ross instructed her to do away with the cop by inventing a narrative. He’d keep on the road to pay attention. She rolled down the window and did as Ross instructed, reassuring the officer that every one was properly, and she or he’d be residence quickly.

David P. Weber

When the policeman left, Ross despatched Mae to a close-by Meals Lion grocery store to purchase extra reward playing cards. The Meals Lion was near Mae’s home, and the shop supervisor knew her. He refused to promote her the reward playing cards. It is a rip-off, he instructed her. It was now nearly 8 pm. Resigned, Ross instructed her to go residence however not inform anybody what had transpired.

The worry bubble lifts

By the point Mae pulled into her driveway, the ether had lifted and she or he knew she’d been scammed. “It was a giant fats mild bulb: ‘You’ve been screwed,’” she stated.

Mae known as M&T and discovered there was no open fraud case. She known as Goal. Solely half-hour had elapsed since she bought the reward playing cards at Ceremony Assist, however they’d already been spent.

Latest prosecutions of Chinese language reward card draining rings have revealed that the criminals employ networks of mules. These low-level workers are already positioned to purchase items in particular person as soon as reward card numbers are obtained. And there are different avenues to monetize the reward playing cards in addition to a military of low-level patrons. On the Russian-owned Telegram app, dozens of reward card marketplaces promote illegally obtained playing cards. The visitors in illicit reward playing cards seems to be rising in reputation as a result of it’s potential to maneuver large sums of cash offshore anonymously with little to no regulatory controls.

“The diminished fraud safety makes it simple for cybercriminals to search out patrons,” stated Ensar Seker, advisory chief data safety officer at SOCRadar, a cybersecurity agency that displays the channels.

The playing cards are often bought for 50% to 75% of face worth, primarily based on the danger incurred in acquiring them, in line with Seker. If playing cards should be moved rapidly as a result of they have been acquired via hacking and more likely to be canceled, they’re price nearer to 50%. Playing cards obtained by fraud are price nearer to 75%, as a result of there’s little danger of being caught for utilizing one.

Retailers aren’t required to know who their prospects are. So the retailer issuing the cardboard has no thought whether or not the cardholder is the one that purchased it, somebody who was gifted the cardboard, a fraudster or somebody who bought it from a fraudster on Telegram or the darkish net. Typically criminals will report the playing cards stolen and obtain a brand new quantity to cowl their tracks. As a result of the retailer doesn’t know who purchased the cardboard, it may possibly’t inform that it’s the fraudster making the decision.

More and more, cryptocurrencies will be traced and recovered, stated Seker, however reward playing cards can not.

“An important facet for the legal is to remain nameless and untraceable. Reward playing cards permit this,” he stated.

Epilogue

Investigators tried to pursue the criminals answerable for scamming Mae. Her case was referred to a particular elder monetary exploitation workforce. Investigators met with Mae lower than per week after the fraud.

The telephone numbers the fraudsters utilized in talking to Mae have been web traces from a service supplier that had little data to supply and denied any accountability. The telephone service had been bought utilizing an open-loop reward card, so there was no file of who bought the service.

Mae had thrown out the reward playing cards however gave the investigators the Ceremony Assist receipts, which had partial numbers of the reward playing cards, much like ATM receipts. The investigators subpoenaed Ceremony Assist for the total reward card numbers utilizing the postal mailing deal with the shop supplied for subpoenas.

After a considerable delay, Ceremony Assist responded to the subpoena, claiming it couldn’t present the total card numbers utilizing its point-of-sale data. Investigators later linked with a regional loss prevention supervisor at a special retailer who supplied the total reward card numbers that Ceremony Assist company headquarters claimed in its subpoena response it didn’t have.

The investigators then subpoenaed Nordstrom and Goal. However by that point there was no data left to offer. Retailer surveillance footage was months gone, overwritten with new footage. The retailers had no data of who had used the playing cards. So regardless of rapid motion by regulation enforcement, the criminals had vanished, together with Mae’s $2,000.

Mae bought most of her bitcoin a refund, due to the compliance efforts and fraud freeze that had been positioned on her bitcoin account on the day of the fraud.

Whilst fraud towards the aged, together with via reward playing cards, continues to develop, it’s primed to get solely worse. In 2023, Americans 65 and older represented 17.3% of the inhabitants, about 57.8 million individuals. By 2040, they are going to be 22% of the inhabitants, numbering greater than 78 million. By 2060, that quantity is predicted to be 88.8 million.

These seniors can be sitting on nest eggs accrued over a lifetime, and fraudsters need a piece of it.

Mae reported her story to the native police, AARP and the FTC database. “It could possibly occur to anybody,” she stated.

Source link