When a personal fairness big purchased California-based grocery chain Cardenas Markets in 2022, grocery employees like Maria Vargas noticed their hours slashed.

“I can’t cowl my bills anymore,” mentioned Vargas, who, like virtually a third of all renters within the nation, spends greater than half her paycheck on hire. When Vargas requested her employer for extra hours or higher wages, she was informed the corporate couldn’t afford it. “They inform us they’re restricted within the hours they can provide based mostly on the quantity they’re making from gross sales,” Vargas mentioned. “They inform us that if we don’t prefer it, we are able to discover someplace else to work.”

Whereas Vargas and her coworkers wrestle to make hire, nevertheless, authorities help meant to assist housing affordability is as an alternative enriching the grocery store’s non-public fairness proprietor, Apollo International Administration. By means of one other tentacle of its non-public fairness empire, the practically $1 trillion agency has tapped billions in publicly-supported funds from the Federal Home Loan Bank System, a little-known relic of the Nice Despair initially established to encourage reasonably priced mortgage lending.

The system offers tax and regulatory exemptions to the Federal Residence Mortgage Banks in trade for them providing low-interest loans to different monetary establishments to assist them present reasonably priced mortgages to homebuyers. Amongst these monetary establishments are insurance coverage corporations — an anachronism now being exploited by Wall Road.

Non-public fairness corporations are buying insurance coverage corporations which are accessing the banks’ government-subsidized loans to put money into their very own enterprise portfolios, quite than in reasonably priced housing. The insurers in query provide no mortgages in any respect.

The low-interest loans are notably helpful to personal fairness corporations, which depend on debt-financed transactions and which have been hit hard by increased rates of interest. What’s extra, these corporations are utilizing the earnings they make off their insurance coverage corporations to devour the housing market and drive hire will increase and foreclosures that the house mortgage financial institution system was designed to fight.

Whereas regulators have been working to reform the system, these efforts are unsure beneath President Donald Trump’s nominee to supervise such issues — a personal fairness CEO.

Three of the world’s largest non-public fairness corporations, Apollo, KKR & Co., and Blackstone, have all acquired or managed investments for all times insurance coverage corporations which have borrowed greater than $20 billion from the Federal Residence Mortgage Financial institution System prior to now 5 years, in accordance with The Lever’s evaluation of annual reviews and monetary disclosures from the Securities and Trade Fee. Apollo, the most important non-public fairness borrower, seems to earn over $200 million a 12 months on the investments it makes utilizing these loans.

In those self same monetary filings, corporations like Apollo disclose that they use the funds secured from the house mortgage banks to put money into their rising portfolio quite than reasonably priced housing. The insurance coverage corporations managed by Apollo, KKR, and Blackstone haven’t originated a single mortgage prior to now 5 years.

“The Federal Residence Mortgage Financial institution has develop into a de facto piggy financial institution for personal fairness and insurance coverage corporations,” mentioned Ryan Gremillion, senior vp of coverage and analysis of the African American Alliance of CDFI CEOs, a coalition of Black-led group improvement monetary establishments. “The system was created to assist housing finance, however now the cash is being funneled to personal equity-backed corporations with little connection to housing and group improvement.”

Non-public fairness corporations aren’t the one main monetary establishments utilizing the Federal Residence Mortgage Financial institution System in ways in which have little to do with housing. A 2023 Bloomberg investigation discovered that 42 p.c of the then-6,400 member establishments had not originated any mortgages since a minimum of 2018.

In 2022, the Biden administration launched a evaluate strategy of the Federal Residence Mortgage Financial institution System, concluding it ought to be introduced again to its unique reasonably priced housing mission. It’s unclear, nevertheless, whether or not these reforms will occur beneath Invoice Pulte, Trump’s choose for the nation’s high housing regulator. With a $50 million stake in Pulte Capital Partners, the non-public fairness group he based, critics say Pulte’s pursuits could also be at odds with the reform efforts.

In a Feb. 24 letter to Pulte, Sen. Elizabeth Warren (D-Mass.), a member of the Senate Committee on Banking, Housing, and City Affairs, probed the Federal Housing Finance Company director nominee over his potential conflicts of curiosity. “It’s important that the Senate perceive your present monetary relationship to entities that would instantly or not directly profit from selections you’ll make,” Warren wrote.

Pulte didn’t reply to The Lever’s request for remark. When requested whether or not he helps reforming the Federal Residence Mortgage Financial institution System at his Feb. 27 nomination listening to, Pulte said, “I’d like the good thing about getting contained in the group first” earlier than answering.

A “Frankenstein Establishment”

Through the Nice Despair, as the speed of foreclosures reached a thousand per day and millions of Individuals have been pushed out of their properties, Congress handed the 1932 Federal Residence Mortgage Financial institution Act, which established a discount banking system to encourage monetary establishments to provoke mortgage transactions, also referred to as originating mortgages.

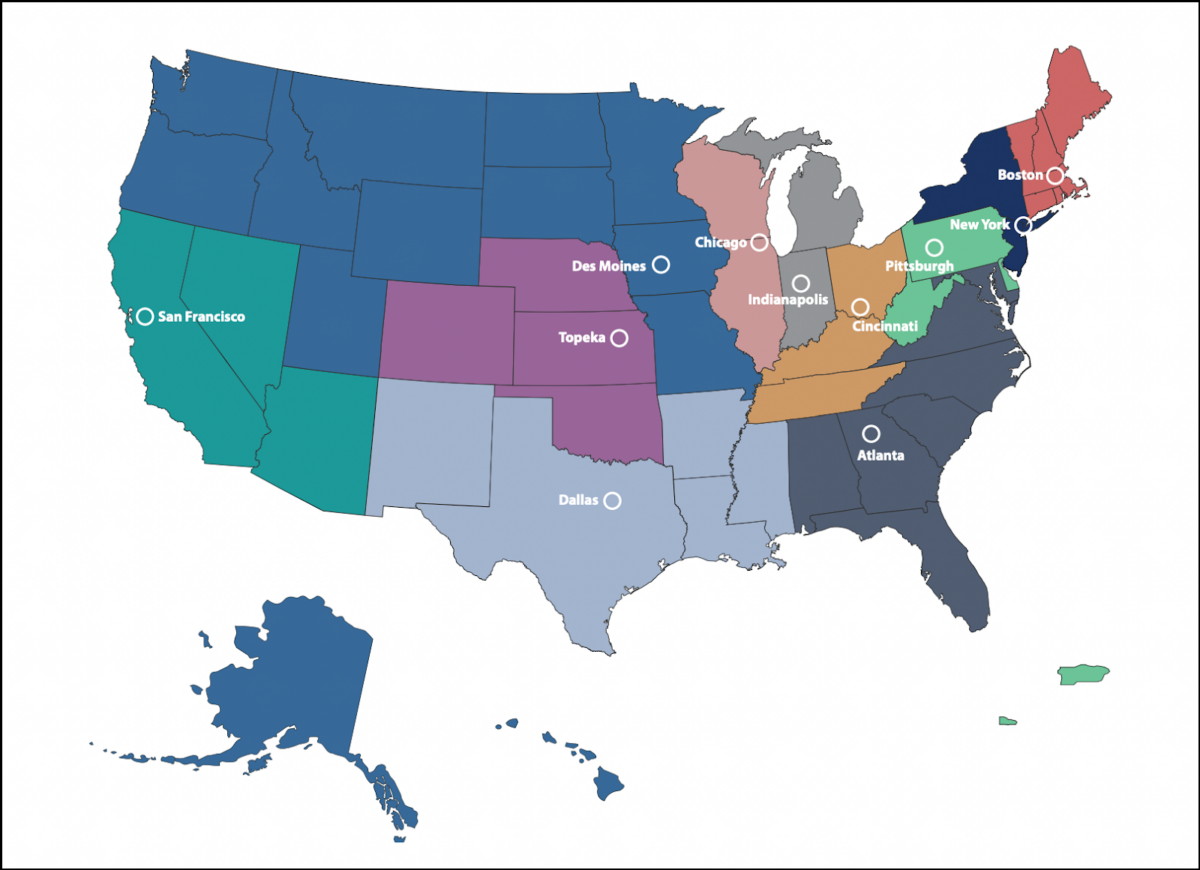

With a stability sheet reaching $1.3 trillion, the Federal Residence Mortgage Financial institution System is the nation’s second-largest issuer of debt behind the Treasury Division. It initially comprised a dozen regional banks scattered throughout the nation that supplied low-cost loans to native mortgage lenders. These mortgage lenders would bundle the loans into low-interest mortgages for homebuyers who in any other case couldn’t afford a mortgage. The regional banks are cooperatively owned by their member monetary establishments, which buy shares within the banks to be able to borrow from them.

The Federal Residence Mortgage Financial institution System is a government-sponsored enterprise with a housing mission just like the businesses Fannie Mae and Freddie Mac. However whereas Fannie Mae and Freddie Mac purchase and promote mortgages from banks and credit score unions, the Federal Residence Mortgage Financial institution System’s essential goal is to supply liquidity to member establishments in order that these establishments can present mortgages.

Residence mortgage financial institution membership was initially restricted to financial savings and loans establishments, also referred to as “thrift banks,” in addition to insurance coverage corporations, which bought mortgages at the time. However within the Eighties, as thrift banks noticed widespread failure because of dangerous funding practices, the federal house mortgage banks started shedding too many members to maintain themselves.

In response, Congress overhauled the system. By means of the Monetary Establishments Reform, Restoration, and Enforcement Act of 1989, Congress invited business banks and credit score unions to develop into members of the Federal Residence Mortgage Financial institution System.

The laws additionally loosened guidelines requiring members to pledge residential mortgages as collateral in case they couldn’t pay again their loans. Now, members are in a position to pledge a wider vary of collateral, together with business loans, mortgage-backed securities, and authorities securities. That change has clouded the oversight on how the loans are used, mentioned Sharon Cornelissen, director of housing for the patron advocacy nonprofit Shopper Federation of America.

The laws additionally launched the system’s reasonably priced housing program, which requires every regional financial institution to allocate 10 p.c of its web earnings annually to grant applications that fund reasonably priced housing initiatives in every of the financial institution’s areas.

Membership within the Federal Residence Mortgage Financial institution System subsequently swelled. There are actually greater than 6,500 members of 11 regional banks, with business banks comprising greater than half of that quantity. The system is predicted to have obtained $7.3 billion in public subsidies in 2024 alone, in accordance with the nonpartisan Congressional Finances Workplace.

The banks’ exercise now displays little of their unique mission, and as an alternative have collectively develop into a “Frankenstein Establishment” that serves non-public pursuits, mentioned Jared Gaby-Biegel, a analysis affiliate for the United Meals and Business Staff (UFCW) union.

Residence mortgage banks have develop into a go-to supply for banks in search of fast money: The system turned a backstop to save lots of monetary establishments from failing throughout the 2008 monetary disaster whereas over three million householders filed for foreclosures. Through the regional banking turmoil of March 2023, as banks invested in dangerous cryptocurrency ventures, the house mortgage banks of San Francisco and New York lent roughly $58 billion to four banks — Silicon Valley Financial institution, Silvergate Capital Corp., Signature Financial institution, and First Republic Financial institution — earlier than all 4 of these banks folded.

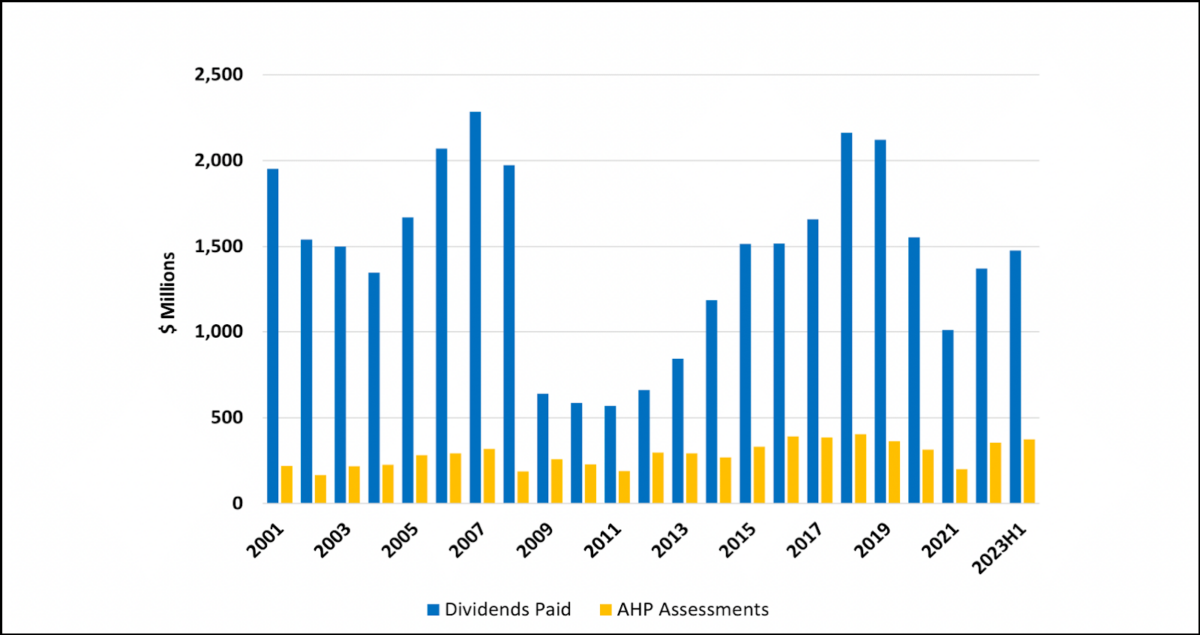

Whereas the system’s reasonably priced housing program is likely one of the largest sources of grant funds for reasonably priced housing within the U.S., allocating $8 billion for reasonably priced housing improvement for the reason that program’s founding, the quantity the banks contribute to this system pales compared to how a lot the system pays in dividends to its members. In 2022, reasonably priced housing program contributions have been assessed at $355 million, whereas the system paid out $1.4 billion in dividends. By 2023, the system paid out a document $3.4 billion in dividends to its members.

A study by the financial and social coverage assume tank City Institute discovered that the regional house mortgage banks’ reasonably priced housing contributions are likely to signify solely a small share of whole improvement prices for reasonably priced housing, which in 2021 ranged from a low of two.7 p.c by the Atlanta financial institution to a excessive of 10.6 p.c in Pittsburgh. And for the reason that house mortgage banks launched the reasonably priced housing program in 1990, the trouble has funded fewer low-income housing initiatives than its counterparts Fannie Mae and Freddie Mac funded in a single 12 months alone.

“If you speak about this system ‘creating reasonably priced housing,’ is funding 2 p.c of whole capital prices actually ‘creating reasonably priced housing’?” mentioned Michael Stegman, creator of the City Institute research. “It’s clearly filling a spot, however the demand for funding far exceeds the provision of these {dollars}.”

In the meantime, member establishments extra aligned with the unique act’s mission, like native banks and cooperative housing networks, now struggle to gain access to the system’s loans as a result of the regional house mortgage banks view them as much less engaging debtors than large banks and insurance coverage corporations.

These local people banks, often known as group improvement monetary establishments, assist economically deprived communities acquire entry to monetary providers, together with mortgage loans. Nevertheless, solely 5 percent of those establishments licensed with the Treasury Division are members of the Federal Residence Mortgage Financial institution System, a determine that Stegman said “ought to elevate a regulatory purple flag.”

Neighborhood improvement monetary establishments are sometimes required to cough up almost double the quantity of collateral than their bigger financial institution counterparts in trade for advances as a result of they’re seen as riskier shoppers. These steep necessities “make it so economically infeasible for us that many say it’s simply not price it,” mentioned Gremillion, on the African American Alliance of CDFI CEOs.

“It’s as if a company big exhibits as much as a meals financial institution and takes all of the provides,” Gremillion mentioned.

“Pure Funding Technique”

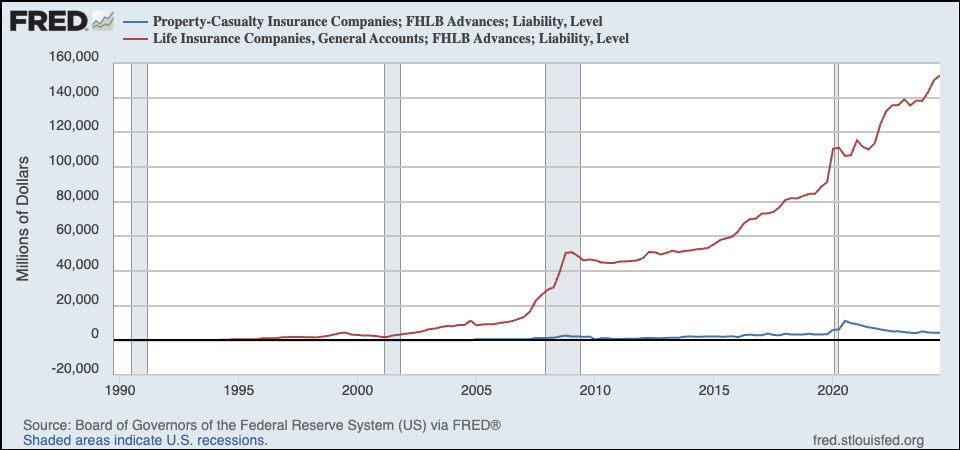

Though insurance coverage corporations have been eligible to develop into members of the Federal Residence Mortgage Financial institution System for the reason that program’s starting, many corporations didn’t reap the benefits of the system till the 1989 laws loosened oversight on how the loans may very well be used. Up to now thirty years, insurers’ use of the system has skyrocketed, with insurance coverage membership more than doubling prior to now decade — though insurance coverage corporations no longer originate mortgages.

Insurance coverage corporations have develop into the system’s second-largest borrower after business banks, with over $150 billion in advances. And regardless of comprising solely 9 p.c of the system’s membership, insurance coverage corporations make up 20 percent of whole loans.

In the meantime, non-public fairness corporations on Wall Road have recognized the life insurance coverage trade as an attractive investment target that provides the businesses entry to huge quantities of capital. The variety of non-public equity-owned life insurance coverage corporations has jumped 50 percent since 2018, now representing greater than 9 percent of the life insurance coverage trade.

When non-public fairness corporations purchase insurers, they acquire the fitting to control insurers’ property, permitting the corporations to make use of insurance coverage portfolios for their very own funding methods. In response to McKinsey, a worldwide administration consulting agency, the highest 5 largest non-public fairness corporations have holdings in life insurance coverage corporations, representing as much as half of the corporations’ whole property.

Lately, non-public fairness corporations have begun focusing on life insurance coverage corporations which are members of the Federal Residence Mortgage Financial institution to realize entry to the system’s low-cost advances to make use of for their very own investments, mentioned Courtney Alexander, a senior analysis analyst for the United Meals and Business Staff Union.

Business gamers have advertised how insurance coverage corporations can enhance their earnings from membership within the house mortgage banks, calling membership a possibility to “improve funding yield and whole return.”

By 2023, there have been 29 non-public equity-owned life insurance coverage corporations that had entry to the Federal Residence Mortgage Financial institution System, a 20 p.c enhance in only one 12 months, in accordance with a Nationwide Affiliation Insurance coverage Commissioners report. Apollo, KKR, and Blackstone personal or handle property for corporations that share greater than $20 billion in loans taken out from the Federal Residence Mortgage Banks.

At the least $80 million of that quantity could be traced again to the tax and regulatory advantages that house mortgage banks obtain as a government-sponsored enterprise, Alexander mentioned.

Apollo International Administration is by far the most important consumer of the system, with over $15.6 billion in present funding agreements by means of its subsidiaries. “Apollo has been the chief in shopping for these insurance coverage corporations, and it has spurred different non-public fairness corporations to do the identical,” Alexander mentioned. “The development is accelerating.”

Apollo CEO Marc Rowan helped create Athene Annuity and Life Firm in 2009. The insurer instantly turned a member of the Federal Residence Mortgage Financial institution of Des Moines, in accordance with membership data. Apollo held a 35 p.c stake within the firm for greater than a decade earlier than it totally acquired Athene in 2022. The acquisition doubled Apollo’s whole property, that are projected to succeed in $1 trillion by 2026.

Since 2022, Athene’s borrowing from the house mortgage financial institution system has grown over sixfold. Regardless of having zero mortgages on its books, Athene was the fifth largest borrower of the Des Moines financial institution earlier than it merged with Apollo, with $2.4 billion in excellent advances. That quantity has since elevated to $15.6 billion this 12 months, making Athene the Des Moines financial institution’s largest borrower and representing greater than 13 percent of the regional financial institution’s whole advances.

Apollo has disclosed in federal monetary filings that the house mortgage financial institution advances are used as a part of its “investment spread strategy,” that means Apollo makes use of the low-interest loans to put money into different tasks that pay the next rate of interest. In a recent quarterly report, the corporate famous “robust quarterly inflows” pushed by house mortgage financial institution exercise.

“We search to earn extra returns. And once we see alternatives to do this, we will probably be very aggressive,” Rowan said in Apollo’s 2024 year-end name.

Based mostly on the $15.6 billion Apollo at the moment holds in borrowing from the house mortgage financial institution system, together with the virtually two p.c rate of interest that the corporate receives from its investments in accordance with latest financial reports, the non-public fairness agency could earn greater than $274 million per 12 months on its house mortgage financial institution borrowing, i.e., virtually 10 p.c of its total investment earnings, in accordance with the UFCW’s Alexander.

“It’s a pure funding revenue technique,” mentioned Alexander. “They’re doing it to earn money off of cash,” Alexander mentioned.

A spokesperson for Apollo and Athene declined a request for remark.

Different corporations have adopted Apollo’s lead. New York Metropolis-based agency KKR purchased retirement and life insurance coverage firm International Atlantic Monetary Group on the start of last year for greater than $4.4 billion, giving KKR entry to a few insurance coverage subsidiaries of International Atlantic Monetary Group which are members of Federal Residence Mortgage Banks. Between Forethought Life Insurance Company, Accordia Life and Annuity Company, and Commonwealth Annuity and Life Insurance Company, KKR’s subsidiaries maintain $2.3 billion in excellent loans from the house mortgage banks of Indianapolis, Boston, and Des Moines.

KKR didn’t reply to a request for remark.

Non-public fairness big Blackstone added Everlake Life Insurance Company to its portfolio in 2021. The insurance coverage firm at the moment holds $54 million in funding agreements used for “funding unfold methods or normal operations,” in accordance with a monetary submitting. Blackstone additionally briefly held a giant share of Constancy & Warranty Life Insurance coverage Firm, which has been a member of the Atlanta financial institution since 2004. Blackstone still partners with the insurance coverage firm in managing the insurer’s property, that are boosted by $2.6 billion from the Atlanta house mortgage financial institution.

Blackstone clarified their funding property, however declined to remark.

As soon as the cash leaves the federal house mortgage banks, debtors can do no matter they need with it, Gaby-Biegel mentioned. This additionally means it’s unimaginable to trace the place house mortgage financial institution cash goes. “There is no such thing as a oversight over how these loans are used,” Gaby-Biegel. Whereas longer-term loans that final over 5 years are statutorily required for use for residential housing finance, “there’s additionally no actual oversight on that,” Gaby-Siegel mentioned.

Non-public Fairness’s Landlord Enterprise

Darlene Simpson had lived in her residence in Escondido, California, for greater than a decade when Blackstone bought the constructing in 2021. Simpson receives Part 8 authorities vouchers, which assist low-income tenants pay for housing, however the portion she pays out of pocket for hire has doubled since Blackstone’s acquisition.

Lots of her neighbors have moved out, citing hire will increase, and plenty of extra have been evicted for falling behind on hire. Since Blackstone got here in, Simpson says that upkeep points, like a leaky ceiling and a clogged sink, have largely gone ignored.

“It’s like they’re forcing me out by not fixing issues,” Simpson mentioned. “It doesn’t really feel like a house anymore.”

Simpson’s expertise just isn’t an anomaly. As non-public fairness teams purchase members of the Federal Residence Mortgage Financial institution System to entry the system’s funds, the trade is concurrently swallowing giant swathes of the housing market. These corporations are exacerbating the nation’s housing disaster by inflating rent prices, ramping up evictions, and squeezing the marketplace for homebuyers.

What’s extra, the real estate funds these non-public fairness corporations use to buy residential properties just like the one Simpson lives in are largely financed by insurance coverage corporations which have taken out billions in Federal Residence Mortgage Financial institution advances, creating yet one more direct line of money move from the house mortgage banks to personal fairness corporations.

In whole, non-public fairness corporations are estimated to personal 500,000 single-family homes and over 1 million rental models throughout the nation, and they’re anticipated to manage 40 p.c of the single-family rental market by 2030.

Blackstone is now the nation’s largest landlord after shopping for up over 300,000 rental housing models in a multiyear actual property shopping spree, in accordance with analysis by the nonprofit watchdog Non-public Fairness Stakeholder Mission. The agency began buying single-family properties following the 2008 monetary disaster when more than 2 million folks foreclosed on their properties. It now boasts a portfolio of over 60,000 single-family properties.

In firm filings, Blackstone has informed buyers the way it earnings from the reasonably priced housing disaster and the dwindling housing provide. In a 2024 letter to stockholders, Blackstone listed “Declining new provide” in a piece titled “We See A number of Causes for Optimism in 2024.” The dearth of housing has given the corporate “pricing energy for rental housing property,” in accordance with a 2023 letter.

Whereas borrowing $2.3 billion from the Federal Residence Mortgage Financial institution System, KKR has additionally been ramping up its personal landlord enterprise, buying greater than 5,200 apartment units throughout the nation for simply over $2 billion earlier this 12 months.

Non-public fairness corporations use giant quantities of debt to purchase residential buildings. The corporations then elevate rents at exorbitant charges, impose new charges, neglect property upkeep, and ramp up evictions to spice up earnings, in accordance with a 2022 study from the advocacy group, Individuals for Monetary Reform. Lastly, they off-load the buildings at a revenue, a tactic ProPublica recognized as “corporate house-flipping.”

Pulte, Trump’s alternative for the nation’s federal housing regulator, named mobile parks, an important supply of housing for low-income communities, as a primary funding goal for his firm. On a recent podcast with the monetary advising agency Wealthion, Pulte recognized single-family actual property and cell house parks as “the subsequent era of our wealth era,” calling his agency “very bullish” in actual property investing.

Stated Pulte, scion of one of many nation’s largest homebuilding empires, “There are going to be many, many millionaires and possibly billionaires made in housing over the subsequent ten, twenty years.”

Jordan Ash, director of housing on the Non-public Fairness Stakeholder Mission, mentioned that the non-public fairness enterprise mannequin is “not about long-term funding.”

“It’s about making the asset extra worthwhile and promoting it off,” Ash mentioned. “It has a big influence each by way of hire will increase, and in addition by way of driving up housing costs and squeezing out homebuyers.”

Blackstone has settled a number of lawsuits filed by renters for violating rent-stabilization guidelines over time. In San Diego, the agency bought greater than 5,000 reasonably priced housing models in 2021 for $1 billion, then hiked rents for some models by as a lot as 64 percent — six occasions the utmost hire hike cap of 10 p.c beneath California state law.

The fund that Blackstone used to buy the housing in San Diego for $1 billion was closely bankrolled by life insurance coverage corporations which are members of the Federal Residence Mortgage Financial institution System, in accordance with a listing of buyers within the Blackstone Actual Property Companions IX Fund obtained by The Lever.

Life insurance coverage corporations akin to Prudential Insurance Company of America, ReliaStar Life Insurance Company, and Voya Retirement Insurance and Annuity Company all funneled money into Blackstone’s fund whereas taking out virtually $4 billion in loans from the Federal Residence Mortgage Banks of New York and Des Moines.

“Insurance coverage corporations are giant buyers in non-public fairness funds,” Ash mentioned. “It makes me marvel if they’re utilizing cash from the house mortgage banks to truly put money into these actual property funds that very clearly counter the push for reasonably priced housing.”

“Should you do it proper,” Pulte said about his firm investing in actual property, “you’ll be able to put your head on the pillow at night time and know that you’re doing OK.”

The System’s Overhaul

Below Pulte’s management, it’s unclear what is going to occur to efforts already underway to reform the Federal Residence Mortgage Financial institution System. Sandra Thompson, director of the Federal Housing Finance Company beneath Biden, launched a sweeping evaluate of the system in 2022 to handle its recognized deficiencies.

FHFA’s resulting report proposed doubling required contributions to the system’s reasonably priced housing program and tightening membership necessities, together with a mandate that members regularly maintain a portion of their property in mortgage loans. Nowhere within the report, nevertheless, is there any point out of personal fairness’s encroachment into the system.

The report’s suggestion to double reasonably priced housing program contributions was endorsed by Sens. Catherine Cortez Masto (D-Nev.) and Elizabeth Warren (D-Mass.). However the regional house mortgage banks — and the life insurance industry — have pushed again.

Whereas the house mortgage banks agreed to voluntarily enhance their contributions to 15 percent of their web revenue in 2023, the banks rebuffed a recent request by the Treasury Division to lift that contribution to twenty p.c. The banks, which earned $6.7 billion and paid out $3.4 billion in dividends to their members in 2023, argued that elevating the extent of reasonably priced housing contributions would “not tackle the underlying complexities of the housing disaster.”

In response to federal lobbying data, regional Federal Residence Mortgage Banks and their members have spent more than $5 million since January 2022 lobbying on points together with housing finance reform, such because the Federal Home Loan Banks’ Mission Implementation Act to double the reasonably priced housing applications to twenty p.c. That invoice was launched in 2021 as companion legislation in each chambers of Congress by Sen. Cortez Masto (D-Nev.) and Rep. Ritchie Torres (D-N.Y.). Since then, there was no motion on the payments.

In a letter to the Federal Housing Finance Company, Council of Federal Residence Mortgage Banks President Ryan Donovan argued towards elevating the reasonably priced housing program contribution degree. He as an alternative instructed that the company ought to use its evaluate of the system “as a possibility to supply extra flexibility” and that “further regulatory flexibility would improve contributions to reasonably priced housing.”

Representatives from the Council of Federal Residence Mortgage Banks didn’t reply to inquiries from The Lever.

“It’s a really profitable system for the banks and insurance coverage corporations which are a part of it,” mentioned Alexander at UFCW. “They’ve a resistance to any modifications which are going to scale back the dividends and earnings to their members.”

Sharon Cornelissen, who serves as chair of the Coalition to Reform Federal Residence Mortgage Banks, a coalition of 17 nationwide organizations selling reform of the system, advocates for a tripling of reasonably priced housing program contributions to 30 percent, noting that 40 p.c of every financial institution’s web earnings are paid out in dividends. “They’re very beneficiant to their shareholders,” Cornelissen mentioned. “They need to be extra beneficiant to the general public, too.”

Gremillion of the African American Alliance of CDFI CEOs mentioned that the Federal Housing Finance Authority ought to cut back the collateral obstacles that house mortgage banks impose on group improvement monetary establishments. “We aren’t in search of a handout,” Gremillion mentioned. “We simply need truthful entry to a system that was constructed to assist the work we now have been doing for many years.”

In a rustic the place affordability has all however disappeared, Cornelissen mentioned that it shouldn’t be an enormous ask to carry the system again to its unique aim of serving to folks acquire housing.

“It looks like a victimless crime,” Cornelissen mentioned of the system’s drift from its housing mission. “However each greenback {that a} non-public fairness firm will get from this method is a greenback that would assist somebody struggling to afford housing.”

We’re resisting Trump’s authoritarian strain.

Because the Trump administration strikes a mile-a-minute to implement right-wing insurance policies and sow confusion, dependable information is an absolute should.

Truthout is working diligently to fight the concern and chaos that pervades the political second. We’re requesting your assist at this second as a result of we’d like it – your month-to-month present permits us to publish uncensored, nonprofit information that speaks with readability and reality in a second when confusion and misinformation are rampant. As properly, we’re wanting with hope on the materials motion group activists are taking. We’re uplifting mutual help tasks, the life-sustaining work of immigrant and labor organizers, and different exhibits of solidarity that resist the authoritarian strain of the Trump administration.

As we work to dispel the ambiance of political despair, we ask that you simply contribute to our journalism. Over 80 p.c of Truthout’s funding comes from small particular person donations from our group of readers, and over a 3rd of our whole price range is supported by recurring month-to-month donors.

You may assist by giving right now. Whether or not you may make a small month-to-month donation or a bigger present, Truthout solely works together with your assist.

Source link