Goran Babic | E+ | Getty Photographs

Constructing a $1 million nest egg could appear an unattainable feat.

Nevertheless, amassing such retirement wealth is inside attain for nearly anybody — offered they take sure steps, monetary advisors say.

“You may assume that, ‘Nicely, I’ve to change into a Silicon Valley entrepreneur to change into wealthy,'” mentioned Brad Klontz, a monetary psychologist and authorized monetary planner.

The truth is, you could be a fast-food employee your complete life and amass wealth, mentioned Klontz, a member of the CNBC Financial Advisor Council and the CNBC Global Financial Wellness Advisory Board.

The calculus is easy, he mentioned.

Each time you are paid a greenback, save and make investments a share towards your “monetary freedom,” Klontz mentioned.

With this mindset, “you’ll be able to work virtually any job and retire a millionaire,” he mentioned.

It is not essentially a ‘Herculean job’

Saving $1 million could sound like a “Herculean job” nevertheless it “may not be as onerous as you assume,” Karen Wallace, a CFP and former director of investor training at Morningstar, wrote in 2021.

The secret is to start out saving early, maybe in a 401(okay) plan, particular person retirement account or taxable brokerage account, specialists mentioned. This enables buyers to harness the magic of compound interest over a long time. In different phrases, you “let your investments do as a lot heavy lifting as potential,” Wallace wrote.

About 79% of American millionaires say their internet price was “self-made,” in line with a Northwestern Mutual poll printed in September. Simply 11% mentioned they inherited their wealth, whereas 6% bought it from a windfall occasion like successful the lottery, in line with the survey of 4,588 U.S. adults, fielded from Jan. 3 to Jan. 17, 2024.

Extra from Private Finance:

IRS: There’s a key deadline approaching for RMDs

Egg prices may soon ‘flirt with record highs’

Federal Reserve is likely to cut interest rates next week

There have been 544,000 People with 401(okay) balances of greater than $1 million as of Sept. 30, according to Constancy Investments, which is the most important administrator of office retirement plans. There have been additionally greater than 418,000 IRA millionaires.

The truth is, the variety of 401(okay) millionaires grew by 9.5%, or 47,000 individuals, between the second and third quarter of 2024, largely attributable to stock-market gains.

How you can get to $1 million

Wera Rodsawang | Second | Getty Photographs

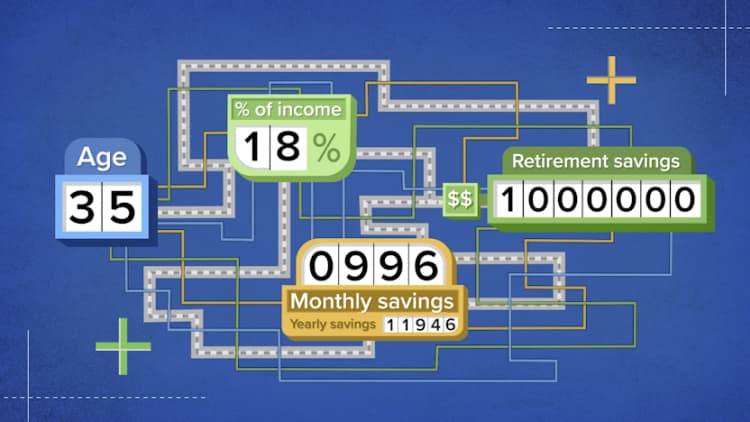

Winnie Solar, a monetary advisor, supplies an instance of the maths that hyperlinks $1 million of wealth with constant saving.

To illustrate a 30-year-old makes $60,000 a yr after tax. In the event that they have been to save lots of $500 a month — or, 10% of their annual earnings — they’d have $1 million by age 70, assuming common market returns of seven%, she mentioned.

This does not account for monetary components that may enhance financial savings over that interval, like an organization 401(okay) match, bonuses or raises.

You’ll be able to work virtually any job and retire a millionaire.

Brad Klontz

monetary psychologist and authorized monetary planner

“In 40 years, you will have over $1 million, and that is doing nothing else however $500 a month,” mentioned Solar, co-founder of Solar Group Wealth Companions, primarily based in Irvine, California, and a member of CNBC’s Monetary Advisor Council.

It is also necessary to keep away from debt, which might be the “largest cavity” for constructing financial savings, and take a look at to not enhance bills an excessive amount of, Solar defined.

Timing is extra necessary than being excellent, Solar mentioned.

She recommends beginning with a low-cost index fund — like one monitoring the S&P 500, which diversifies financial savings throughout the most important publicly traded U.S. firms — and constructing from there.

“Even ready a yr could make a dramatic distinction in reaching that $1 million level,” Solar mentioned. “Cease and take motion.”

What’s the correct quantity of financial savings?

Damircudic | E+ | Getty Photographs

After all, $1 million in retirement will not be the correct amount for everybody.

An oft-cited rule of thumb — generally known as the 4% rule — signifies a typical retiree can draw about $40,000 a yr from a $1 million nest egg in an effort to safely assume they will not run out of cash in retirement. (That annual withdrawal is adjusted yearly for inflation.)

For a lot of, this sum can be supplemented by Social Safety.

Constancy suggests a financial savings objective primarily based on earnings. For instance, by age 67 a employee ought to aim to have saved 10 instances their annual wage to make sure for a snug retirement.

Ideally, households would intention to save lots of 15% to twenty% of their earnings, Solar mentioned. This can be a rule of thumb usually cited by monetary planners.

How a lot wealth you need — and the way rapidly you need to be wealthy — will decide the share, Klontz mentioned.

He is personally aimed for a 30% financial savings price, however is aware of individuals who’ve shot for close to 90%. Saving such massive chunks of 1’s earnings is a typical thread of the so-called FIRE motion, which stands for Monetary Independence, Retire Early.

How do they do it?

“They did not transfer out of their dad and mom’ home, they minimized every thing, they do not purchase new garments, they take the bus, they shave their head as a substitute of paying for haircuts,” Klontz mentioned. “There’s all kinds of hacks you are able to do if you wish to get there sooner.”

How you can take pleasure in right this moment and save for tomorrow

After all, there is a pressure right here for individuals who need to take pleasure in life right this moment and save for tomorrow.

“We weren’t meant to solely survive and lower your expenses,” Solar mentioned. “There must be that good high quality of life and that blissful medium.”

One technique is to allocate 20% of family bills towards the factor or issues which might be most necessary to you — maybe massive holidays, fancy automobiles, or the most recent know-how, Solar mentioned.

Make some concessions — i.e., “scrimp and save” — on the opposite 80% of family prices, she mentioned. This helps savers really feel like they are not lowering their high quality of life, she mentioned.

Source link