(Bloomberg) — HSBC Holdings Plc is kicking off a contemporary spherical of job cuts at its funding financial institution as new Chief Govt Officer Georges Elhedery continues his overhaul of Europe’s greatest lender, in accordance with individuals accustomed to the matter.

Most Learn from Bloomberg

The most recent section of cuts will begin in Asia, however will finally have an effect on staff globally, mentioned the individuals, who requested to not be recognized discussing non-public issues. It’s not clear how many individuals might be affected by the strikes.

Some cuts are already underway within the agency’s markets division however wider layoffs throughout the funding financial institution will start as early as Monday, the individuals mentioned. The dismissals might be staggered over a number of weeks and months, one of many individuals mentioned. Workers might be let go primarily based on efficiency in addition to to take away duplication of jobs or to simplify operations, the individual mentioned.

“As introduced on October 2024, HSBC is concentrated on growing management and market share within the areas the place it has a transparent aggressive benefit and the place it has the best alternatives to develop,” an HSBC spokesperson mentioned in an emailed response to Bloomberg inquiry.

Elhedery is searching for to cut back prices with a restructuring that has to this point included combining the industrial banking division with its international banking and markets unit and pulling out of some underwriting and advisory companies in Europe and the Americas.

Since taking cost in September, Elhedery has already lower the dimensions of his personal group government committee by a few third. Reductions to senior staffers had been anticipated to have an effect on just a little over 40% of the corporate’s high 175 managers, Bloomberg reported in December. The financial institution has mentioned it expects to finish the strikes by June.

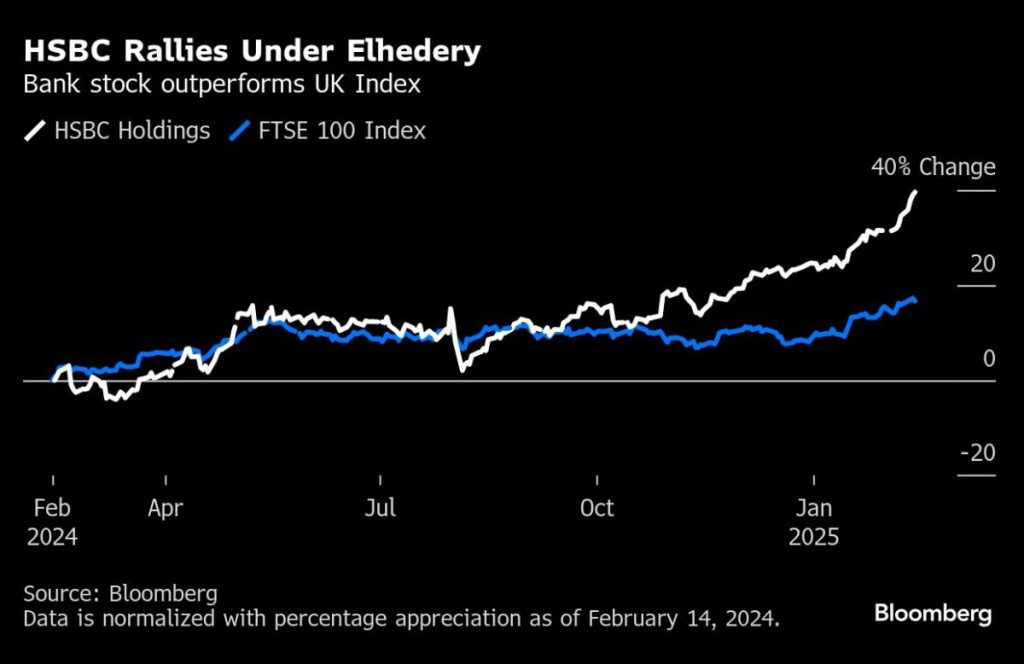

HSBC has mentioned it is going to present extra readability on the size of the restructuring when it reviews its full-year outcomes on Feb. 19. The financial institution is forecast by analysts to publish pre-tax revenue of $31.7 billion for 2024, a 4.6% enhance from the earlier 12 months. The inventory rose 0.5% on Thursday morning in Hong Kong buying and selling to round a seven-year excessive.

Townhall

The UK financial institution’s abrupt retrenchment from fairness underwriting and advisory providers exterior its core markets of Asia and the Center East has rattled dealmakers in Asia over the previous a number of weeks.

HSBC bankers have been sending a flurry of resumes to headhunters and rivals, individuals accustomed to the matter mentioned. They’re involved that HSBC might lose some companies similar to cross-border M&A advisory from Asia to Europe and the US, and it could be tough to get a lead function on US listings of Chinese language corporations.

Source link