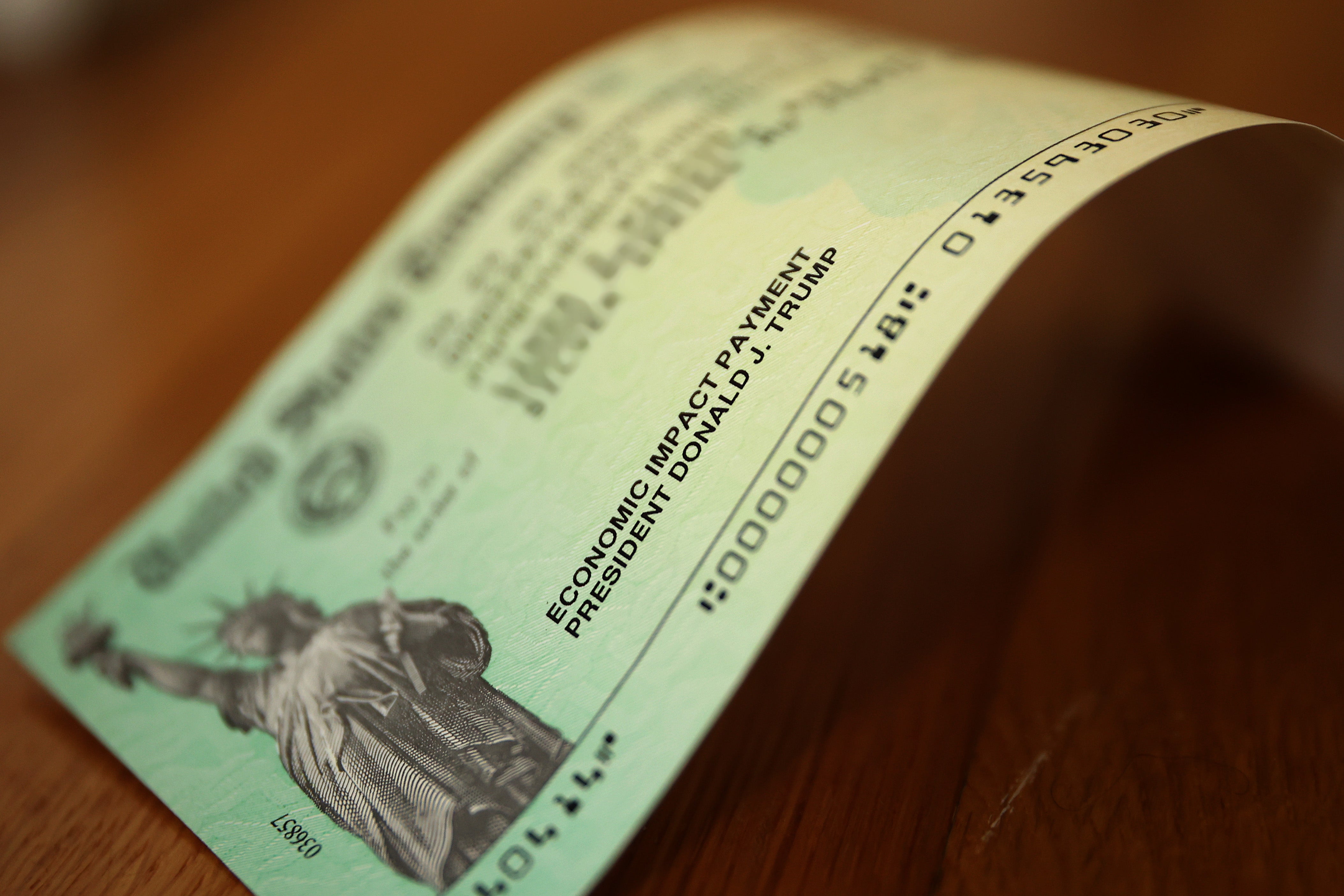

Many People are nonetheless eligible to assert a stimulus check of as much as $1,400 – however the deadline is quick approaching.

The Internal Revenue Service issued a reminder final month for eligible people to file their 2021 tax return by April 15 in the event that they haven’t acquired the Recovery Rebate Credit.

The refundable credit is for many who missed the third and closing spherical of stimulus checks through the Covid-19 pandemic underneath the American Rescue Plan Act of 2021.

The company is anticipated to mechanically ship funds by way of paper verify to those that qualify utilizing banking info listed on 2023 tax returns.

Nonetheless, these eligible who fail to file their 2021 tax returns by April 15 – Tax Day 2025 – may forfeit the checks.

The particular quantity relies on adjusted gross earnings. Single filers qualify for the total $1,400 if AGI in 2021 was $75,000 or much less however phases out at an earnings of $80,000. The identical applies to dependents, no matter age.

Married {couples} collectively submitting would obtain the total $2,800 obtainable if their mixed earnings was not more than $150,000 – and phases out at $160,000.

Taxpayers sometimes have three years to file and declare their tax refunds, and failure to file inside that time-frame may end result within the cash turning into the property of the U.S. Treasury.

The IRS has clarified that there can be no extensions or automated funds for many who miss the April 15, 2025 deadline.

Final-minute filers might face processing delays that would influence their capability to assert the stimulus verify in time, the company stated.

About $2.4 billion was paid out in January to people who didn’t declare the Restoration Rebate Credit score however had filed their 2021 tax returns, the company stated.

Roughly 1.1 million People have unclaimed refunds for tax yr 2021, amounting to over $1 billion, the IRS introduced final week. They comprise taxpayers who had not filed their Kind 1040 for that yr.

In response to the company, the median refund quantity for non-filers from 2021 is about $781 – not together with the Restoration Rebate Credit score.

Source link