Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

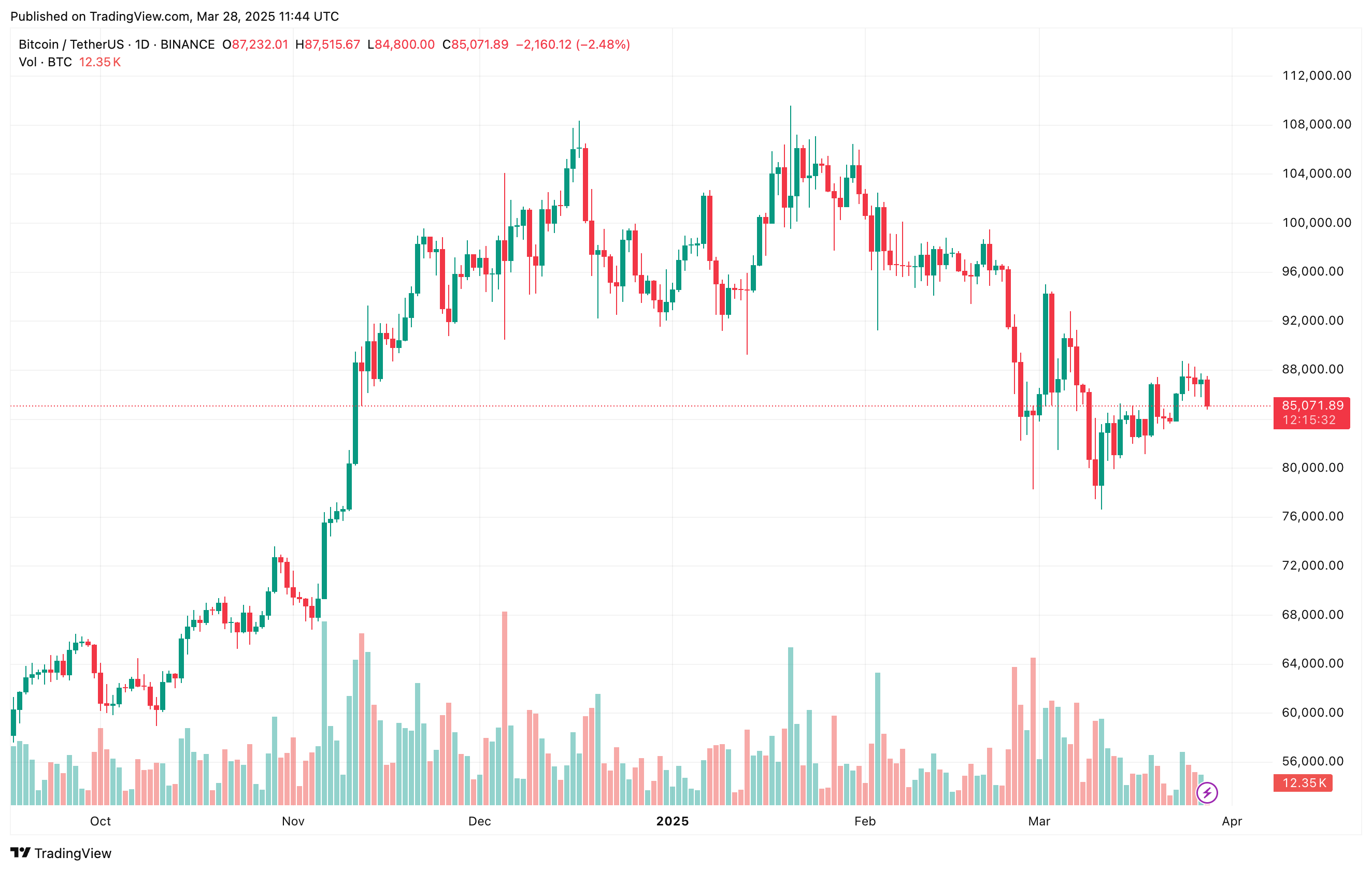

Based on a CryptoQuant Quicktake post revealed earlier at this time, Bitcoin (BTC) could also be on the verge of a major value rally. Since February 6, internet movement throughout crypto exchanges has remained unfavourable – a traditionally bullish sign for the digital asset.

Bitcoin To Profit From Damaging Alternate Web Move

The previous 24 hours have been extremely risky for the crypto market, with liquidations exceeding $360 million, the bulk involving lengthy positions. Nonetheless, regardless of this market pullback, on-chain information stays bullish, suggesting that issues could also be overstated.

Associated Studying

In a Quicktake put up shared at this time, CryptoQuant analyst ibrahimcosar highlighted Bitcoin’s change flows. He famous that since February 6, BTC has skilled a persistent unfavourable internet movement throughout buying and selling platforms.

To clarify, when a big amount of BTC is withdrawn from exchanges, it typically signifies that buyers – seemingly those that purchased at decrease costs – predict a value rally. These buyers transfer their holdings to chilly wallets, anticipating long-term beneficial properties and paying community charges to safe their property. Over time, this habits ends in a unfavourable internet movement of BTC throughout exchanges, a bullish indicator.

Conversely, when a major quantity of BTC is deposited onto exchanges, it will increase promoting stress, typically signalling a bearish pattern. Prolonged intervals of excessive crypto deposits result in constructive internet flows, usually previous value declines.

The analyst said that current information – from February 6 onwards – means that a considerable amount of BTC is being withdrawn from crypto exchanges. The analyst added:

Traditionally, such excessive outflows have led to important value will increase in Bitcoin. This implies that market volatility to the upside might be on the horizon.

Ibrahimcosar’s insights align with a current evaluation from CryptoQuant analyst ShayanBTC, who noted that BTC reserves on exchanges are quickly reducing. A sustained decline in change reserves may set the stage for a provide shock-driven value rally, reversing Bitcoin’s current downtrend.

Momentum, Macroeconomic Components Level Towards Bullish Pattern

Past on-chain metrics, technical indicators just like the Relative Energy Index (RSI) have additionally turned bullish. A current analysis by Rekt Capital highlighted that BTC’s day by day RSI has damaged its multi-month downtrend, suggesting {that a} value rally could also be imminent.

Associated Studying

Moreover, macroeconomic elements seem like fueling optimism. Experiences suggest that US President Donald Trump might rethink upcoming reciprocal tariffs set to take impact on April 2, doubtlessly easing market issues.

In the meantime, Bitcoin whales – wallets with substantial BTC holdings – have resumed accumulation after a quick interval of dormancy, additional reinforcing a bullish sentiment. At press time, BTC trades at $85,071, down 2.1% up to now 24 hours.

Featured picture created with Unsplash, charts from CryptoQuant and TradingView.com

Source link