Tremendous Micro Pc (NASDAQ: SMCI) is without doubt one of the extra controversial shares on Wall Road. After allegations of accounting missteps final 12 months, an exterior committee discovered no wrongdoing, and the corporate employed a brand new accounting agency, which has launched all the mandatory monetary statements to adjust to Nasdaq inventory change and Securities and Alternate Fee tips.

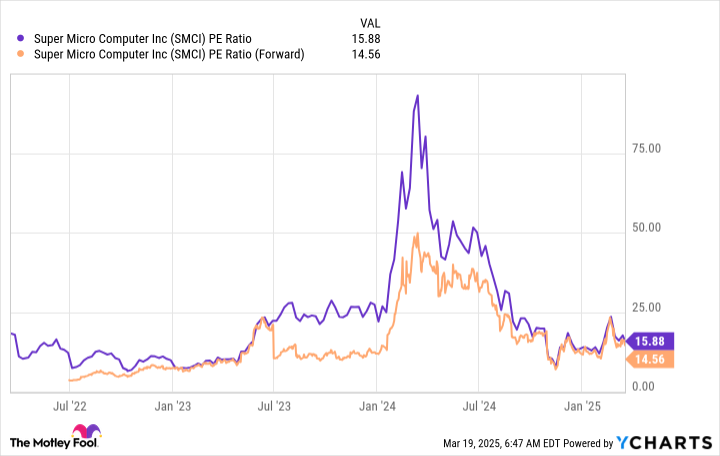

Whereas that was a wild roller-coaster journey to take buyers on, the inventory is simply 50% larger than when it entered 2024, regardless of rising greater than 300% at one time up to now 15 months. This looks as if a inventory that would have way more worth than the market realizes, particularly as a result of it nonetheless has a black eye from the accounting allegations.

Northland Securities bumped its value goal for Tremendous Micro Pc (usually referred to as Supermicro) to $70 per share, which might point out 66% upside from Friday’s shut. That may be a large achieve for the inventory, and any investor would like to have a performer like that in a portfolio.

However is {that a} sensible expectation for Supermicro?

Supermicro is one other firm benefiting considerably from the AI increase. It makes components for server racks that home and funky GPUs. This will sound boring, however it’s an vital a part of the substitute intelligence (AI) infrastructure being constructed globally.

Many of the rivals on this area do not have a differentiating issue, however Supermicro does. Its direct liquid cooling (DLC) expertise permits GPUs (which produce a number of warmth) to be cooled with liquid moderately than air. This will value additional up entrance, however administration estimates this expertise saves its shoppers 40% in vitality prices and occupies 80% much less area. The effectivity permits racks to be positioned nearer collectively as a result of there is not as a lot airflow wanted to chill them.

One of many largest development catalysts for Suipermicro is Nvidia‘s new GPU structure, Blackwell. Supermicro’s DLC has been engineered with Blackwell in thoughts, so, if Nvidia’s Blackwell GPUs promote effectively and proceed proliferating, Supermicro will straight profit from that.

With the AI infrastructure and cloud computing actions removed from completed, Supermicro nonetheless has numerous room left for development, which we’re seeing play out proper now.

Within the second quarter of fiscal 2025 (ending Dec. 31), Supermicro’s gross sales totaled $5.7 billion, up 55% from the year-ago interval. Administration supplied the same outlook for the third quarter, with income anticipated between $5 billion and $6 billion, about 43% development. This development wave is predicted to persist for a while. CEO Charles Liang initiatives $23.5 billion to $25 billion in income for fiscal 2025 and $40 billion for fiscal 2026.

Source link