Introduction

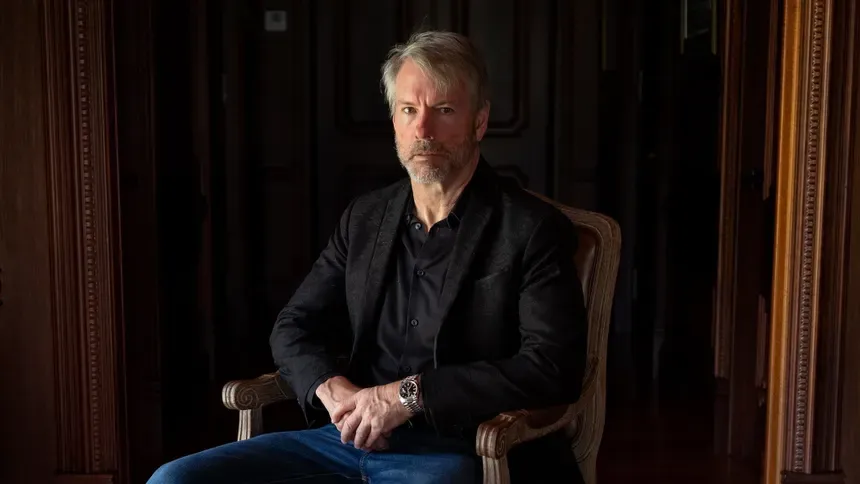

Michael Saylor, the co-founder and Govt Chairman of MicroStrategy, has been a distinguished advocate for Bitcoin (BTC). His unwavering perception in Bitcoin’s potential has formed MicroStrategy’s aggressive acquisition technique, positioning the corporate as one of many largest institutional holders of BTC. At a current White Home summit, Saylor launched a groundbreaking ‘$100 trillion’ crypto technique, additional solidifying the rising institutional deal with digital belongings.

For traders, Saylor’s strategy offers extra than simply perception into company adoption—it highlights important methods for capitalizing on Bitcoin’s long-term potential. His philosophy underscores how institutional traders and retail contributors alike can leverage Bitcoin’s rise as an indispensable monetary asset.

Michael Saylor’s Strategic Imaginative and prescient

Saylor’s technique revolves across the relentless accumulation of Bitcoin, using monetary leverage to maximise returns. His thesis is anchored within the perception that Bitcoin is digital gold—a decentralized and finite asset that serves as a superior retailer of worth in comparison with conventional fiat currencies. The important thing sides of his technique embrace:

- Lengthy-Time period Holding: Saylor advocates a “purchase and maintain” technique, viewing Bitcoin as a once-in-a-generation financial revolution. He envisions BTC changing into the dominant international retailer of worth over time.

- Institutional and Governmental Adoption: He foresees companies, hedge funds, pension funds, and even governments incorporating Bitcoin as a reserve asset, additional driving institutional demand.

- Using Debt for Strategic Acquisition: MicroStrategy has pioneered leveraging low-interest debt to purchase Bitcoin, a deliberate technique aimed toward capitalizing on inflationary traits and the decline of fiat currency buying energy.

- Harnessing the Community Impact: Bitcoin’s adoption is exponentially rising as a result of its community impact. As Bitcoin’s utility and acceptance develop, shortage intensifies, strengthening its worth proposition.

If the envisioned $100 trillion Bitcoin market materializes, it might dramatically reshape international wealth and asset valuation, probably delivering life-changing monetary returns for early adopters.

Funding Implications: Classes from Saylor

For traders searching for to emulate Saylor’s success, a number of actionable insights will be drawn from his funding technique:

- Bitcoin because the Premier Asset: Saylor views Bitcoin as an unparalleled asset class. Traders who align with this philosophy would possibly take into account overweighting Bitcoin of their portfolios, particularly over conventional belongings like shares and bonds.

- Optimum Entry Methods: In contrast to institutional patrons who purchase Bitcoin in giant tranches, particular person traders can use Greenback Value Averaging (DCA), a way that enables for gradual Bitcoin accumulation with out worrying about short-term value fluctuations.

- Cautious Use of Leverage: Whereas MicroStrategy has efficiently used debt to buy Bitcoin, retail traders should tread fastidiously. Market volatility can amplify dangers when utilizing leverage, probably resulting in liquidations throughout steep downturns.

- Safety and Self-Custody: Given the long-term funding horizon, Saylor has steadily emphasised the significance of safety in Bitcoin storage. Traders ought to prioritize self-custody options resembling {hardware} wallets to guard their holdings in opposition to trade failures or custodial dangers.

The overarching takeaway? Bitcoin presents an uneven return alternative. Even modest allocations can yield extraordinary beneficial properties, notably when seen via the lens of a multi-year funding timeframe.

Case Research: MicroStrategy’s Method and Market Validation

Over the previous few years, a number of key developments have validated Saylor’s Bitcoin funding technique:

- MicroStrategy’s BTC Holdings: Since initiating its Bitcoin accumulation technique in 2020, MicroStrategy’s inventory value has persistently outperformed many conventional equities, demonstrating the robust correlation between BTC accumulation and shareholder worth.

- Rising Institutional Curiosity: Saylor’s imaginative and prescient has already gained traction amongst main institutional gamers. Corporations like BlackRock, Constancy, and Tesla have built-in Bitcoin into their funding methods, legitimizing BTC as a treasury asset.

- Historic Market Cycles: Bitcoin has undergone a number of market cycles, every reinforcing the notion that long-term holders sometimes profit from substantial value appreciation. Holding via volatility somewhat than reacting impulsively has traditionally yielded superior returns.

These case research reinforce the concept that disciplined traders who prioritize long-term accumulation typically reap vital rewards, additional supporting Saylor’s Bitcoin thesis.

Challenges and Potential Dangers

Whereas Saylor’s technique is compelling, Bitcoin traders should stay conscious of potential challenges that would impression long-term adoption and value appreciation:

- Regulatory Uncertainty: Governments worldwide are nonetheless grappling with the best way to regulate Bitcoin. Potential restrictions or unfavorable laws might have an effect on Bitcoin’s value trajectory, though the worldwide pattern has largely moved towards elevated adoption.

- Market Volatility: Bitcoin’s value will be extremely unstable. Whereas long-term holders have a tendency to learn, short-term swings will be excessive, testing investor endurance and conviction.

- Technological Dangers: Though Bitcoin’s blockchain is very safe, potential vulnerabilities resembling quantum computing developments might current long-term technical challenges.

- Adoption Dangers: Whereas adoption is rising, Bitcoin’s broad acceptance as a world reserve asset remains to be evolving. Sure central banks could resist full-scale integration in favor of their very own digital currencies (CBDCs).

Regardless of these potential dangers, Saylor stays steadfast in his perception that Bitcoin represents the best monetary innovation of the twenty first century.

Ultimate Ideas: Is Saylor’s $100 Trillion Imaginative and prescient Reasonable?

Michael Saylor’s daring prediction of a $100 trillion Bitcoin market capitalization displays his unwavering confidence in Bitcoin’s position as the last word retailer of worth. His dedication, together with rising institutional adoption, means that Bitcoin’s long-term trajectory stays sturdy.

For prudent traders, the selection is evident: understanding and strategically positioning oneself within the Bitcoin market might provide unparalleled monetary advantages. Whereas challenges resembling regulatory developments and market cycles persist, Bitcoin continues to entrench itself as a viable various to conventional monetary belongings.

If Saylor’s imaginative and prescient involves fruition, right now’s market represents probably the most vital wealth-building alternatives in monetary historical past. The query now’s, how will you put together to benefit from it?

Source link