Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

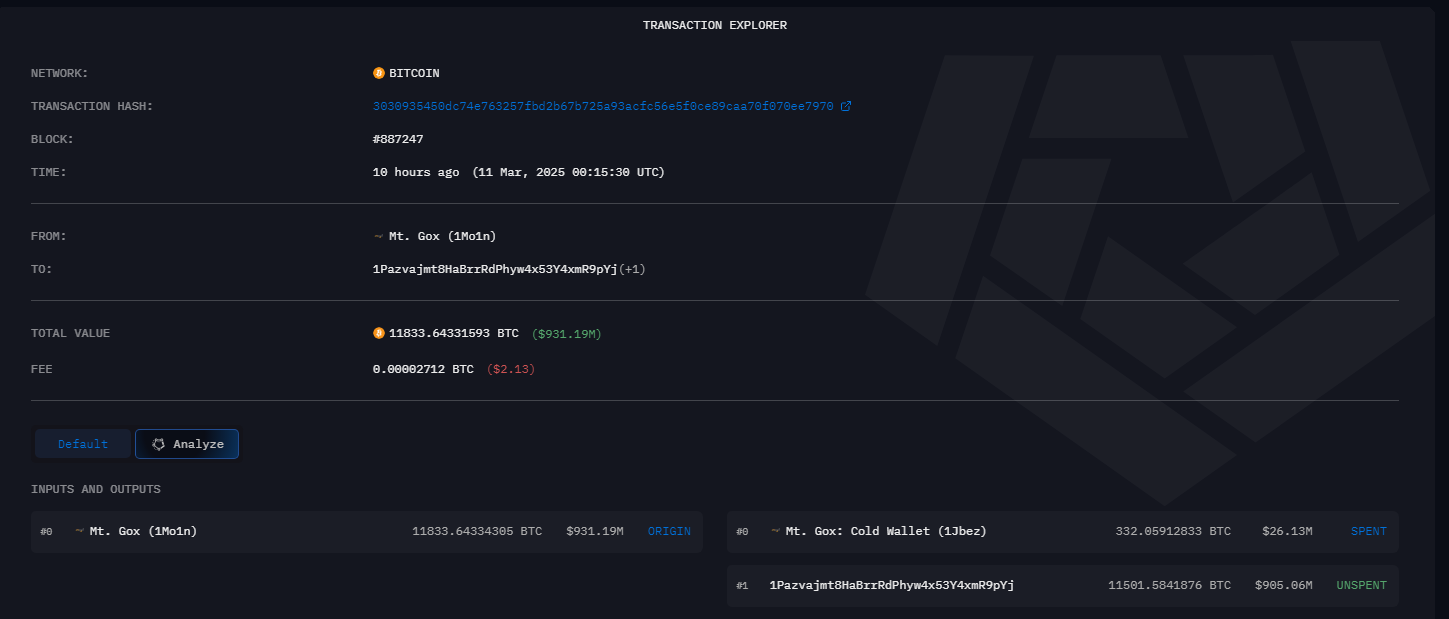

Mt. Gox, the Bitcoin alternate that’s now bancrupt, has transferred 11,833.6 BTC, totaling roughly $931 million, to new addresses, in a major improvement throughout the cryptocurrency group. The potential influence of this motion on the broader crypto market has sparked discussions.

Associated Studying

Bitcoin Motion: Particulars Of The Switch

In line with blockchain analysis by Arkham Intelligence revealed on March 11, Mt. Gox made two notable Bitcoin transactions. The primary transaction consisted of the 11, 501.58 BTC (about $905 million) being despatched to an unknown pockets. The second transaction consisted of the switch of 332 BTC (about $26.1 million) to a sizzling pockets.

Context And Background

This latest exercise is the results of a succession of serious transactions by Mt. Gox. On March 6, the alternate transmitted greater than $1 billion in Bitcoin to a pockets assigned the title “1Mo1n.”

The latest transfers have been initiated by the identical pockets, which is now acknowledged as an official Mt. Gox tackle. The present worth of Mt. Gox’s holdings is roughly $2.85 billion, with an estimated 35,915 BTC.

Market Penalties

Traditionally, buyers have expressed apprehension relating to the potential for sell-offs of considerable Bitcoin portions from Mt. Gox, which might doubtlessly decrease the worth of the flagship crypto.

Nonetheless, the market’s quick response to those latest transfers has been lackluster, indicating that the market might have already factored in these occasions or that the precise sale of those belongings has not but taken place.

A Look Again At Mt. Gox’s Historical past

At one level, Mt. Gox dealt with as much as 80% of all Bitcoin transactions worldwide, making it the most important Bitcoin alternate on the earth. The platform skilled a major safety breach between 2011 and 2014, which led to the lack of about 850,000 Bitcoin, which was price about $500 million on the time.

The alternate filed for chapter on account of this incident, leaving 1000’s of collectors in a precarious monetary – and even psychological – scenario.

There have been makes an attempt to pay again collectors in recent times. This restitution course of consists of the recovered funds, together with the Bitcoins which might be transferring proper now. The cryptocurrency group retains a cautious eye on the timing and format of those reimbursements since they’ve the power to have an effect on market dynamics.

Associated Studying

The Greater Image

The bitcoin business has had a number of well-publicized safety lapses over time. As an illustration, the February 2025 hack on the Bybit exchange resulted within the theft of $1.5 billion price of Ether tokens, making it one of many largest cryptocurrency thefts to this point.

The latest $931 million Bitcoin switch from Mt. Gox has spurred recent discussions concerning the safety and feasibility of cryptocurrency exchanges. Regardless of the situation’s obvious lack of quick market influence, it serves as a warning of the risks and complexity inherent within the digital asset house.

Featured picture from Gemini Imagen, chart from TradingView

Source link