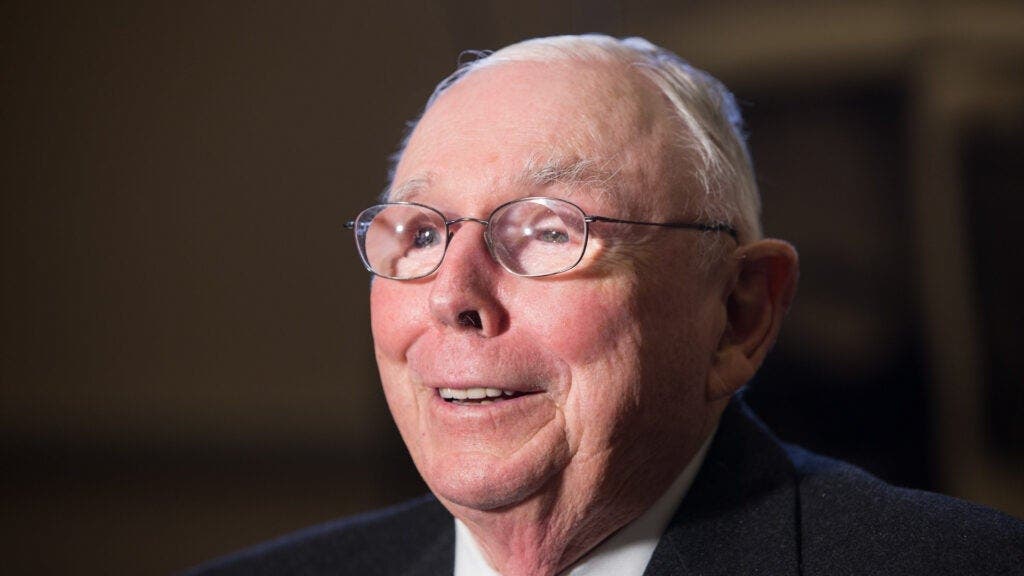

The late billionaire Charlie Munger, who handed away on the age of 99, shared in an interview that there’s no hidden components to attaining financial success and longevity.

What Occurred: Munger’s lifestyle and work was easy and direct. He centered on evading standard pitfalls and was prudent in his decision-making.

Munger, a resident of the identical humble abode for seven many years, held the assumption that lavish dwelling typically paves the way in which to discontent.

“I prevented the usual methods of failing, as a result of my recreation in life was all the time to keep away from all commonplace methods of failing. You educate me the mistaken technique to play poker and I’ll keep away from it. You educate me the mistaken technique to do one thing else, I’ll keep away from it. And, after all, I’ve prevented rather a lot, as a result of I am so cautious,” Munger mentioned within the interview with CNBC.

Do not Miss:

This pragmatic method was additionally mirrored in his spending habits. When his enterprise affiliate at Berkshire Hathaway, Warren Buffett, opted to switch an organization jet, Munger deemed the $6.7 million expense as extravagant.

In Munger’s view, steering away from obvious dangers, frivolity, and “insane” situations had been instrumental to his monetary success and longevity. “Avoid madness in any respect prices. Madness is way extra prevalent than you’d think about,” he mentioned.

Munger’s monetary success and longevity had been pushed by his capacity to keep away from pointless dangers, frivolous choices, and irrational conditions.

“Keep away from loopy in any respect prices. Loopy is far more widespread than you suppose. It is simple to slide into loopy. Simply keep away from it, keep away from it, keep away from it,” Munger mentioned.

Trending: The common American couple has saved this a lot cash for retirement — How do you compare?

Why It Issues: Munger’s philosophy of monetary success and longevity gives priceless insights into his life and work ethic.

His avoidance of standard failure modes, his cautious decision-making, and his disdain for extravagance and dangerous ventures like cryptocurrency, all paint an image of a person who valued practicality and prudence over fast positive factors and lavish life.

His views on monetary success and longevity, whereas not groundbreaking, supply a refreshing perspective in a world typically obsessive about fast riches and ostentatious shows of wealth.

Source link