Some Ontario voters who think about themselves politically non-aligned — setting apart their want in addition Doug Ford and his PC authorities out of workplace — usually bemoan the unwillingness of the Liberals and NDP to co-operate at election time.

These voters underestimate how a lot animosity there’s between the Liberal and NDP campaigns.

“Liberals and New Democrats have a much more bitter rivalry than Liberals and Conservatives as a result of we’re competing for a similar voter pool,” says Dan Moulton, a associate at Crestview Technique and a part-time adviser to Liberal Chief Bonnie Crombie’s marketing campaign.

“There are particular values that progressive voters have that they do not all the time see mirrored within the governing fashion of the Liberal Social gathering,” says Kim Wright, founding father of Wright Methods and a part-time adviser to NDP Chief Marit Stiles’s marketing campaign.

United solely by their want to defeat the Progressive Conservatives, the variations between Stiles’ New Democrats and Crombie’s Liberals are on full show as Thursday’s election attracts nearer, significantly as every social gathering tries to pitch itself as the one actual different to Ford.

The 2 rivals released their platforms on the identical morning on the finish of final week and whereas some guarantees are related, the contrasts are notable.

WATCH | Election Day in Ontario is Thursday. Here is what to anticipate within the marketing campaign’s closing days

There’s one week to go till election day and the candidates are out making an attempt to win votes throughout the province. CBC’s Shawn Jeffords breaks down what the events and Ontarians can anticipate within the final week of campaigning.

One of many starkest variations between the 2 events’s platforms is discovered of their plans to put money back in taxpayers’ pockets.

The Liberal proposal is aimed solely at middle-income earners: an income-tax cut that may chop two proportion factors off the provincial tax charge on annual earnings between $51,446 and $75,000.

The NDP proposal is aimed toward low-to-moderate earnings earners: a tax rebate, pitched as a ‘grocery rebate,” by which people incomes lower than $50,000 and households incomes lower than $65,000 get the complete quantity, whereas the rebate is decreased for individuals who earn extra.

The reply to the query of which social gathering provides you an even bigger tax break is determined by your earnings, the scale of your family and whether or not you’ve kids.

The reply to the query of which social gathering is promising extra tax aid in whole appears clearer:

-

The Liberal income-tax reduce (together with scrapping HST on house heating and hydro) would ship $2.8 billion yearly again to taxpayers as soon as absolutely applied, in line with a background document.

-

The NDP tax rebate would ship about $4 billion again to taxpayers as soon as absolutely applied, in line with a background document.

WATCH | Which social gathering provides the most important tax break? The reply would possibly shock you

From tax cuts to money-back rebates, CBC’s Mike Crawley compares the guarantees made by Ontario’s main social gathering leaders to make the province extra reasonably priced for people and households.

The NDP and Liberal platforms do share a variety of guarantees in frequent: doubling charges for the Ontario Incapacity Help Program, billions of {dollars} to be invested to get everybody in Ontario a household physician inside 4 years and a promise of common psychological well being care beneath OHIP.

The 2 platforms are even fairly related within the frequency of references to Doug Ford: the NDP makes use of his identify 17 instances in its 22-page platform; the Liberals point out him 20 instances in 19 pages.

Neither social gathering offers a ton of element of their platform costing paperwork — far lower than Mike Schreiner’s Inexperienced Social gathering provides in its platform, released on Feb. 12. The PCs have but to launch a costed platform, however social gathering officers mentioned one will likely be launched on Monday.

The NDP platform costing lists eight traces of latest annual prices, every labelled beneath such classes as “Houses Ontario” (the social gathering’s reasonably priced housing development plan pegged at $2.5 billion per 12 months) and “Defending Ontario Jobs” (assist for companies affected by tariffs, $530 million within the coming fiscal 12 months).

The Liberals’ costing doc is a chart on page 17 of their platform, itemizing simply 4 traces of latest annual prices, every labelled with a broad class akin to “a greater future for you” ($1.88 billion per 12 months) and “a group that works for you” ($475 million per 12 months), with a mean listed for annually and no breakdown of the place the figures come from.

The NDP’s guarantees of tax rebates and elevated spending develop annually, beginning at $16.7 billion in 12 months one of many plan, rising to $27 billion in 12 months three.

The Liberals do not supply a year-by-year breakdown of their guarantees of tax cuts and elevated spending, as an alternative displaying them as a mean of $16.3 billion per 12 months.

How would events pay for guarantees?

The Liberals say they’d discover $7.1 billion in “financial savings, worth, effectivity and reallocation of current spending,” however present no particulars of how they’d try this.

They declare the remaining $9.2 billion in further prices could be lined by means of sooner than forecasted financial progress.

“A 50 foundation level enchancment in financial progress would end in a surplus of greater than $11 billion per 12 months as of 2026-27,” says the Liberal platform. “This may greater than offset the brand new investments and tax cuts outlined in our plan.”

This declare is going through criticism as a provincial model of “the finances will steadiness itself,” an notorious 2014 remark by Justin Trudeau in his first marketing campaign as federal Liberal chief.

The NDP is pledging to pay for a few of its new spending and tax rebates with new taxes on the rich. The platform guarantees larger earnings tax charges on earnings of $300,000 and up (producing $3 billion per 12 months), rising the quantity of capital positive aspects topic to tax (producing $3.6 billion per 12 months and a one-time tax on grocery retailer income (producing $1 billion in 2026).

Like. the Liberals, the NDP platform math additionally depends on reallocating some authorities spending. It totals $12.7 billion over the course of three years, notably lower than the Liberals’ $7.1 billion per 12 months.

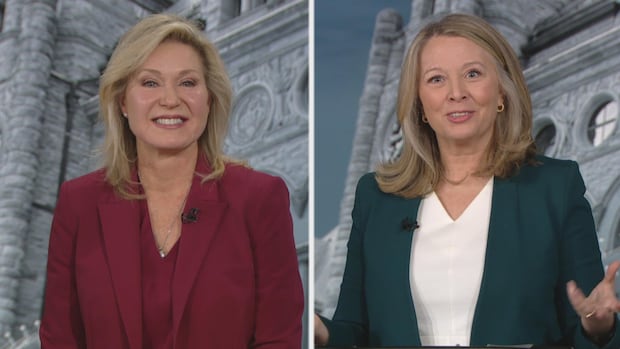

Crombie, Stiles examine their platforms

CBC Information requested every chief what makes their marketing campaign platform completely different from their rival’s.

“Effectively, mine is costed. It is sensible. We have had the specialists design it,” mentioned Crombie in an interview on Sunday.

Crombie emphasised her plan to make sure that everybody in Ontario has a household physician inside 4 years — a promise that the NDP makes too.

“Our platform provides instant options to the problems that individuals are grappling with proper now in Ontario,” Stiles mentioned in an interview on Sunday.

Stiles emphasised the NDP’s hire management promise, which might cap hire will increase in two conditions which can be at present exempt from provincial limits: when a brand new tenant strikes into an current rental, and when a unit was constructed after 2018.

The Liberals are promising what they describe as “truthful, phased-in hire management just like Manitoba” however Crombie has not supplied any specifics through the marketing campaign, and the platform comprises no additional particulars.

Source link