When you had $100,000 sitting in your account, what would you do with it? Purchase a home? Dump it into shares? Repay your pupil loans and go on a Goal spree with what’s left?

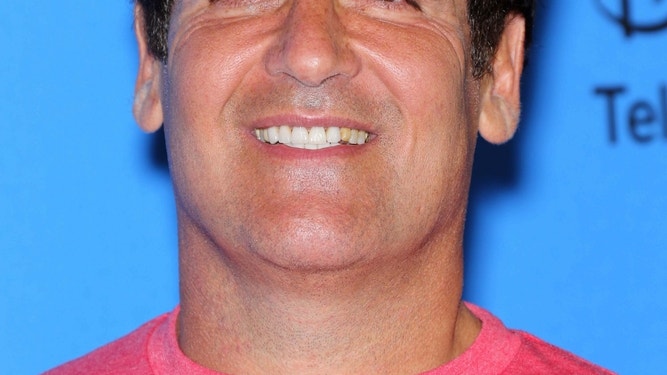

In a 2010 Forbes interview, billionaire Mark Cuban—longtime “Shark Tank” star and the man now attempting to shake up Big Pharma—provided his take. And spoiler: it isn’t what the TikTok finance gurus are preaching.

As a substitute of pouring it into the market or investing in a startup, Cuban mentioned this:

“First I pay off all my credit card debt and consider paying off another debt I’ve. What I’ve left I put within the financial institution.”

Do not Miss:

That is proper. The person who made billions promoting Broadcast.com to Yahoo within the Nineteen Nineties says the first step is killing your debt. Step two? Parking your leftover money within the financial institution—not as a result of it will develop, however as a result of it will wait.

His technique is equal elements frugal and sharp. He provides, “Then I attempt to create as a lot transactional worth as attainable from that money.”

He appears to be like at his total price range and finds financial savings in boring however obligatory stuff—like “toothpaste to soup.” Shopping for in bulk, he argues, provides you the perfect assured ROI wherever, typically saving you 30% to 50% on on a regular basis objects. That is your most secure return, Cuban says. Higher than attempting to time the market.

Trending: BlackRock is looking 2025 the yr of other belongings. One firm from NYC has quietly built a group of 60,000+ investors who have all joined in on an alt asset class previously exclusive to billionaires like Bezos and Gates.

Cuban says, “Each 5 years or so there’s a bubble bursting or superb offers obtainable due to a change within the financial system.” That may sound dramatic, however the sample is not fully off. Have a look at the timeline:

-

2025: Industrial actual property’s underneath strain, VC funding has slowed, and inflation remains to be hanging round.

-

2020: COVID-19 hits. Shares tank. Unemployment soars. Stimulus cash floods the system.

-

2015: Oil costs plunge, China’s inventory market crashes, and U.S. markets stumble in a serious late-summer selloff.

-

2010: The housing market’s nonetheless reeling from the 2008 crash. Banks are shaky. Foreclosures peak.

-

2005: U.S. housing bubble in full swing—simply two years earlier than the subprime mortgage disaster begins to unwind.

-

2000: The dot-com bubble bursts. NASDAQ loses almost 80% of its worth in two years.

-

1995: Tech shares begin to soar, fueled by early web hype. Simply 5 years later—increase.

Source link