It’s a sophisticated time for Nvidia (NVDA) as the corporate strikes on from the current GTC (GPU Know-how Convention) week. Shares surged yesterday as a rally swept over the market, however the momentum appears to have subsided since then.

The previous six months have been extremely unstable, whilst the substitute intelligence (AI) market has remained sturdy. When Chinese language startup DeepSeek launched an AI mannequin that ran on much less superior chips, it triggered a selloff, and Nvidia remains to be struggling to get better.

As NVDA inventory has trended downward, hypothesis has risen as as to if or not Nvidia’s time because the market’s undisputed AI chief is over. Its unstable efficiency is in stark distinction to the seemingly unshakable progress buyers keep in mind from 2023 and far of 2004.

One quantum computing chief lately weighed in on that subject, providing an anticipated perspective on the way forward for each Nvidia and the broader tech market.

Final week, Nvidia unveiled a number of new AI chip improvements, together with the Blackwell Extremely and the latest model of the Rubin GPU (graphics processing unit) household. Whereas they caught the eye of many tech fanatics, one CEO believes that one other space of expertise affords Nvidia its greatest likelihood at progress: quantum computing.

As TheStreet stories, “quantum computing is a extremely superior type of computing during which duties are carried out at a a lot quicker price. A normal laptop sometimes works one step at a time, whereas a quantum system can carry out a number of duties directly.”

Related: 5 quantum computing stocks investors are targeting in 2025

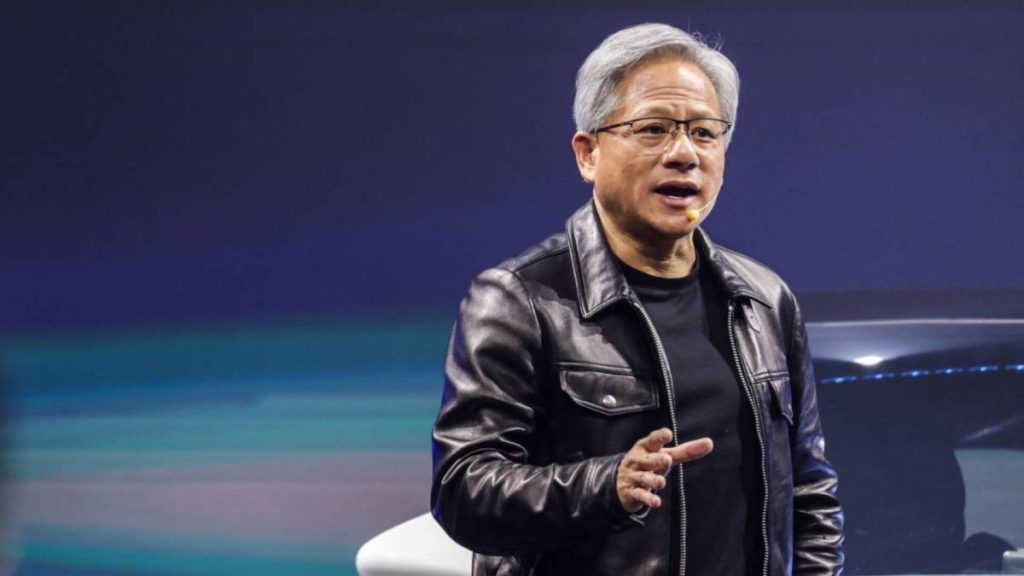

One quantum knowledgeable lately weighed in on Huang and Nvidia. Peter Chapman is the chairman and former CEO of IonQ (IONQ) , an organization at present making waves within the quantum area. He lately joined Huang on stage at Nvidia Quantum Day 2025 to debate the way forward for the trade after which gave an interview during which he revealed one thing shocking.

Making it clear that he doesn’t imagine it is smart to wager in opposition to Nvidia, Chapman acknowledged, “I would not be shorting Jensen’s inventory due to quantum.” This comes only a few months after Huang predicted that quantum computing doubtless wouldn’t have helpful functions for 15-20 years, sending the sector right into a free fall.

At Quantum Day 2025, Huang walked again these statements, admitting that he had been fallacious and expressing shock on the energy that his phrases had on quantum computing shares. After the occasion, Chapman described it as an try for Huang to backtrack his feedback, including that he hoped the trade would regard it as such.

Source link