The EU Markets at this time noticed President Donald Trump fulfill his “Liberation Day” tariff hammer that despatched ripples by means of international markets. The transfer punches by means of alliances, focusing on not simply rivals however shut companions just like the EU, Japan, and South Korea.

I used to be anticipating markets to slip nearer to 7% circuit-breaker territory, however I feel markets are pricing in that Trump will backtrack on the tariffs. We predict that is improper.

Trump is a tariff man. He’s basically skeptical of world commerce. He thinks a commerce deficit means you’re being ripped off. That is one thing he has been saying because the Nineteen Eighties. It’s most likely his most constant coverage perception, perhaps the one one. So I don’t see any indication he rolls again.

Right here’s how the EU Markets at this time plan to retaliate and goal the U.S. crypto sector after the tariff information.

EU Markets At this time: Will Trump Change His Thoughts?

Those that will earn a living are those that will adapt and as shortly as attainable.

Already leaders like French President Emmanuel Macron and Italian Prime Minister Giorgia Meloni critiqued Trump’s tariff coverage for its potential to destabilize the West and strengthen rival powers like China.

Macron recommended pausing French investments within the U.S. solely till the tariffs obtain clarification: “Brutal and unfounded, this determination calls for a unified European stance to guard our pursuits.”

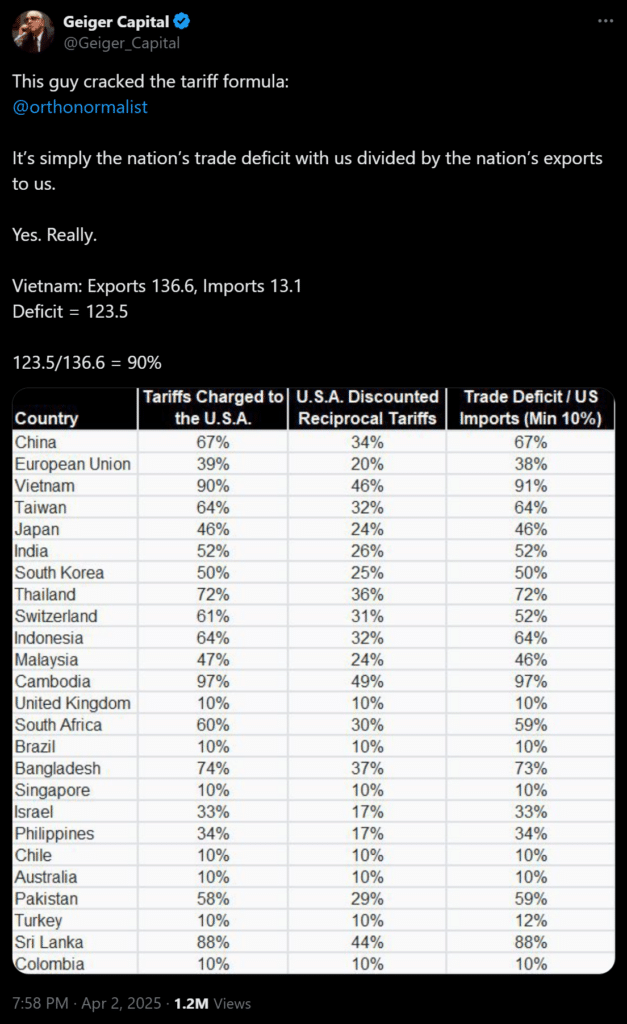

US tariffs record

– Ukraine is on the record

– Russia is NOT on the record

– Europe is on the record pic.twitter.com/hPA2JUwNny— Lord Bebo (@MyLordBebo) April 3, 2025

If U.S. investments are focused due to the tariff, it may embrace U.S. crypto like XRP, SUI and Solana.

Sarcastically sufficient, these are the tasks down hardest over the past week, with SUI and SOL each down double-digit percentages.

Trump has additionally stated tariffs aren’t up for negotiation. That is very bearish. The one cause the market isn’t dumping extra is that it’s pricing within the expectation that nations will cave, de-escalate, and take away their tariffs.

The Finest Trump Tariff Rationalization You’ll Learn At this time

The Trump admin’ s tariff technique is deficit divided by exports. In different phrases, even in the event you’re a poorer nation like Cambodia or Sri Lanka, in the event you export so much to the US, you’re screwed.

Cambodia: 97%

- US exports to Cambodia: $321.6 M

- Cambodia exports to US: 12.7 B

- Ratio: 321.6M / 12.7 B = ~3%

Vietnam: 90%

- US exports to Vietnam: $13.1 B

- Vietnam exports to US: $136.6 B

- Ratio: 13.1B / 136.6B = ~10%

Sri Lanka: 88%

- US exports to Sri Lanka: $368.2 M

- Sri Lanka exports to US: $3.0 B

- Ratio: ~12%

Ostensibly, whereas this obliterates Cambodia, it brings again U.S. manufacturing in order that $6 t-shirt aren’t made in some overseas sweatshop. They’re made in a home sweatshop. Kidding.

Nevertheless, tariffs solely work if managed rigorously. Focused tariffs with a staggered rollout and incentives to get corporations to construct industrial crops within the USA may truly accomplish what they are saying they need. However this sudden pedal-to-the-floor method, rocketing the typical import tariff to about 30% with no helps in place or incentives laid, may be myopic.

Wanting extra industrial manufacturing is a fully legitimate objective. To keep away from alienating our commerce companions, restrict it to some focused merchandise and nations. A flat large proportion on every little thing in each nation is simply going to unite everybody towards us. Why would anybody belief us once more?

Deutsche Financial institution already stated the U,S, will suffer more than Europe.

EU Markets At this time: Ultimate Ideas

“It’s worse now to be a U.S. ally than to be an adversary. At the least you realize what you’re getting as an adversary.” – Thitinan Pongsudhirak of Thailand’s Chulalongkorn College

International locations like Cambodia, Vietnam, and Thailand, hailed as alternate options to China’s manufacturing dominance, now face crushing levies of as much as 49%.

In the meantime, the EU, affected by tariffs on 70% of its exports to the US, plans to retaliate if resolutions can’t be discovered by means of talks. They could additionally freeze out U.S. investments in shares and cryptocurrencies solely.

And what was as soon as an try to weaken China’s grip would possibly find yourself tightening it, however we’ll see.

DISCOVER: Best Meme Coin ICOs to Invest in April 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

-

EU Markets at this time noticed President Donald Trump fulfill his “Liberation Day” tariff hammer that despatched ripples by means of international crypto markets. -

International locations like Cambodia, Vietnam, and Thailand, hailed as alternate options to China’s manufacturing dominance, now face crushing levies of as much as 49%. ” -

In the meantime, the EU, affected by tariffs on 70% of its exports to the US, plans to retaliate if resolutions can’t be discovered by means of talks. They could additionally freeze out U.S. investments in shares and cryptocurrencies solely.

Source link