After a extremely unstable 2024, the electrical car (EV) market has not stabilized up to now in 2025. The present U.S. presidential administration’s lack of give attention to clear power has led to a questionable outlook for the business.

As soon as the sector’s most promising startup, Rivian (RIVN) is caught within the throes of an advanced economic system and faces constant challenges because it struggles to compete with Tesla (TSLA) . Its electrical vans and SUVs stay widespread among the many firm’s fanbase, however that hasn’t been sufficient to drive wholesome share development.

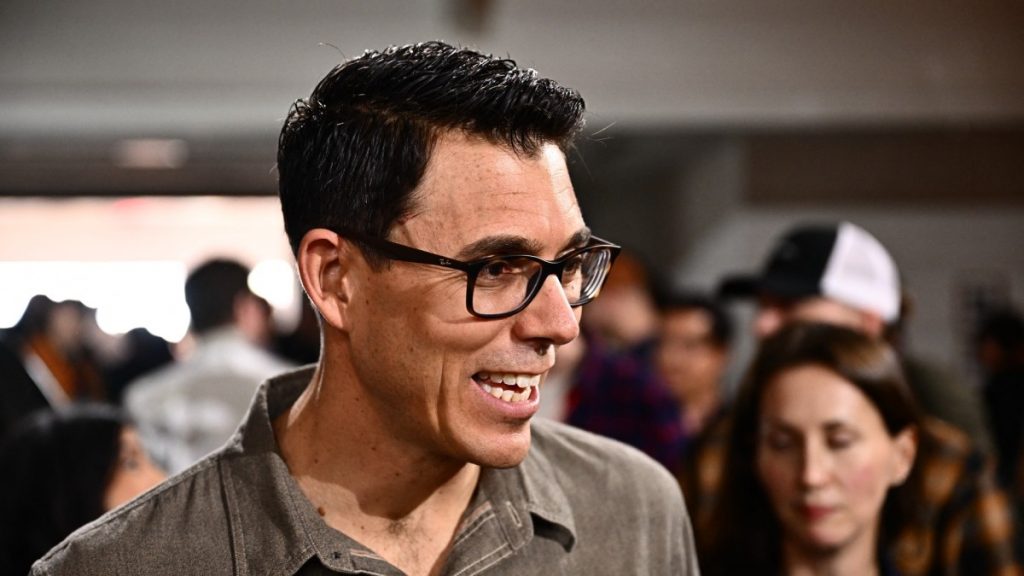

As TheStreet’s James Ochoa reviews, Rivian CEO RJ Scaringe lately tried to repeat Musk’s ways as a way of stoking enthusiasm for its new EV fashions amongst followers, however it might be too little too late. Nonetheless, the corporate has made it clear that it isn’t solely centered on automobiles.

Rivian is exploring a brand new space of transportation, one which most individuals doubtless didn’t see coming.

In an business dominated by Tesla, constant adoption is a key to success for any startup. Remaining aggressive with an organization whose assets and attain surpass everybody else is daunting.

Rivian seems to be rising to the event, although, or no less than making a notable effort. The EV startup has introduced that it’s going to spin off a startup known as Additionally, which operates within the micro-mobility area and can produce a wide range of small, light-weight electrical automobiles.

Related: Analysts agree to disagree on Rivian’s “empty” 2025

Essentially the most surprising facet of this information is probably going that Rivian is concentrated on a market like micromobility, an business really synonymous with failure. Just a few years in the past, American cities had been stuffed with electrical scooters from corporations like Chook and Lime that might be accessed with just some cell phone clicks.

Nonetheless, this fad would show extraordinarily short-lived, as this new technique of transportation proved unsustainable as a enterprise mannequin. Years later, many of the business has crumbled, together with Chook, as soon as the nation’s largest e-scooter supplier with a valuation of $2.5 billion, which filed for chapter in December 2023.

The business’s decline is effectively represented by the truth that the corporate known as micromobility.com, previously Helbiz, delisted from the Nasdaq in 2023 after failing to commerce above the $1 per share threshold.

Nonetheless, Rivian seems assured in Additionally’s prospects, even in a market with a extremely questionable historical past. Eclipse Ventures appears to share this view: it simply invested $105 million within the startup.

Source link