Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana is exhibiting indicators of energy because it pushes above a key resistance degree, suggesting that bulls are starting to regain some management after weeks of weak point. The broader crypto market stays unstable, pushed by ongoing macroeconomic uncertainty and heightened commerce tensions between the US and China. Regardless of these dangers, investor sentiment seems to be bettering barely, fueling hopes that Solana and different altcoins may enter a restoration rally.

Associated Studying

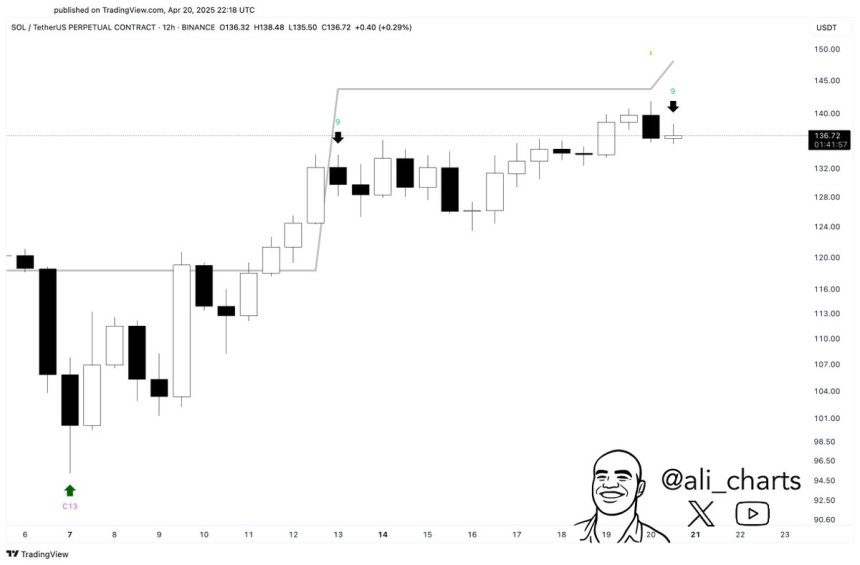

Nonetheless, warning stays warranted. High analyst Ali Martinez shared a technical sign that tempers the current optimism—based on his evaluation, Solana could also be due for a short-term pullback. A promote sign has flashed on the 12-hour chart utilizing the TD Sequential indicator, which has traditionally marked native tops and worth exhaustion phases.

Whereas Solana’s current breakout is encouraging, the presence of this bearish sign suggests the rally could also be dropping steam within the close to time period. Buyers shall be watching carefully to see whether or not SOL can hold support above the reclaimed ranges or if it retreats below promoting strain. For now, the market is caught between early indicators of restoration and the ever-present danger of one other leg down.

Solana Faces Key Resistance As Quick-Time period Pullback Sign Emerges

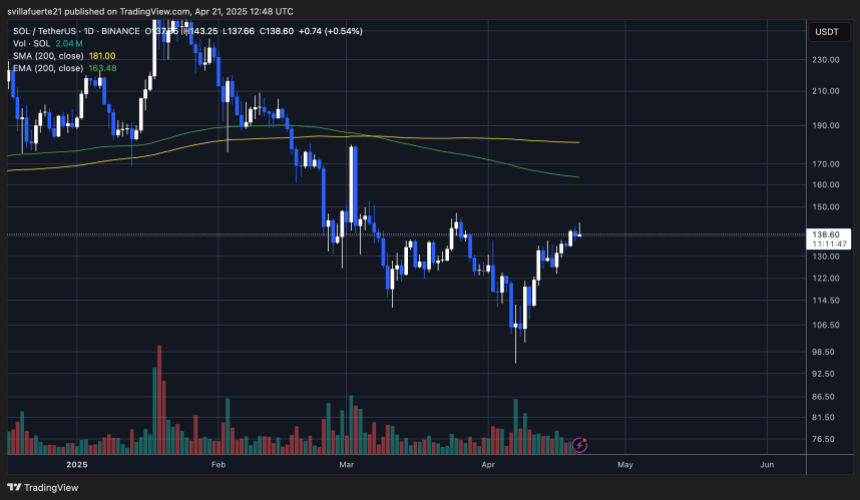

Solana has surged over 48% since April 7, signaling renewed momentum after a chronic interval of intense promoting strain. Bulls are actually going through a vital take a look at as worth approaches the $150 degree—a key resistance zone that has held again additional advances up to now.

Regardless of the current restoration, Solana stays one of the affected property through the 2025 downtrend, having misplaced greater than 65% of its worth since its January peak. This underscores the importance of the present transfer and the significance of holding greater ranges to substantiate a real reversal.

Nonetheless, warning is warranted. Martinez shared data on X highlighting a TD Sequential promote sign on the 12-hour chart—a technical indicator that always precedes short-term development exhaustion or reversals. The TD Sequential works by figuring out a sequence of worth actions that may point out overbought or oversold circumstances. If the sign performs out, Solana may face a brief pullback earlier than any sustained upside continues.

Macroeconomic components stay in play, with ongoing commerce tensions between the US and China nonetheless shaping sentiment throughout international markets. Nonetheless, hopes for a possible settlement between the 2 international locations and increasing international liquidity are giving bulls some optimism, particularly throughout the altcoin sector.

Associated Studying

SOL Worth Hovers At Pivotal Zone: What’s Subsequent?

Solana (SOL) is at present buying and selling at vital ranges, testing the important thing $150 resistance zone after a pointy restoration from current lows. Bulls should reclaim and maintain above this degree to substantiate a breakout and validate the beginning of a sustained uptrend. A decisive transfer above $150 would possible set off additional shopping for momentum, presumably resulting in a retest of upper targets not seen since early March.

Nonetheless, if SOL fails to interrupt above this barrier within the quick time period, a interval of consolidation between the $130 and $120 ranges may nonetheless sign energy. Holding this zone would recommend that bulls are constructing a base for continued upward worth motion and absorbing promoting strain with no vital retrace. Such consolidation phases are sometimes thought-about wholesome in bullish market constructions, permitting momentum to rebuild earlier than the following leg greater.

Associated Studying

On the draw back, failure to carry the $120 assist degree may expose SOL to deeper losses, with the $100 zone as the following vital space of demand. A break under this degree would invalidate the present bullish outlook and presumably reignite a broader downtrend. For now, all eyes are on SOL’s response across the $150 mark.

Featured picture from Dall-E, chart from TradingView

Source link