Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana’s worth has fallen to $116, marking a 12% lower over the previous week amid rising issues about giant buyers promoting their holdings. In keeping with studies, a number of main cryptocurrency holders, referred to as “whales,” unstaked and moved roughly $46 million price of SOL tokens to exchanges, fueling the downward development.

Associated Studying

4 Main Wallets Lead Promoting Wave

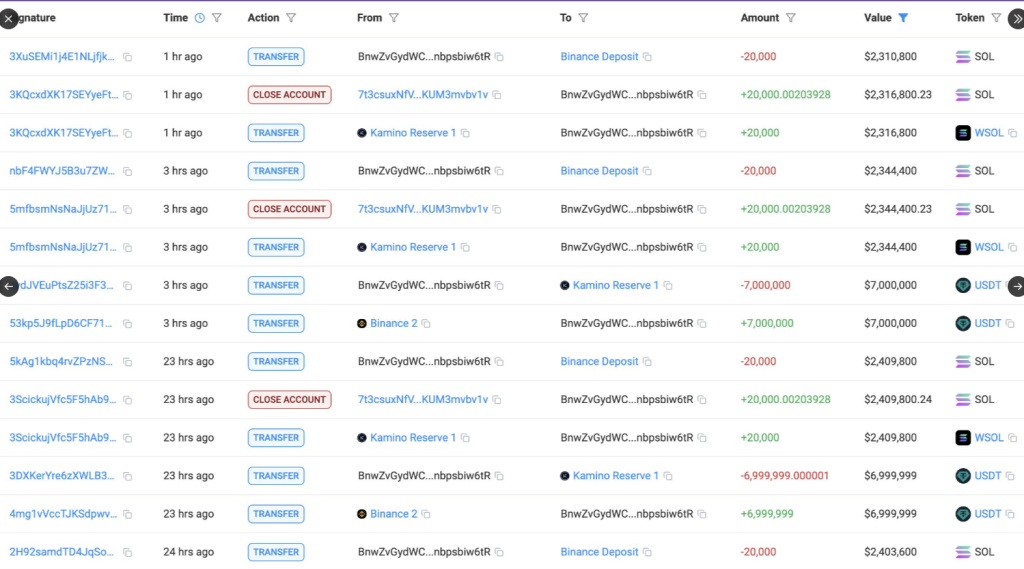

In keeping with cryptocurrency monitor Lookonchain, 4 pockets addresses accounted for the huge trade of funds. The most important vendor, ‘HUJBzd,’ transferred $30 million price of SOL to exchanges. Three different wallets additionally did the identical, with ‘BnwZvG’ promoting $9.47 million, ‘8rWuQ5’ transferring $3.53 million, and ‘2UhUo1’ transferring $3 million price of tokens.

These mass transfers often presage bearish sentiment out there since they add promoting stress to exchanges. The current worth motion bears this development out, with SOL falling by greater than 3% throughout the previous 24 hours alone.

Many whales unstaked and dumped $SOL immediately!

HUJBzd dumped 258,646 $SOL($30.3M).

BnwZvG dumped 80,000 $SOL($9.47M).

8rWuQ5 dumped 30,000 $SOL($3.53M).

2UhUo1 dumped 25,501 $SOL($3M).

Deal with:https://t.co/mCaB45W6pVhttps://t.co/wjhEwyZgFHhttps://t.co/Waqe4cxvbP… pic.twitter.com/kc1Q5GEKIX

— Lookonchain (@lookonchain) April 4, 2025

Market Uncertainty Tied To Tariff Bulletins

The broader cryptocurrency market has been buffeted by financial coverage shifts. Reviews point out that Bitcoin price fluctuations have been influenced by the announcement by US President Donald Trump of reciprocal tariffs. This uncertainty within the economic system has unfold to the altcoin market, with Solana being one of many cryptocurrencies beneath stress.

Primarily based on current knowledge, the value of Bitcoin would possibly nonetheless transfer in keeping with inventory market tendencies in response to those contemporary tariffs. Analysts have cautioned that your entire cryptocurrency market would possibly witness short-term volatility as Bitcoin emulates inventory market tendencies.

Some Analysts Stay Optimistic Regardless of Declines

Although the current figures point out a declining development, not everybody out there is pessimistic. Cryptocurrency professional Brandon Hong just lately expressed an opposing view on social media platform X and wrote: “SOL is about to have its greatest breakout ever.”

Hong’s forecast is concentrated on Solana presumably breaking out of its 400-day buying and selling vary. The analyst inspired buyers to “Purchase now or remorse later,” offering a uncommon optimistic view amidst the general market uncertainty.

Associated Studying

Merchants Maintain An Eye On SOL

This divergence in market opinion displays the unstable nature of cryptocurrency investments in occasions of financial transition. Merchants stay carefully monitoring Solana because it navigates these powerful market circumstances.

The 30-day efficiency for Solana buyers is even worse, with figures indicating an 15% drop previously month. This longer decline suits with wider market tendencies among the many cryptocurrencies which have additionally been depreciating over the current period of financial instability.

Whereas markets adapt to potential coverage shifts and massive holders maintain shifting their belongings, SOL worth actions are nonetheless a serious reflection of investor sentiment throughout the cryptocurrency market. Whether or not the token follows the bearish path implied by whale motion or breaks out as some analysts anticipate is to be seen throughout the subsequent few weeks.

Featured picture from Gemini Imagen, chart from TradingView

Source link