That is The Takeaway from at the moment’s Morning Transient, which you’ll sign up to obtain in your inbox each morning together with:

The mud has settled on the newest Nvidia (NVDA) earnings week frenzy.

And I believe it is essential to take inventory of the place issues stand for the world’s most essential inventory (sorry, Apple (AAPL)). Why? As a result of you have to be desirous about whether or not the pullback in Nvidia is a shopping for alternative or the beginning of a deeper sell-off as expectations are reset.

We all know Nvidia’s margins within the first half of the 12 months will likely be under their standard sturdy ranges as Blackwell AI chips ramp up. I might argue the Avenue knew this forward of the outcomes, so that they received flustered over nothing.

On Nvidia’s earnings name, execs sought to push again on the bears, who’ve put forth a story that there will likely be a digestion interval for AI investments by hyperscalers comparable to Amazon (AMZN) and that Nvidia’s margins could have peaked.

“As soon as our Blackwell totally rounds, we are able to enhance our value and our gross margin,” Nvidia CFO Colette Kress mentioned. “So, we count on to most likely be within the mid-70s later this 12 months.”

We additionally know that, essentially, Nvidia’s enterprise is robust and prone to keep robust.

Fourth quarter income rose 12% sequentially and 78% from the prior 12 months. Information heart gross sales greater than doubled from the prior 12 months. Earnings handily beat analyst estimates.

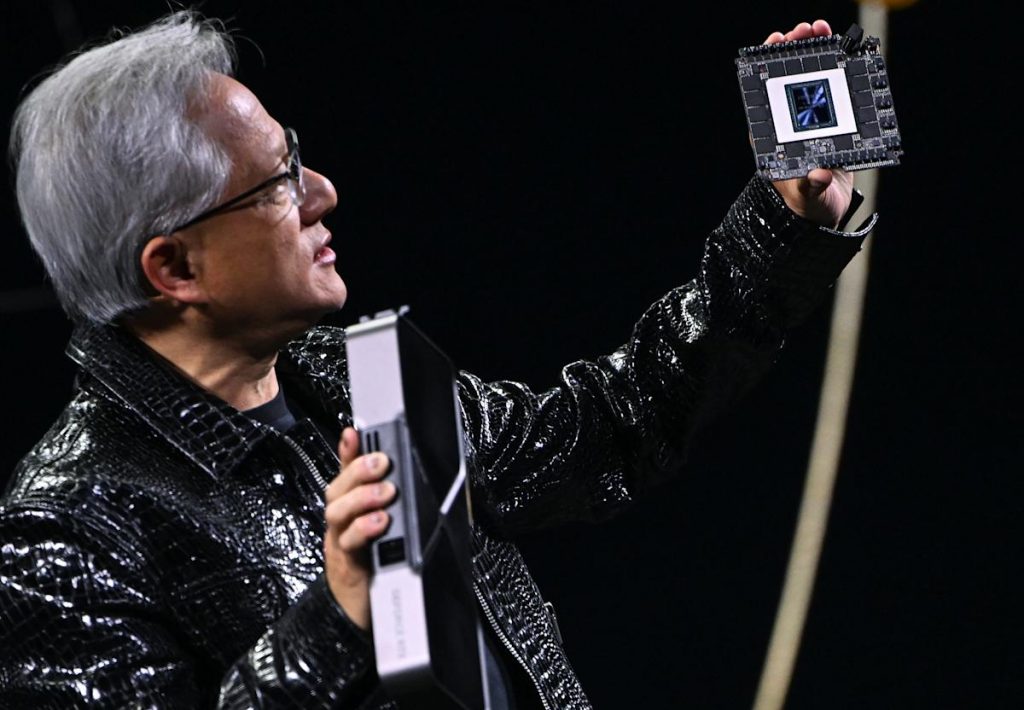

“We’ll must proceed to scale as demand is sort of excessive, and clients are anxious and impatient to get their Blackwell methods,” Nvidia founder and CEO Jensen Huang mentioned.

Nowhere within the firm’s 2025 steerage or commentary from Huang did I sense that AMD (AMD) is taking Nvidia’s market share; ditto customized chips from Amazon. I heard no trace that hyperscalers are sending AI chips again to Nvidia or have stopped fawning over Jensen to get extra of those chips at any value.

Put collectively, I might argue what we heard from Nvidia when it comes to demand and margins was all well-known going into the outcomes. So, the sell-off might show to be an overreaction, a operate of buyers aiming to mannequin out blended first quarter steerage for the following two years.

However there are a few issues we do not but learn about Nvidia that warrant higher consideration. These play into the long-term bull thesis.

For starters, there’s Huang’s level about DeepSeek’s R1 requiring 100x extra compute sources in comparison with pre-training fashions attributable to inference time scaling. Look, most of us haven’t any clue what this even means. However the informal observer might learn it because the market has it robust on DeepSeek, and there may very well be quite a lot of upside to Nvidia estimates as DeepSeek and different reasoning fashions achieve maintain.

Source link