As we expertise a brand new crypto crash right now, the blockchain world is overdrive as Wall St. jockeys for place within the crypto ETF submitting race, anticipating a post-Gensler SEC with Trump.

Gary Gensler’s upcoming resignation marks the end of an era, and corporations like Tidal Monetary Group, ProShares, CoinShares, and VanEck are losing no time staking claims in a shifting regulatory panorama.

Some extra hopium:

- Paul Atkins, the brand new SEC head, will doubtless be friendlier to us baggies.

- Proshares, VanEck, Canary, Coinshares, and Bitwise have all filed to make ETFs based mostly round XRP and Solana.

- Trump’s new meme cash $TRUMP and $MELANIA are making crypto mainstream once more.

Preserve the religion, and maintain your baggage tightly.

Overlook the Crypto Crash As we speak: A New Wave of ETF Filings Is Coming

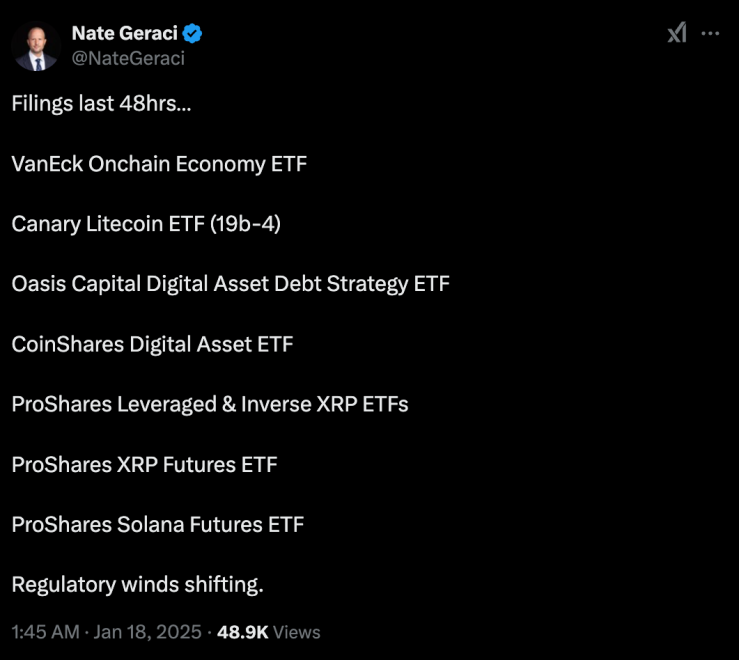

This week noticed a torrent of crypto ETF filings, hinting at a contemporary wave of optimism crashing by institutional finance.

Bloomberg analyst James Seyffart highlighted the eclectic mixture of methods and property, a testomony to the market’s relentless evolution and increasing depth.

In the meantime, Gary Gensler’s exit from the SEC caps a tenure marked by relentless skirmishes with the crypto world. His reign noticed high-profile authorized battles with Coinbase and Ripple Labs, in addition to a cussed blockade on Bitcoin ETFs—damaged solely by a courtroom order. His mantra was to focus on the dangers posed by intermediaries and altcoins—a polarizing legacy, to say the least.

“In a sector so tied to sentiment and indifferent from fundamentals, regulatory vigilance is essential,” Gensler stated throughout a latest Bloomberg interview.

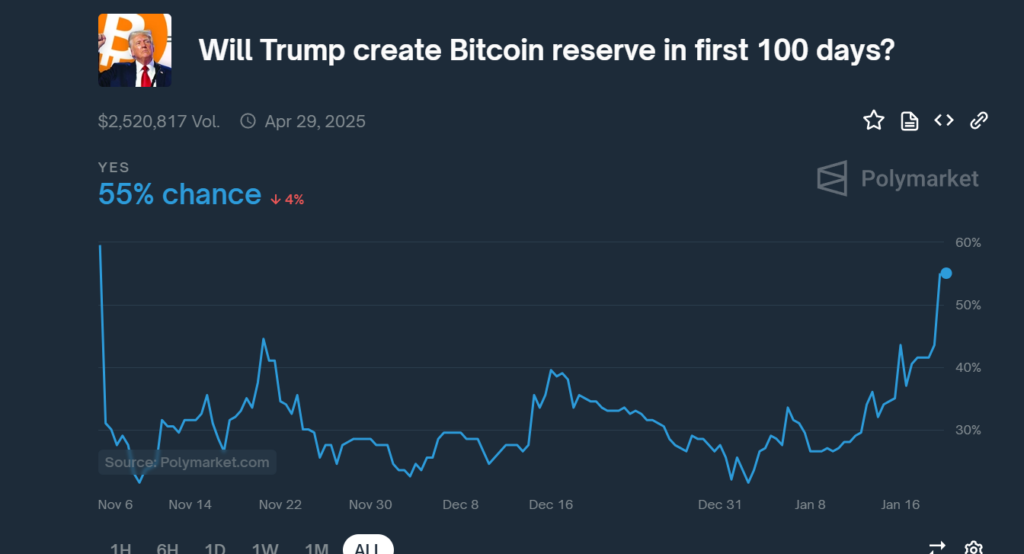

Trump’s SEC nominee, Paul Atkins, is positioned to roll again the regulatory noose left by the outgoing administration. Trump praised Atkins as a “commonsense” reformer, spurring hope for crypto-friendly insurance policies.

Markets took the trace—Bitcoin

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

Worth

Quantity in 24h

<!–

?

–>

Worth 7d

ticked up 2.3%, cracking the $107,000 threshold in anticipation.

Atkins’ period might open the door for crypto ETFs, giving traders new instruments and drawing institutional money, reshaping the trade’s trajectory within the course of.

Crypto in 2025: A Second Likelihood For Generational Wealth

Guys, I haven’t been right here lengthy. I purchased into crypto in 2019, and my baggage are small in comparison with others, however I’ve some ideas.

First, I’ll slurp each dip till BTC goes over $1 million per token.

Second, I do know 9-5 stackers like me should wait earlier than we make it. However I don’t suppose it’ll be so long as we worry. Crypto is now within the public consciousness; Trump may be very pro-crypto (by alternative or stress).

I name this the $TRUMP sample. pic.twitter.com/ImPnZCMDwJ

— lynk (@lynk0x) January 19, 2025

And when you’re an altcoin holder: when crypto begins to moon throughout Trump’s second time period (make no mistake, it WILL moon), people who find themselves priced out of shopping for Ethereum and Bitcoin will flip to altcoins. Why? The value.

Normies gained’t know the lore, and so they gained’t have hours of schizoposting behind them. However they WILL know the highest cryptocurrencies which might be cheaper than Bitcoin and Ethereum.

We’re ALL getting out of the wage cage by 2030. Each final man and lady right here.

EXPLORE: 10 Coins with High Returns: Crypto Forecast 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The submit The Tyranny of Gary Gensler is Finally Over: Here’s What To Expect After Crypto in 2025 appeared first on 99Bitcoins.

Source link